Economy

Economy

|

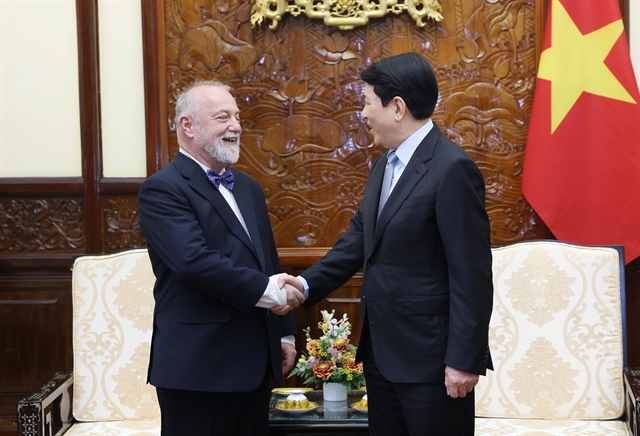

| Nguyễn Mại, Chairman of the Association of Foreign Investment Enterprises. — VNS Photo Hạnh Nguyên |

Due to the COVID-19 pandemic, some businesses have to look for buyers, raising concern that local businesses could be taken over by foreigners. Việt Nam News spoke with economist Nguyễn Mại, Chairman of the Association of Foreign Investment Enterprises, about the issue.

There are worries that domestic enterprises have been taken over during the pandemic through M&A deals and foreigners will dominate the market. What do you think about this issue?

M&A has become the most effective investment channel. The shift of foreign enterprises from investing in new projects to M&A deals is an obvious consequence of internal economic development.

In the realty industry, instead of spending on new construction, buyers can contribute capital, buy shares and take advantage of the available infrastructure of existing enterprises, enjoying preferential mechanisms and policies instead of asking for all those things from the beginning.

For example, without an M&A deal, foreign enterprises must go through the procedures and it takes about two or three years to start operating a new project.

There are two types of businesses through M&A. One is weak businesses, especially those that have bad management and operation exposed amid the pandemic. The other are those with potential, in which other investors inject capital and implement better management.

The second type could be seen in the US$5.2 billion-deal between Sabeco and Thai investors.

Similarly, Vingroup also sold a 6 per cent stake to South Korean investors and received $1 billion last year. In the first four months of the year, foreign enterprises are gradually increasing their investment in domestic enterprises (with an increase of up to 32.9 per cent) instead of spending on new projects (decreasing 9.1 per cent).

However, M&A activity was only 34.7 per cent compared to the same in 2019 and the size of each capital contribution and share purchase was of a small size, at about $770,000 each.

In the first four months of the year, in such deals, South Korea ranked first, Japan ranked second and China ranked third (only a few hundred million US dollars per project).

With a market of hundreds of millions of people and an increasing stock market value like Việt Nam, such M&A deals are not something to worry about.

There is a suggestion to suspend M&A activities during the pandemic. What do you think about the suggestion?

There is no way to stop the wave of M&A.

Apple has quietly produced up to 30 per cent of its headphones in Vietnamese facilities instead of in China. There is a wave of investment movement from China to other places, with which Việt Nam is required to catch up. New investment or M&A are both development trends that the country needs to open and take the chance before the investors go to other places.

In the COVID-19 pandemic, businesses with difficulties need to call for investment from external sources to rescue themselves. It is impossible to deprive their trading rights in such a difficult situation. Of course, foreign investors get benefits of buying at low prices but both of them will have benefits. Weak enterprises with low capital are in a better position to be negotiated for a buy-back instead of going bankrupt and close down.

Taking the Sabeco deal as an example, is there any reason to worry that the Vietnamese brand is acquired by a foreign owner?

The Thai acquisition of Sabeco is a successful deal that brought in nearly $5.2 billion to the State. And we don’t lose the trademark of Saigon Beer at all. We can have the special consumption tax for the beer products in Việt Nam and the Saigon Beer is promoted in English football matches with the Thai investors. There are many businesses expanding and becoming more profitable after being sold to foreigners.

Some people say that Sabeco should not be acquired by a Thai enterprise, but they should know that Việt Nam has now opened for integration, so there is no way we should stop businesses of ASEAN countries such as Thailand and Malaysia investing in Việt Nam. In such integration, large Vietnamese enterprises can also invest abroad.

What should Việt Nam learn from M&A experiences from others?

Recently, Japan has made a list of domestic companies subject to strict controls on foreign ownership. Accordingly, more than 500 enterprises, out of a total of more than 3,800 enterprises of this country are required to comply with stricter regulations on foreign investment.

Instead of 10 per cent as before, foreign investors only need to buy 1 per cent or more of shares in Japanese enterprises in 12 regulated fields and have to be screened in principle to be allowed to own shares. This is aimed at limiting the influence of foreign companies on key industries, including defence, as well as preventing the risk of leaking confidential information.

However, in countries such as Germany and Japan, governments have introduced measures to prevent the risk of acquiring enterprises during an economic crisis in order to protect important economic sectors and important enterprises.

The Vietnamese Government can intervene in key projects related to national defence and social safety in the fields of banking, oil and gas, aviation and energy in the process of buying shares or contributing capital.

There should be a close watch on big real estate projects spanning hundreds of hectares in coastal tourist areas and key locations of national security and defence in many cities and provinces. In particular, if large projects are assigned to small-sized enterprises, they must check the capital source carefully.

The M&A phenomenon will be stronger and stronger, especially when Viet Nam is still in the process of equitisation, what we can do is select the most sustainable investors when making the deals. — VNS