In view of the important contributions of investment capital to the local economy, Việt Nam needs immediate solutions to attract more FDI and strengthen its sources, according to experts.

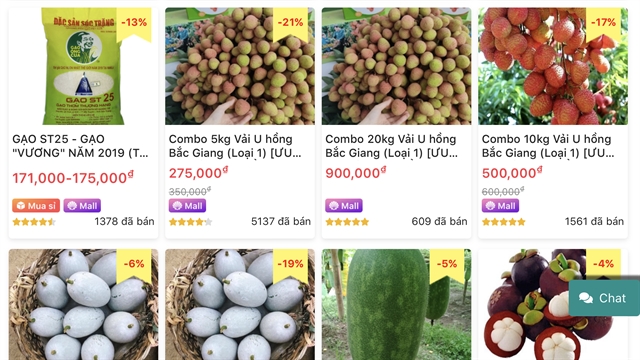

To help sell agricultural products, many localities are working to establish linkages between businesses in the supply chain and turning their focus to e-commerce platforms.

The stock market marked its first weekly fall in four, with the VN-Index breaking down 1,300 points. This has led analysts to suggest that the market is likely in an inevitable correction phase.

PetroVietnam Exploration Production Corporation (PVEP) contributed more than VNĐ7.99 trillion (US$344 million) to the State budget in the first five months of 2022, surpassing the target by 92 per cent.

Socio-economic, environmental and social welfare impacts of the Thạch Khê iron ore mining project must be taken into consideration thoroughly to soon decide whether or not to deploy it, Prime Minister Phạm Minh Chính has requested.

HCM City’s retail sales of goods topped VNĐ57.75 trillion (US$2.49 billion) in May, up 3.08 per cent against the previous month and 13.8 per cent from a year earlier, a report released on Thursday by the city Department of Industry and Trade has said.

The role of data in digital transformation, data trends in the world, critical path to turning data into business value, data for small and medium-sized businesses, building a data processing team for businesses, and case studies from businesses that have successfully exploited their data pool are among topics that will be discusses at the first Vietnam Data Summit.

The Ministry of Finance (MoF) is suggesting amendments to Decree 153 on corporate bonds, tightening up on privately-placed bond issuance

In the controversy over limited-term apartment ownership, some experts see positives and say it could change the situation of slum areas and reduce housing prices.

The central city of Đà Nẵng has been planning for an international and regional finance centre, a national start-up centre, a duty-free zone, an expansion of the international airport and a new deep-sea port for the Master Plan in 2030, creating a magnet for future large investors

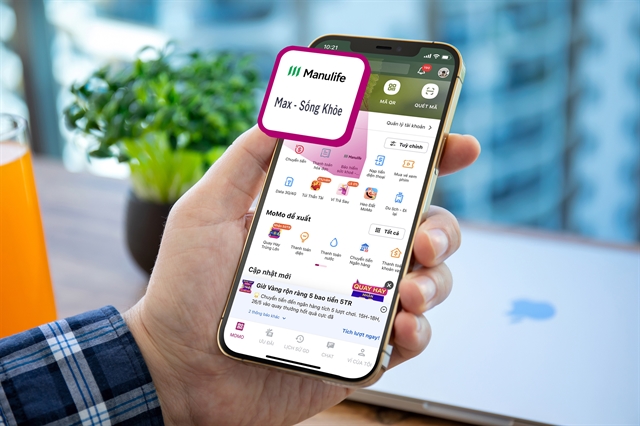

Manulife Vietnam has partnered with lifestyle super-app MoMo to distribute its digital health product and offer payment solutions to customers, further underscoring the insurer’s commitment to making financial solutions more accessible to everyone.

The capital city of Hà Nội is promoting information technology (IT), including the use of QR codes, in traceability to increase the consumption of farm produce on e-commerce platforms.

The country will reduce the number of credit institutions and basically finish the settlement of poor-performing banks by 2025 to make the banking system develop healthily and sustainably.

The Ministry of Finance has proposed a regulation be brought in to ensure payments for all real estate transactions are carried out via bank transfers.

CIMB Bank Việt Nam and F88 Business JSC have just made a new step in their strategic co-operation, moving toward financial universalisation for the unskilled, low-income working class who have not been able or have difficulty accessing financial services.

Compal, the leading global manufacturer of smart electronic devices, is cultivating its production capacity for its worldwide operation to serve international customers' increasing orders.

Deputy Prime Minister Lê Minh Khái has asked HCM City to adjust infrastructure fees at seaports by July.

Global renewable energy developer, service provider, and distributor, BayWa r.e., has opened its wind projects representative office in Lạng Sơn Province on June 10.

, joined HKCSS management for a group photo.

From left:

Hon Grace CHAN Man-yee, Chief Executive Of HKCSS

Mr. CHAN Tsz Ming, Director, Analysts at Level 1, Department of Social Affairs, Lia)

TUMI China, Senior Director Julian Yung, Vice President of Asia Pacific and Middle East Aris Maroulis, TUMI Asia-Pacific Brand Ambassador Wei Daxun, TUMI Creative Director Victor Sanz, Executive Vice President and COO of Shanghai Centre Byron Kan (Jian Bailuan), taking part in the ribbon-cutting ceremony.

(Right) TUMI Asia-Pacific Brand Ambassador Wei Daxun at the ne)

meets with the Director-General of the World Trade Organization, Dr Ngozi Okonjo-Iweala, in Davos, Switzerland)