Economy

Economy

IFRS standards require complex techniques and accurate assessments such as making estimates of fair value, real interest and losses.

|

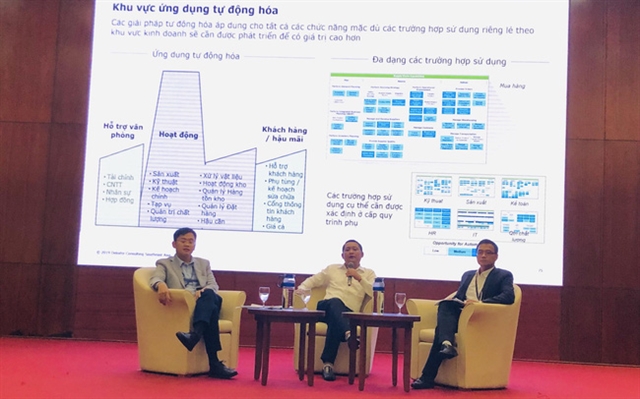

| The Ministry of Finance held a seminar in Hà Nội on Friday. During 2022-2025, the ministry will select certain firms to implement IFRS. — Photo cafef.vn |

HÀ NỘI — Vietnamese firms should adopt International Financial Reporting Standards (IFRS) instead of current Vietnamese accounting standards (VAS) if they want to enhance transparency and become more attractive to investors.

The statement was made by Trịnh Đức Vinh, Deputy Director of the Accounting and Auditing Management Supervision Department of the Ministry of Finance in a seminar held in Hà Nội yesterday.

“Việt Nam's financial market in general and the securities market in particular are changing drastically, attracting more and more foreign investors who seek business opportunities. The switch to international accounting standards is essential to improve companies' transparency, thereby maintaining the competitiveness,” Vinh said.

The application of IFRS would bring benefits to enterprises as the quality of their financial statements would improve, while accountability and comparability would also be enhanced, Vinh said.

Under the draft IFRS roadmap released by the Ministry of Finance in April, IFRS implementation will become compulsory for the consolidated financial statements of all State-owned enterprises, listed companies and large-scale unlisted public companies after 2025.

From 2019 to 2021, the Ministry of Finance will perform preparation work, including translating IFRS from English into Vietnamese and disseminating them so local firms can understand them.

However, according to the ministry, it would be very difficult to translate technical terms accurately, meaning disputes between businesses and the auditing and inspection agencies would be complicated by the language barrier.

During 2022-2025, the ministry will select some firms to implement IFRS. All other businesses that wish to apply IFRS and find the application is possible will be encouraged to do so.

The preparation time for applying IFRS may vary from business to business, depending on many factors such as professional qualification, management system and industry characteristics.

According to auditor PricewaterhouseCoopers (PwC), enterprises need to prepare before the official application of IFRS for at least 2-3 years.

The first phase of transition would become a big challenge for firms if they underestimate the requirements and impacts of the transition, PwC told news website tinnhanhchungkhoan.vn.

IFRS standards require complex techniques and accurate assessments such as making estimates of fair value, real interest and losses. — VNS