Economy

Economy

|

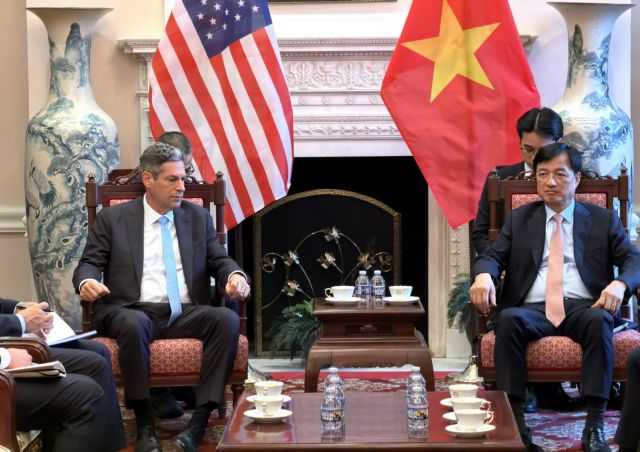

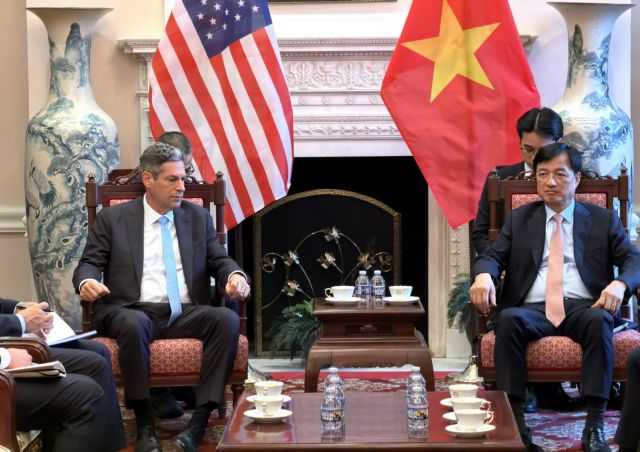

| Swiss Ambassador to Việt Nam Thomas Gass (left) and IFC Country Manager Thomas Jacobs sign the cooperation agreement for Phase 2 of the Việt Nam Supply Chain Finance Programme. — Photo courtesy of IFC |

HÀ NỘI — The International Finance Corporation (IFC) and the Swiss government have launched the second phase of their supply chain finance (SCF) programme in Việt Nam, aiming to improve access to working capital for small and medium enterprises (SMEs).

Backed by a five million Swiss Francs (US$5.6 million) grant from the State Secretariat for Economic Affairs (SECO), the initiative will run until 2029, helping over 500,000 SMEs access up to $35 billion in financing.

With nearly half of Việt Nam’s economy and jobs linked to exports, local businesses often struggle with cash flow due to long payment cycles. According to a recent World Bank survey, fewer than 20 per cent of local firms were connected to global value chains in 2023.

SCF solutions can ease these constraints by converting sales receivables into cash, enabling SMEs to take on larger orders and expand their operations.

“We estimate that the first phase of the program has unlocked over $30 billion in capital for around half a Vietnamese SMEs,” said Thomas Gass, Swiss Ambassador to Việt Nam.

“By providing financial support to these businesses, the program not only helped SMEs to thrive but also contributed to the growth of the broader economy, fostering a more inclusive and sustainable marketplace.”

Since its launch in 2018, the IFC-SECO SCF programme has helped improve regulations, enhance institutional readiness and stimulate market demand and awareness. Over the past five years, it facilitated $33 billion in financing for 500,000 SMEs. In this next phase, the focus will be on strengthening regulations, improving lender capacity and increasing awareness of SCF solutions among businesses.

Deputy Governor Nguyễn Ngọc Cảnh said that the State Bank of Việt Nam, in collaboration with IFC and SECO, will continue reviewing and adjusting regulations to foster a more favourable environment for SCF, including refining rules for e-financing platform lending and encouraging financial institutions to diversify their offerings to improve credit access for SMEs.

"IFC is very happy and proud to be working with SECO and our bank partners to really help stimulate the market for supply chain finance, which is going to be a critical part of the financial ecosystem for SMEs. We really want to be a positive force for supply chain finance and better trade finance for Vietnam as a whole," said Thomas Jacobs, IFC Country Manager for Viet Nam, Cambodia and Lao PDR. — VNS