Economy

Economy

.jpg)

|

| Investors are pinning their hopes on Circular 68/2024/TT-BTC officially taking effect, notably stipulating that foreign institutional investors can trade stocks without full pre-funding. — Photo vneconomy.vn |

HÀ NỘI — Short-term pressures like exchange rates significantly influence foreign capital flows, but the long-term challenge lies in the scarcity of high-quality goods, leaving foreign investors lukewarm towards the Vietnamese stock market.

The country’s stock market currently faces unprecedented and prolonged selling pressure from foreign investors.

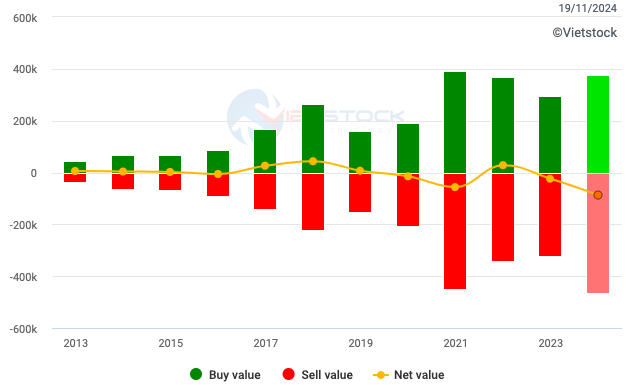

Since the beginning of 2024, foreign investors have net sold over VNĐ85 trillion (over US$3.3 billion) on the Hồ Chí Minh Stock Exchange (HoSE), marking a record figure in its 24-year history.

|

| Foreign investors' trading value on HoSE (billion đồng). Source vietstock.vn |

Over the past 20 months, foreign investors only momentarily paused their selling spree in January 2024.

In the short term, the soaring exchange rates, hitting record highs, play a crucial role in affecting foreign capital flows. The devaluation of the đồng against the US dollar impacts the performance of foreign funds, limiting their capital attraction potential.

Notably, many institutions predict that this trend will persist in the foreseeable future.

In a recent update, Dragon Capital disclosed that US dollar deposits in the Vietnamese banking system decreased from $42 billion in 2022 to $39.5 billion in 2024.

Foreign exchange reserves also dropped by over $20 billion from a peak of $110 billion.

Additionally, international bond obligations worth $1.1 billion are nearing maturity, coupled with increased US dollar holdings by businesses and individuals, creating short-term pressures.

Growth-supporting policies of incoming US president Donald Trump, will also strengthen the US dollar, exerting significant pressure on the Vietnamese đồng.

The pace and extent of the US Federal Reserve's interest rate cuts may be constrained by Trump's proposals, potentially limiting Việt Nam’s ability to further reduce interest rates.

Recent economic data from the US indicates a 0.4 per cent increase in retail sales in October, with September's growth revised to 0.8 per cent.

The US Consumer Price Index (CPI) in October rose by 2.6 per cent compared to the same period last year, with economists noting a gradual slowdown in inflation.

Fed Chairman Jerome Powell stated last week that the economy remains stable, implying no rush to cut interest rates.

Meanwhile, the lack of attractive long-term investment opportunities due to a dearth of quality goods is a primary reason foreign investors remain wary of the Vietnamese stock market.

The number of new companies listed is scant, with truly notable names even rarer. Auction activities are also lacklustre, narrowing the choices for foreign capital.

In this context, many investors are pinning their hopes on Circular 68/2024/TT-BTC officially taking effect, notably stipulating that foreign institutional investors can trade stocks without full pre-funding (Non Pre-funding solution - NPS). However, expecting a significant short-term change is challenging.

According to a report from SSI Research, a small number of transactions have been executed. Barry Weisblatt David, head of analysis at VNDIRECT, believes that NPS will prompt some fund managers to increase their allocations to Việt Nam as investing becomes more cost-effective, although this scope remains limited.

This does not affect allocations from Việt Nam - dedicated funds, such as Pyn Elite Fund, Dragon Capital or VinaCapital, as they are already 100 per cent invested in Việt Nam, although profits may increase slightly. The circular mainly impacts regional funds or funds specialising in frontier and emerging markets globally interested in Việt Nam, he added.

Nevertheless, implementing NPS marks a significant step in upgrading Việt Nam’s stock market.

He also anticipates that when FTSE officially upgrades Việt Nam in September 2025 and Vietnamese companies are included in new emerging market indices, substantial capital inflows can be expected from new emerging market’s exchange-traded funds (ETFs), estimated to be around $500 million to less than $1 billion. — VNS

.jpg)