Economy

Economy

|

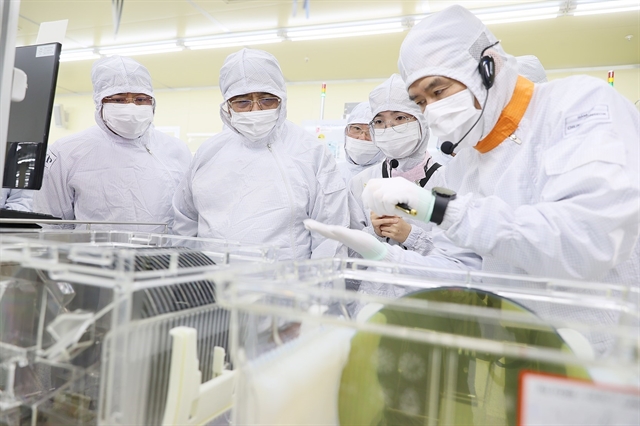

| IN THE LAB: Prime Minister Phạm Minh Chính visiting a semiconductor chip production line at Hana Micro Vina in the northern province of Bắc Giang in 2023. — VNA/VNS Photo Dương Giang |

Việt Nam is betting on semiconductors as one of the high-tech sectors that will propel the country into a new era of development. To foster this nascent but promising industry, Việt Nam needs a unique approach, a grand aspiration, firm determination, perseverance, and a willingness to accept risks. In this context, Minister of Information and Communications Nguyễn Mạnh Hùng outlines a potential semiconductor strategy for the country.

|

| Minister of Information and Communications Nguyễn Mạnh Hùng. — VNA/VNS Photo |

If we were to formulate Việt Nam's Semiconductor Strategy, it might look like this: C = SET + 1 (C stands for Chip, S for Specialised, E for Electronics, and T for Talent).

At the core of the Semiconductor Strategy are the design and manufacture of semiconductor chips.

C (Chip)

The core technologies of the Fourth Industrial Revolution (4IR) — the Internet of Things (IoT) and Artificial Intelligence (AI) — are driven by semiconductor chips. IoT digitises the physical world, creating a digital environment and generating data, while AI processes this data, adding value. The heart of both IoT and AI is the semiconductor chip.

Semiconductors are reshaping the world we live in, embedded in nearly every device and facet of life. They play a crucial role in economic and national security. This influence is expected to continue at least until the mid-21st century, as semiconductors are integral to the ongoing global digital transformation.

S (Specialised chips)

The 4IR encompasses technologies like AI, IoT, and industrial automation, all of which demand high computational performance, significant data processing capacity, and rapid response times. Specialised chips are designed to meet these needs, outperforming general-purpose chips in specific applications. They are vital for sectors like low-power IoT, high-security industrial systems, telecommunications, healthcare, transport, and energy.

Specialised chips will drive technological advancements. When general-purpose chips are used in specialised applications, they typically only use 10-20 per cent of their capacity, resulting in inefficiencies and higher costs, particularly in terms of power consumption. While general-purpose chips are produced by a few manufacturers, specialised chips are far more diverse, creating numerous opportunities.

While the Third Industrial Revolution was defined by general-purpose chips, the Fourth Industrial Revolution will be marked by specialised chips. Countries that are latecomers in the semiconductor race should focus on specialised chips.

E (Electronics industry)

The development of Việt Nam's semiconductor industry must be closely aligned with the growth of its electronics and digital transformation industries. Semiconductor chips are an essential component of electronic devices. Without a strong electronics industry, chipmakers would be dependent on external buyers, such as electronics manufacturers. All the 'dragon' and 'tiger' economies have established robust electronics industries.

With the rise of AI, next-generation electronics will need to be AI-powered, and AI chips will become central to these new devices. In the late 20th century, incorporating semiconductor chips into consumer electronics helped transform Japan into an industrial powerhouse. Similarly, countries that integrate AI chips into their electronics could become future 'dragon' economies.

If Việt Nam chooses this path, it has the potential to lead the industry, reviving its 'lost' electronics sector. Developing the electronics industry will also create a downstream market for semiconductors. The electronics industry, which includes consumer and specialised electronics (telecommunications, healthcare, energy, automotive, aerospace, defence, etc.), is five to six times larger than the semiconductor industry.

The digital transformation sector is even larger, involving the digitisation of the physical world through IoT devices that require semiconductor chips. The demand for chips in the digital transformation and electronics sectors is immense, even though these chips are less complex than high-tech semiconductors from companies like Intel or Nvidia.

'T' (Talent)

A key element of Việt Nam's Semiconductor Strategy is to position the country as a global talent hub for the semiconductor industry. This talent pool will attract investment in research, design, production, packaging, and testing. Việt Nam’s hub will also encompass outsourcing and labour export activities related to semiconductors.

Việt Nam is well-equipped to meet labour demands through 'reskilling' and 'upskilling'. The country has 700,000 engineers in electronics, telecommunications, IT, and digital technology, many of whom can be retrained for the semiconductor industry. Việt Nam’s STEM education is also among the best globally.

Every year, thousands of students graduate in fields like electronics, telecommunications, IT, and semiconductors. Talent is the foundation for building Việt Nam’s semiconductor industry, and human resources must span all stages of the industry, not just chip design.

Preparing the workforce requires a long-term vision but must also adapt to market needs. Partnerships between training institutions and semiconductor companies, both domestic and international, will be key to success. At the national level, the Government will establish agreements with countries experiencing shortages of semiconductor talent.

A successful training programme needs to guarantee job placements with attractive salaries — semiconductor engineers must earn more than IT engineers. While long-term education and research programmes are essential, including STEM education from primary to postgraduate levels, short-term solutions are also necessary to address immediate labour shortages through quick training.

The best short-term option is to reskill or upskill IT, software, and electronics engineers. With 6 to 12 months of retraining, they can be ready for the semiconductor industry. This effort requires teachers, instructors, facilities, and curricula, necessitating collaboration between semiconductor companies and universities, as well as government investment. Retraining teachers or recruiting foreign semiconductor experts may be a top priority in the near term.

'+1' (X + 1)

The global semiconductor industry is undergoing a restructuring process with an 'X + 1' strategy, aiming to diversify supply chains across all stages of the industry. Countries with established or partial semiconductor industries seek to establish additional production sites, and Việt Nam is well-placed to be that '1'. Việt Nam has strong strategic relationships with most major semiconductor powers and can participate in all stages of the industry.

With this strategy, Việt Nam will attract foreign direct investment, offering a 'safety net' to the global semiconductor industry. FDI companies will find that Việt Nam not only offers human resources, land, infrastructure, and tax incentives but also ensures safety – a top priority for an industry that is so critical to national economic and security interests.

Việt Nam has a geopolitical advantage in the semiconductor industry. Within a 4-5 hour flight from Việt Nam lies 70 per cent of the world's semiconductor industry. The country is also politically stable, has one of the fastest-growing economies, and has a national strategy for semiconductor development, with the Party and State giving high priority to this industry.

A differentiated approach

'C = SET + 1' represents a unique strategy. The global semiconductor industry is highly innovative, with new business models constantly emerging. These shifts often lead to breakthroughs, creating new leaders in the field.

With Việt Nam’s participation and differentiated approach, a new global semiconductor business model could emerge. However, the process is not easy. Success requires a unique strategy, a grand vision, unwavering determination, resilience, and a willingness to accept risks. VNS