Economy

Economy

|

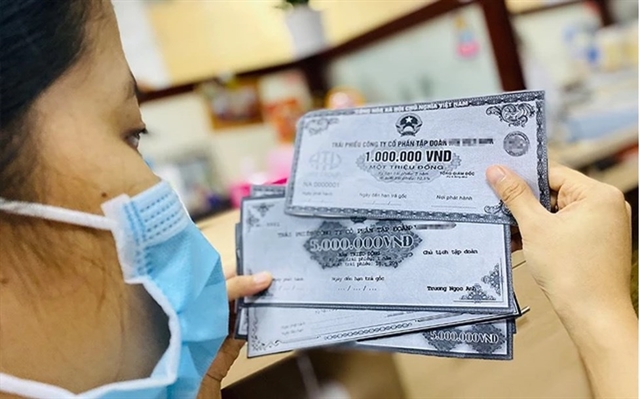

| A total of VNĐ5.965 trillion worth of corporate bonds is issued in the first two months of this year, 2 public issuances worth VNĐ2.65 billion and 6 separate issuances worth VNĐ3.315 billion. — VNA/VNS Photo |

HÀ NỘI — The corporate bond market is quiet in the beginning of this year with only three separate corporate bond issuances in February with a total value of VNĐ1.16 trillion (US$47 million), 68 per cent lower than January.

According to Việt Nam Bond Market Association, the market remains gloomy when regulations on corporate bond issuance are tightened, including criteria for professional individual investors and credit rating.

Specifically, Hải An Transport and Loading Joint Stock Company (HAH) successfully issued a batch of VNĐ500 billion worth of bonds at a fixed rate of 6 per cent per year, five-year term. The rate is the lowest in the market in the first two months of this year, only slightly higher than the current deposit rates of 4-5 per cent.

Hà Nội Highway Investment and Construction issued a batch worth VNĐ550 billion with 117-month term. The rate for the first period is 10.1 per cent and the following periods is the average medium-term lending rate of Vietcombank, BIDV, Vietinbank and Agribank.

Lạc Hồng Tourism issued VNĐ115 billion worth of bonds of three-year term. The rates for the first four periods are fixed at 9 per cent per year and for the following periods, are the average of 12-month deposit rate of Vietcombank, BIDV, Vietinbank and Agreement plus 4.3 per cent per year.

Data from WiGroup showed that the real estate and banking sectors which used to be major issuers in the market have not seen any new issuance in the first two months this year.

The rates average 8.05 per cent in February, lower than the same period last year at 10.77 per cent.

This demonstrated that loosening monetary policy, low banking interest rates and a sharp decrease in Government bond interest rates over the same period support the rates of financial assets such as bonds, according to WiGroup.

A total of VNĐ5.965 trillion worth of corporate bonds is issued in the first two months of this year, two public issuances worth VNĐ2.65 billion and two separate issuances worth VNĐ3.315 billion.

Also in February, businesses bought back VNĐ2 billion bonds before maturity, dropping by 68 per cent against the same period last year.

Thus, it is estimated that more than VNĐ255 trillion bonds will mature by the year end, 38.4 per cent are of the real estate sector.

Seven issuers announced late payment of principal and interest in the month with a total value of about VNĐ6.2 trillion.

According to Đỗ Bảo Ngọc, Deputy Director of Việt Nam Construction Securities Joint Stock Company, the biggest concern of investors today when buying corporate bonds is ensuring safety of their capital.

The violations of Tân Hoàng Minh Group and Vạn Thịnh Phát in the corporate bond market, along with a number of real estate companies failing to pay principal and interest, have made investors cautious.

“The problem is no longer about yields. Even if bond yields are raised, investors are still cautious. This is a common psychology that holds back transactions in the bond market,” Ngọc said.

Investors are now paying more attention to legal regulations and carefully studying information and operation of issuers, including financial capacity and credit rating.

According to economist Đinh Trọng Thịnh, tightened regulations will help the bond market be safer and more sustainable in the long run, providing an effective channel for capital raising. — VNS