Economy

Economy

|

| Deputy Minister of Finance Cao Anh Tuấn made his remarks at the event. — VNA/VNS Photo |

HÀ NỘI — Facing adverse impacts of the COVID-19 pandemic and the world’s economic and political issues, the Ministry of Finance (MoF) has suggested authorities promulgate and issued many unprecedented solutions in terms of taxes, fees, and charges to assist people and businesses.

Deputy Minister of Finance Cao Anh Tuấn made the remarks while addressing a dialogue on taxation and customs policies with Korean businesses in Hà Nội on February 29.

He noted that each year, the MoF handled hundreds of petitions from Korean firms about problems during their operations in Việt Nam. In response, it had sought consultancy and proposed policy amendments and supplements to maximise assistance for foreign direct investment (FDI) companies.

The issuance and implementation of tax, fee, and charge-related solutions had received support and high evaluation from businesses, including Korean entities, he said, adding that such solutions had helped firms weather difficulties and stabilise production and business activities.

To respond to the implementation of Pillar 2 on global minimum tax of the Organisation for Economic Co-operation and Development (OECD)’s Base Erosion and Profit Shifting initiative, the MoF had worked with other ministries and sectors to consult with FDI companies, including Korean businesses, to propose the National Assembly issue a resolution on the imposition of top-up corporate income tax under the Global Anti-Base Erosion (GloBE) rules from January 1, 2024, the official added.

|

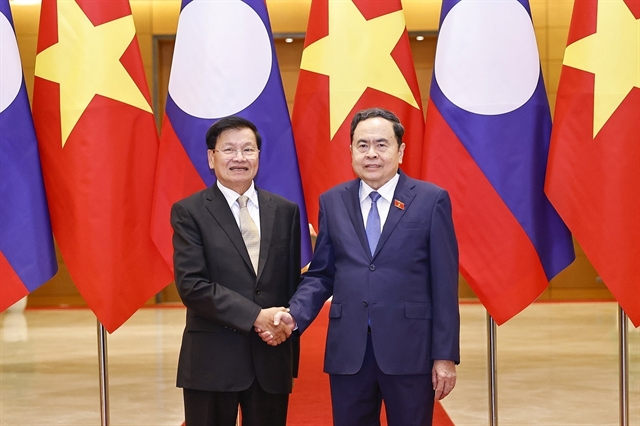

| A Korean business representative speaks at the dialogue. — VNA/VNS Photo |

Tuấn said that the MoF would continue perfecting mechanisms and policies, step up administrative procedure reform, and boost comprehensive digitalisation in the fields of taxation and customs to create a more equal, transparent, and optimal environment for both domestic and FDI businesses to further develop, create jobs, and contribute to local socio-economic development.

He also expressed his hope that South Korean businesses would also actively seize opportunities to promote their competitiveness and grow while complying with taxation and customs regulations to help with Việt Nam’s development.

At the event, representatives of the MoF, the General Department of Taxation, and the General Department of Customs presented recent taxation and customs results. They also fielded questions from Korean firms about related issues.

As of January 2024, there were 8,058 businesses with over 50 per cent of their charter capital invested by the RoK, accounting for 28 per cent of all FDI firms in Việt Nam. This makes the East Asian nation the biggest among the 144 countries and territories investing in Việt Nam at present, data from the Foreign Investment Agency under the Ministry of Planning and Investment showed.

Over the last five years, despite challenges caused by the COVID-19 pandemic and adverse impacts of the global economy, South Korean businesses' contributions to the state budget have continually increased, approximating VNĐ175 trillion (US$7 billion), according to the Deputy Minister. — VNS

Brandinfo

Brandinfo