Economy

Economy

|

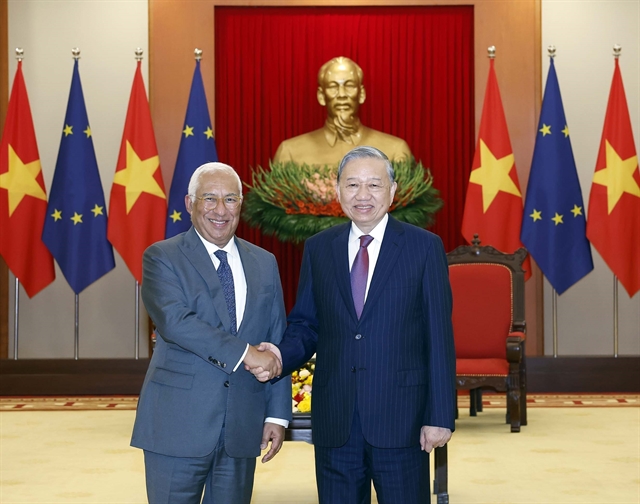

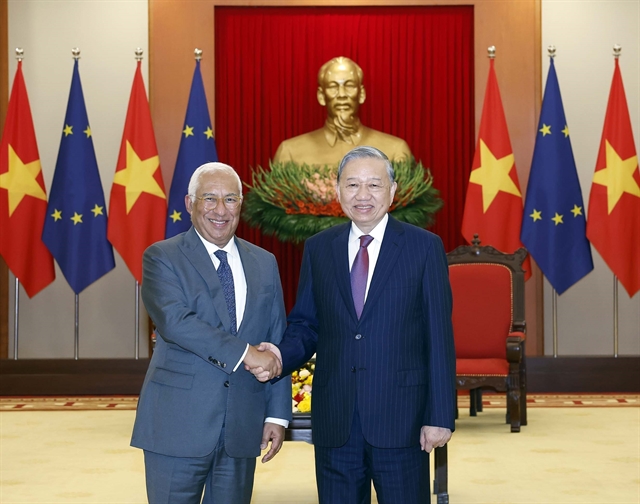

| Southeast Asia Startup Talent Report 2023 lists Việt Nam as a hub for tech talent. — Photo Courtesy Hill Ventures (MHV) and Glints |

HCM CITY — Việt Nam continues to be a hub for strong tech talent, said the Southeast Asia Startup Talent Report 2023.

The second iteration of the report, which is launched by Monk's Hill Ventures (MHV) and Glints, provides a deeper dive into hiring trends, salary and equity data for founders, C-suite and startup talent from over 10,000 data points and 30 interviews with startup founders across Singapore, Indonesia and Việt Nam.

“With a young skilled population steeped in STEM education and its huge services industry ripe for digital innovations, Việt Nam continues to be a strong tech talent market despite the current economic slowdown,” said Justin Nguyen, general partner of Monk’s Hill Ventures.

“There is a steady rise of Vietnamese engineering-centric founders who have propelled product-centric cultures. This is behind the growth of some formidable companies and a big reason behind Việt Nam turning into a major startup tech hub. The workforce here is one to be reckoned with and it’s increasingly the case that Việt Nam is where regional champions go to build their high-performing tech teams,” he said.

The report finds that startups will look to invest in more revenue-generating roles such as sales, business development, and marketing and PR in 2023 as companies refocus on paths to profitability.

Additionally, while salaries continue to increase, the growth rate will be much lower than in previous years from upwards of 30 per cent to 5-7 per cent per annum.

“The best coders in Việt Nam are compensated competitively to those based in Singapore. The report we hope equips local startups with the tools they need to hire, attract, and retain talent and empowers talent to grow and scale within the maturing startup ecosystem,” said Bryan Lee, general manager of Glints Vietnam.

According to the report, the tech talent crunch persists in Southeast Asia, with tech roles remaining high in demand, earning on average 38 per cent more than non-tech roles.

Cash still prevails over equity in the region. While 86 per cent of companies surveyed offer ESOP, on average, ESOP is only made available to one-third of their talent.

The median CEO base salary grew 2.4 times for those that raised up to $5 million compared to 2021, as companies raise larger rounds. More CEOs are taking greater equity dilution, likely due to current headwinds. The report found a 5 per cent drop in equity for CEOs in the $5-10 million funding stage compared to 2021.

Engineering remains the most sought-after tech function. Specialised skills such as product and data are also highly attractive to employers. After engineering, talent in product and data are the highest paid.

Product managers saw the biggest salary increase, making 27 per cent more than in 2021.

Hybrid work is becoming the status quo, with 45 per cent of startups offering hybrid work and 12 per cent offering remote work options to employees across markets.

As companies focus on the path to profitability and positive cash flow this year, the top three functions that companies prioritize hiring for in 2023 across markets are engineering, BD & sales, and marketing & PR, the report said.

Glints is the leading talent ecosystem in Southeast Asia.

Meanwhile, Monk’s Hill Ventures (‘MHV’) is a venture capital firm investing in early-stage technology companies, primarily pre-Series A and Series A, in Southeast Asia. — VNS