Economy

Economy

|

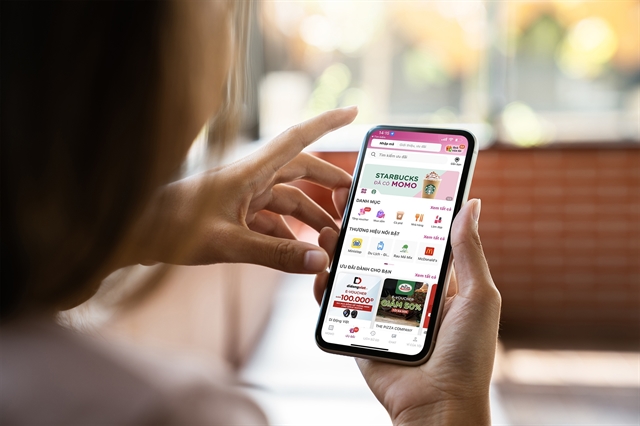

| A customer uses her MoMo ewallet to pay for a cup of Starbucks coffee. Việt Nam is a top markets for the adoption of new technologies. — Photo courtesy of the MoMo |

HÀ NỘI — Việt Nam is a top market in adopting new technologies, in which 58 per cent of digital consumers have used online banking solutions, e-wallets, money transfer applications, and digital banking.

According to the "SYNC Southeast Asia" report on digital consumers in Southeast Asia in the new stage of development, Việt Nam has nearly 80 per cent of the population represented as digital consumers. Moreover, the average contribution of e-commerce to total retail has continued to grow at 15 per cent over the past year, higher than India's 10 per cent and China's 4 per cent growth, with an online-to-total retail share of 6 per cent.

About three years into the pandemic, research shows that regional consumers are at a new stage of development, prioritising an integrated shopping experience that effectively combines online and in-person services.

After the pandemic, 10 per cent of Vietnamese surveyed moved at least one of their shopping categories from online to direct channels because of the "interface" factor that direct sales channels bring. However, there are still certain shopping categories that consumers still prefer to choose "closing" online, indicating that online shopping continues to serve as an important channel for digital shoppers in the country. During the 'discovery' phase, 84 per cent of Vietnamese shoppers see online as their go-to channel to browse and find items.

E-commerce accounts for 51 per cent of online spending

According to the report, this is a period when Vietnamese digital consumers use more platforms than ever before, with the dominance of the e-commerce market accounting for 51 per cent of online spending. At the same time, social networks account for nearly half of online discoveries, including images at 16 per cent, social media videos at 22 per cent and related tools such as messaging at 9 per cent.

Social media and related tools such as messaging were paramount channels for Việt Nam's digital shoppers during the consideration period, accounting for 44 per cent of survey respondents.

"Consumers' openness to interaction and experimentation has also led to behavioural change, with 64 per cent of respondents saying they have interacted with a business conversation account in the past year. As customers seek more engagement, the content creation economy also shows many positive signals.

"In Việt Nam, the average sales volume related to entertainment, streaming and related products to content creators in the three months before our survey has increased 12 times," said Lê Khôi, Country Director of Việt Nam Market of Meta, adding: "In the context of digital consumption, Vietnamese users switch brands more often and increase the number of platforms they use to find a better value, with 22 per cent of online orders made on various e-commerce platforms."

He added: "Value is one of the main factors driving this behaviour when 'better price' is chosen as the top reason for switching platforms, followed by the product quality and delivery times. As a result, the number of online platforms Vietnamese consumers use will increase from 8 in 2021 to 16 in 2022.

Last week, in the seminar 'Promoting digital transformation for organisations and businesses', Nguyễn Bá Diệp, Co-Founder of MoMo Ewallet, said: "Digital transformation for retail businesses is an inevitable trend."

Diệp added that with more than 31 million customers on MoMo, they have solutions to help businesses, especially SMEs, banks, credit institutions, and investment funds, to reach more customers quickly and efficiently.

Diệp said MoMo would continue coordinating with tens of thousands of other partners to expand this service ecosystem specifically for retail solutions.

Diệp said in the last four years, it developed the Finance-Insurance service on MoMo with more than 10 million users, including consumer credit, accumulated investment and insurance.

The report also shows that thanks to advanced thinking, Việt Nam is among the top markets in adopting future technologies such as fintech and metaverse, alongside Indonesia and the Philippines. Currently, 58 per cent of digital consumers in Vietnam have used fintech solutions such as online banking, e-wallets, money transfer applications, and omnipotent digital banking.

It also said the use of digital technology in Việt Nam is ripe and mainly driven by functionality and convenience, adding 7 out of 10 digital consumers in the country used metaverse technology such as cryptocurrencies, augmented reality, virtual reality, virtual world, and NFT's in 2022. In particular, Việt Nam has the highest rate of VR applications among Southeast Asian countries, with 29 per cent. — VNS