Economy

Economy

|

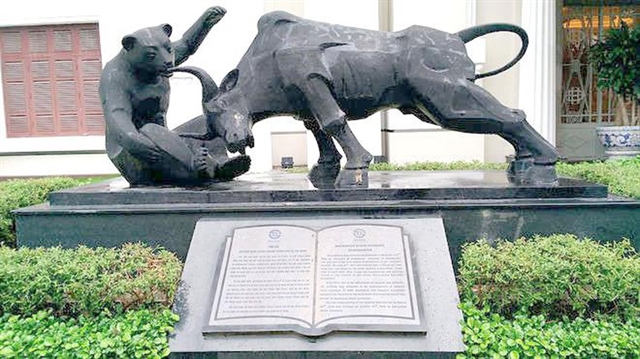

| The statue of a bull and bear in front of HoSE's building in HCM City. Photo tinnhanhchungkhoan.vn |

HÀ NỘI — Việt Nam’s stock market continued to recover last week with improved liquidity and strong inflows from foreign investments. However, as the benchmark VN-Index struggled at the resistance level of 1,350 points and fell in the last session, many securities firms have to take a more cautious view on the market this week.

On the Hồ Chí Minh Stock Exchange (HoSE), the VN-Index closed last week at 1,341.45 points, marking the first fall in two weeks. Meanwhile, the HNX-Index on the Hà Nội Stock Exchange (HNX) was stable at 325.46 points.

For the week, the VN-Index still gained 2.1 per cent, while the HNX-Index rose by 3.3 per cent.

The market liquidity on both exchanges was higher than the week before, but still lower than the 20-day moving average. The average liquidity was VNĐ23.8 trillion (US$1.03 billion) per session.

Trading value on HOSE climbed by 21 per cent to VNĐ102.7 trillion, equivalent to an increase of 25.7 per cent in volume to over 3.2 billion shares, while the trading value on HNX inched 53.6 per cent higher to VNĐ16.7 trillion, equivalent to an increase of 50.2 per cent in volume to 668 million shares.

According to Viet Dragon Securities Corporation (VDSC), the market benchmark still couldn’t break over the resistance level of 1,350 points in the last trading session of the week and dropped slightly. The liquidity in this session increased compared to previous sessions and was higher than the average of the last 50 sessions, showing that investors were taking advantage of the rapid recovery to take profits in the short-term.

The VN-Index is expected to continue to struggle at the resistance level and may correct. However, the correction, if any, is only for rebalancing the market after completing the recovery, the securities firm added.

Therefore, investors should temporarily rebalance their portfolios and take profits on stocks that are under great resistance. At the same time, investors should seek investment opportunities to disburse when the market is balanced and stable again, VDSC recommended.

Meanwhile, Mirae Asset Securities Việt Nam said that investors' bullish sentiment was reflected in a series of four consecutive gaining sessions at the beginning of last week.

In the last session, the VN-Index touched the threshold of 1,350 points in the early session with the positive market breadth. However, selling pressure, which suddenly surged in the afternoon session, dragged the benchmark away from this important resistance level.

During the week, foreign investors flocked back to the market as they net bought in all five sessions with a total value of more than VNĐ2.4 trillion. Of which, Vinhomes JSC (VHM) was in first place in the net buying list with a value of nearly VNĐ1 trillion, far ahead of the second and third positions of Sacombank (STB) and SSI Securities Corporation (SSI) with a value of VNĐ602 billion and VNĐ522 billion, respectively.

On the net selling front, Vingroup JSC (VIC) witnessed the largest net sell value of VNĐ340 billion.

Mirae Asset said that after recovery of nearly 120 points in three weeks, the VN-Index is facing short-term resistance at 1,350 points. Next week, the market is likely to be under short-term correcting pressure and the nearest support level is 1,300 - 1,310 points.

According to Vietcombank Securities Company (VCBS), the benchmark has recovered significantly from the short-term bottom of 1,250 points, even amid the uncertainties of the international financial market and complicated developments of the fourth COVID-19 outbreak in Việt Nam.

“The index will continue to move in a range of 1,300 - 1,350 points in the next few weeks. And the closest resistance level in the near future is 1,350 points,” VCBS said.

The securities firm recommends short-term investors can consider taking profits of some stocks that have achieved expected profits, and at the same time switch to holding mid-cap stocks that not yet jumped strongly in the previous period.

Meanwhile, long-term investors can take advantage of the corrections to continue to accumulate target stocks with positive growth outlooks and healthy financial foundations in 2021.

Taking a more optimistic view, Bank for Investment & Development of Vietnam Securities Company said that the correction of last week will not affect the market’s rally trend to 1,350 - 1,380 points this week.

Last week, the market’s recovery helped all stock groups gain points.

Data compiled by Saigon - Hanoi Securities JSC (SHS) showed that real estate stocks rose strongly with pillar stocks such as Novaland (VNL), Vinhomes JSC (VHM) and Vingroup JSC (VIC) up more than 3 per cent.

Stocks of securities companies, aviation stocks and information technology stocks also recorded big gains in a range of 0.9 - 9.2 per cent. VNS