Economy

Economy

|

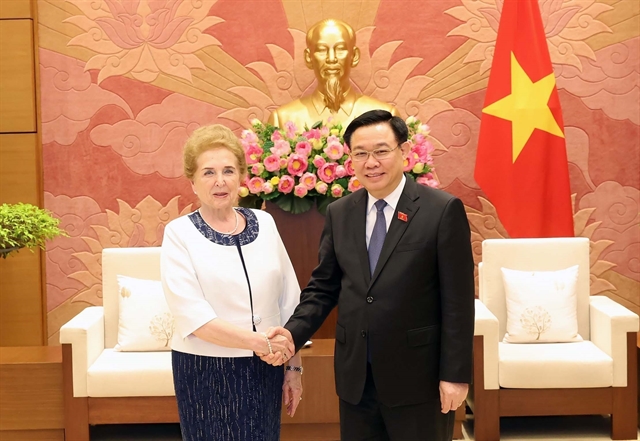

| Agreements signed between the Ministry of Planning and Investment and investment funds at the summit. — Photo kinhtedothi.vn |

HÀ NỘI – Eighteen local and domestic venture capital funds have committed investment of about VNĐ10 trillion (US$429.2 million) to Vietnamese start-ups over the next three years.

A number of cooperation agreements were inked at the Vietnam Venture Summit 2019 which opened on Monday in Hà Nội with the participation of leading global venture capital firms such as Temasek, Golden Gate Ventures, Softbank Vision Fund, CyberAgent Ventures, Insignia Ventures Partners and Sequoia Capital.

At the event, Seoul-based DT&I Investment Fund decided to pour $1.4 million into Propzy, a Vietnamese start-up providing solutions for real estate transactions, this month.

VinaCapital also signed a strategic partnership with South Korea’s Mirae Asset - Naver Asia Growth Fund, a $1 billion joint fund by Mirae Asset and Naver, to prepare $100 million for Vietnamese start-ups over the next three years.

The Ministry of Planning and Investment signed a memorandum of understanding with Golden Gate Ventures to support Vietnamese start-ups and an innovative start-up ecosystem. Meanwhile, the European Chamber of Commerce (Eurocham) announced the establishment of a European Union investment fund worth three billion euros ($3.4 billion) for start-ups

According to the Topica Founder Institute, Vietnamese start-ups received $889 million worth of capital financing from both domestic and foreign investors in 2018, tripling the value recorded in 2017 and six times the number in 2016.

Việt Nam’s start-up ecosystem has been developing with around 3,000 companies and 40 venture capital firms. Many leading Vietnamese corporations such as FPT, Viettel, Vingroup and CMC have also increased their support for local start-ups.

At the summit, leaders of venture funds expressed their interest in financing projects in the fields of proptech (property technology), fintech (financial technology), health tech, logistics and e-commerce. — VNS