Economy

Economy

|

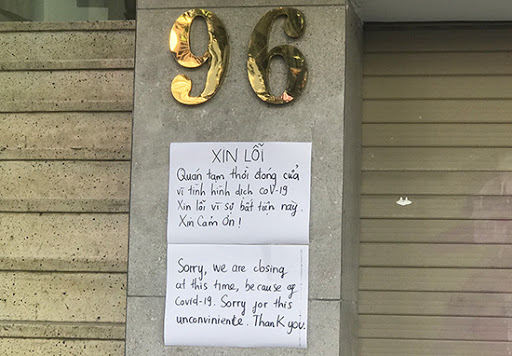

| A businesses announces a temporary closure due to COVID-19. Many firms did not apply for the five-month extension of tax payment. — Photo kinhtedothi.vn |

HÀ NỘI — The Government’s policy of a five-month extension for tax payment deadlines did not attract a large number of firms.

Until the end of July 30 – the deadline for submission of applications for the tax payment delay – more than 179,240 taxpayers submitted documents, according to the Ministry of Finance’s Tax Policy Department. This included more than 125,150 enterprises and 54,000 business households, with the tax worth VNĐ53.6 trillion (US$2.3 billion).

In comparison, the finance ministry estimated that about 700,000 enterprises were eligible for the tax payment postponement with a sum worth up to VNĐ180 trillion.

This meant that more than 70 per cent of businesses eligible for the policy did not apply.

According to Nguyễn Thị Thu Hà from the General Department of Taxation, there were a number of reasons for lower-than-expected applications for the tax payment postponement. One of them was that a number of enterprises and business households did not generate taxable income.

Hà said many others had taxes to pay but the totals were low, so they did not apply for the postponement.

Many did not apply for the postponement to avoid heavy financial pressure at the end of the year, she said.

The policy was not compulsory and applying for postponement was up to taxpayers, Hà said.

Nguyễn Công Hoan, Director of Flamingo Redtours, said tourism was a hard-hit sector and his company did not report taxable income in the period so did not apply for the postponement.

The biggest problem to enterprises at the moment was how to cope with the COVID-19 pandemic when the virus reoccurred in Việt Nam.

According to Nguyễn Quốc Kỳ, chairman of Vietravel, the reoccurrence of COVID-19 might mean firms are unable to recover.

Đinh Trọng Thịnh from the Academy of Finance said that efforts to contain the virus were important for businesses to recover. Thịnh added that domestic consumption should also be promoted. — VNS