|

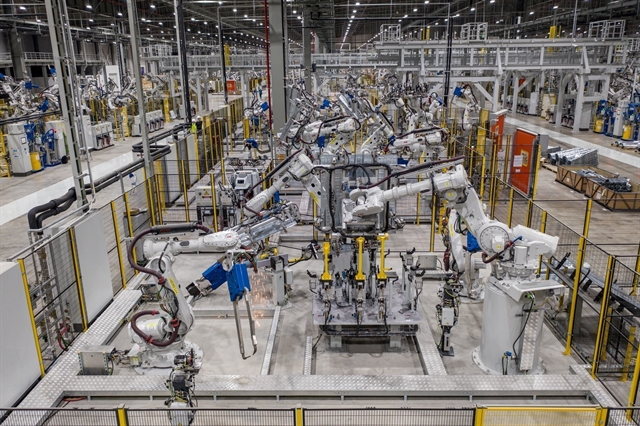

| SSI Securities Corporation met its revenue and profit targets last year despite the volatility in the securities market. — Photo Courtesy of SSI |

HCM CITY — SSI Securities Corporation achieved consolidated revenues of VNĐ3.3 trillion (US$142.8 million) last year, or 112 per cent of the target it had set, and its pre-tax profit target of VNĐ1.01 trillion ($43.7 million).

It retained its leading position among brokerages on both the Hồ Chí Minh and Hà Nội Stock Exchanges with market shares of 13.96 per cent and 9.7 per cent.

Last year marked the introduction of covered warrants to offer investors more options and promote trading activities.

SSI issued 24 million CWs, equivalent to 44 per cent of the market value, while the daily trading value of its CWs accounted for 65 per cent of the total market value.

SSI Asset Management Co., Ltd. last year launched a $30 million ETF called the SSIAM VNFIN LEAD based on the Vietnam Leading Financial Index.

It was the first ETF to simulate one of the three new indices launched by the HCM Stock Exchange and the first to target the largest stocks in the financial sector, and is expected to attract new ETF inflows into the Vietnamese market.

It won a clutch of awards last year for Best Local Brokerage, Best Overall Sales Services and Best Overall Country Research from Asiamoney Brokers Poll, and Best Corporate and Institutional adviser – Domestic at the Asset Triple A Country Awards. — VNS