Economy

Economy

A Việt Nam Report survey on the 500 most profitable companies in the country said most business insiders expect technology to remain the leader in attracting investment.

|

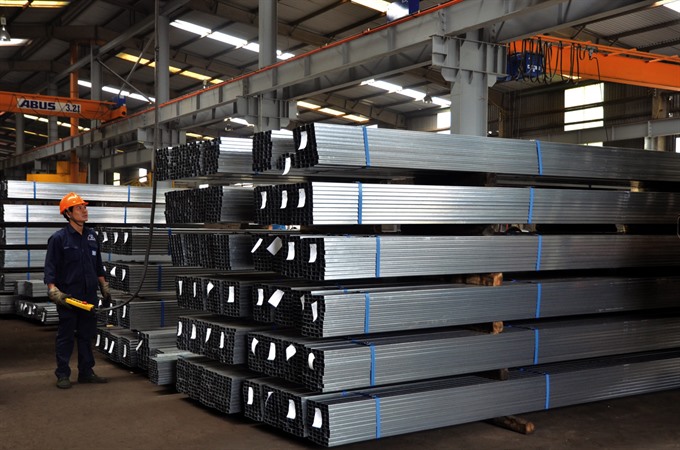

| The man works in the steel pipe factory of Hòa Phát Group JSC. Hòa Phát is among the top 10 most profitable companies in Việt Nam. — VNA/VNS Photo Ngọc Hà |

HÀ NỘI — A Việt Nam Report survey on the 500 most profitable companies in the country said most business insiders expect technology to remain the leader in attracting investment.

The survey announced the Profit500 Ranking for Việt Nam in Hà Nội on Monday.

Technology was the most common answer among enterprises (51.4 per cent of respondents), construction and real estate (40 per cent) and retail (34.3 per cent).

In the Profit500 Ranking, the companies with the highest average pre-tax profits are in telecommunications, information and technology. The enterprises have the potential to show stable growth profit indicators.

While the world is moving towards the Fourth Industrial Revolution, the application of technology in Vietnamese businesses is still in its early stages due to lack of capital, infrastructure and a skilled workforce.

The report said many Vietnamese businesses have strong demand but not enough strategic orientation in the investment process. 57 per cent of surveyed businesses reported they are speeding up investment in technology. 37.1 per cent are investing gradually and 8.6 per cent are still in preparatory stages.

Businesses expect the Fourth Industrial Revolution to help cut their costs, optimise efficiency and increase market share.

In the 2018 Profit500, the number of firms in construction, building materials, real estate (14.8 per cent), electricity (12.8 per cent), finance (11.2 per cent), and food, beverages and cigarettes (10.4 per cent) accounted for a majority of businesses on the list.

The average pre-tax profit of the top 500 most profitable companies in 2017 grew more than 65 per cent from 2016. The sectors with the highest return on asset (ROA) and return on equity (REO) were telecommunications, information technology, pharmaceuticals, healthcare, transportation, food, beverages and cigarettes.

The survey also revealed that, despite positive trends, enterprises face a long list of potential risks and challenges.

The escalating US-China trade war and increasing US import duties on some key commodities are raising concerns, as are volatile exchange rates and tax burdens. 51.4 per cent of respondents cited exchange rates as the biggest difficulty affecting their performance over the past year, followed by taxation at 42.9 per cent.

In the face of economic fluctuations, it is noteworthy that most of the firms approved of the State’s macro-economic management to curb inflation, adjust exchange rates and access information and legal documents.

More than 97.1 per cent of enterprises rated efforts to maintain economic stability and improve the business climate as “good” or “excellent” in the first nine months of the year. Enterprises expressed discontent in the effectiveness of administrative services, infrastructure and access to land.

However, enterprises are still optimistic about their performance this year. 90 per cent expect their profits will be higher than last year and only 8.6 per cent expect profits to stay the same.

The ranking aimed to honour enterprises that are profitable and have the potential to become the backbone of the Vietnamese economy and contribute to the introduction of Vietnamese brands to the international business community.

The award ceremony for the ranking will be held on November 29 at the Việt Nam National Convention Centre. — VNS

Top 10 most profitable companies in Viet Nam in 2018:

Việt Nam Oil and Gas Group

Viettel Group

Samsung Electronics Việt Nam Co Ltd

Honda Việt Nam Company

PetroVietnam Gas Joint Stock Corporation

Việt Nam Dairy Products JSC

Joint Stock Commercial Bank for Foreign Trade of Việt Nam

Hoà Phát Group JSC

Việt Nam Joint Stock Commercial for Industry and Trade

Vingroup JSC