Economy

Economy

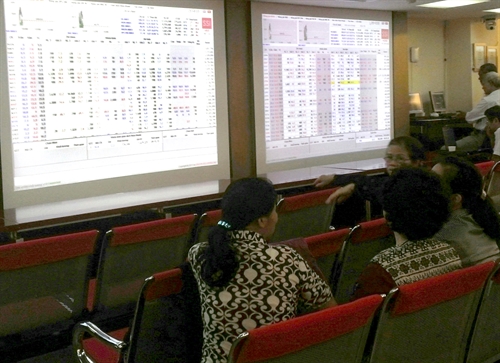

Shares declined on the two national stock exchanges yesterday, driven by trading of large exchange-traded funds in their third-quarter portfolio arrangements.

|

| Investors follow market movements at the Sài Gòn Securities Inc in Hà Nội. - VNS Photo Đoàn Tùng |

HÀ NỘI – Shares declined on the two national stock exchanges yesterday, driven by trading of large exchange-traded funds in third-quarter portfolio arrangements.

The benchmark VN-Index on the HCM Stock Exchange, was down 1.1 per cent to close yesterday at 659.8 points. The Index rose about 0.8 per cent in the previous two sessions.

On the smaller exchange in Hà Nội, the HNX-Index sank for a second day, losing 0.9 per cent to end the session at 83.7 points. It decreased 0.3 per cent on Friday.

Heavy selling by the two biggest Electronic Funds Transfers (ETF) in Việt Nam, FTSE Vietnam ETF and VNM ETF, on large-cap stocks weighed down the market.

They continued to offload shares of dairy firm Vinamilk (VNM), despite these shares being added to the third-quarter portfolios of FTSE Vietnam ETF and VNM ETF. Foreign net selling on these stocks hit more than VNĐ100 billion (US$4.5 million) yesterday.

The share price dropped two days in a row with a cumulative loss of four per cent.

Foreign investors also sold shares of Sacombank (STB) and steelmaker Hòa Phát Group (HPG), two of the 30 largest listed stocks by market capitalisation, for net values of VNĐ33 billion and VNĐ21.7 billion, respectively.

These two shares were seen as must-sells on both FTSE and VNM ETFs in this restructuring.

“Market risk comes from the fact that foreign investors have remained net sellers for more than a month,” Trần Thăng Long, head of analysis at BIDV Securities Co, said.

Long said the market index fluctuated and depended largely on the up and down movement of large-cap stocks which were influenced by ETF trading.

Foreign investors extended their net selling streak to nine consecutive sessions yesterday on the HCM Stock Exchange, responsible for a net sell value of VNĐ171 billion, lifting total net value to nearly VNĐ1.3 trillion in the last nine sessions.

They were net sellers for a total value of more than VNĐ2.2 trillion in the past month.

On the Hà Nội exchange, the foreign sector were net buyers yesterday after four consecutive net selling days, buying shares worth a net value of VNĐ14.3 billion. They sold a net value of VNĐ89 billion last week.

Of the top 10 stocks by market value, only insurer Bảo Việt Holdings (BVH) and real estate giant VinGroup (VIC) were gainers thanks to large foreign buys.

Liquidity remained modest yesterday with a total of nearly 139 million shares worth a combined VNĐ3 trillion traded in the two markets by the end of the session.

Furniture maker Đức Long Gia Lai Group (DLG) was the most active yesterday with 6.3 million shares exchanged but the share price dropped by the highest daily limit of 7 per cent to below VNĐ5,000 per share. – VNS