Economy

Economy

Vietnamese shares struggled to close mixed yesterday, covering some losses as local stocks were attractive to investors after plunging on Britain’s decision to leave the European Union (EU) last week.

|

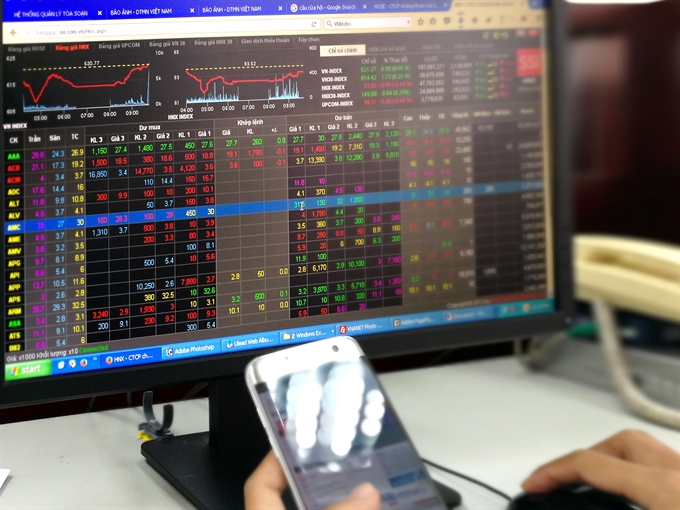

| Local markets closed mixed yesterday and some stocks became attractive to investors after a sharp fall on Friday. — VNS Photo Đoàn Tùng |

HÀ NỘI — Vietnamese shares struggled to close mixed yesterday, covering some losses as local stocks were attractive to investors after plunging on Britain’s decision to leave the European Union (EU) last week.

The benchmark VN Index on the HCM Stock Exchange inched up 0.1 per cent to finish at 621.27 points, rebounding from a plunge in the early session and from a sharp loss of 1.8 per cent on Friday.

Britain’s exit of the EU continued to negatively impact investor confidence and pushed local markets down deeper in the early session, Sài Gòn-Hà Nội Securities Corp (SHS) wrote in its daily report.

“The southern market bounced back strongly as Friday’s sharp fall made large-cap stocks attractive to investors,” SHS said.

Those stocks included information and technology firm FPT Corp (FPT), steel producers Hoa Sen Group (HSG) and Hòa Phát Group (HPG), and property and retail company Vingroup JSC (VIC).

FPT edged up 0.7 per cent, especially after the company’s profit in the first five months exceeded this year’s plan by 9 per cent.

HSG and HPG increased by 1.5 per cent and 0.5 per cent on expectations that their earnings will increase in the second quarter of the year.

VIC jumped 3.3 per cent on the ex-dividend date, on which the company issued 213 million shares to pay dividend to shareholders for last year’s performance.

Other blue chips also made gains to lift the southern market up, including insurer Bảo Việt Holdings (BVH), PetroVietnam Gas Corp (GAS) and PetroVietnam Drilling and Well Service Corp (PVD).

The HNX Index on the Hà Nội Stock Exchange managed to cover some losses made during the day, ending down 0.1 per cent at 83.53 points. The northern market index has dropped 2.1 per cent after the last two sessions.

Stocks that supported the northern bourse were Sài Gòn-Hà Nội Bank (SHB), insurer PVI Holdings (PVI), Việt Nam Construction and Import-Export Corp (VCG) and Sài Gòn Thương Tín Real Estate JSC (SCR). Those stocks rose between 0.4 per cent and 1.6 per cent.

On the opposite side, big companies such as Asia Commercial Bank (ACB), Tiền Phong Plastic JSC (NTP) and Vicostone JSC (VCS) were down. These stocks were down 0.5 per cent, 3.5 per cent and 2 per cent, respectively.

As the US dollar became stronger on the global markets, Việt Nam’s central bank yesterday raised its daily reference mid-point rate for foreign exchange by VNĐ21 to VNĐ21,866 for a dollar.

With the current trading band of plus or minus 3 per cent applied for the rate, a dollar can domestically be traded between VNĐ21,210 and VNĐ22,522.

Almost all commercial banks increased the dollar rates in the morning, reported Nhịp cầu Đầu tư (Investment Bridge) online.

Vietcombank listed the buying price at VNĐ22,310 per dollar and the selling price at VNĐ 22,380 per dollar, both 15 đồng higher than the previous session’s levels, while VietinBank maintained the selling price at VNĐ22,370 per dollar, but increased the buying price by 30 đồng at VNĐ22,300 per dollar.

After a British vote to leave the European Union (EU) last week immediately hit the global financial market, local brokerage MB Securities said the Brexit might lead to a devaluation of the Chinese yuan.

There was a possibility that China would devalue its currency to improve the competitiveness of its exports to the EU. This might also force Việt Nam to depreciate the đồng to ensure competitive exports, the brokerage said.

Investors exchanged more than 155.7 million shares worth VNĐ2.68 trillion (US$119.2 million), a decrease of 26 per cent from last week’s daily trading value. — VNS