Economy

Economy

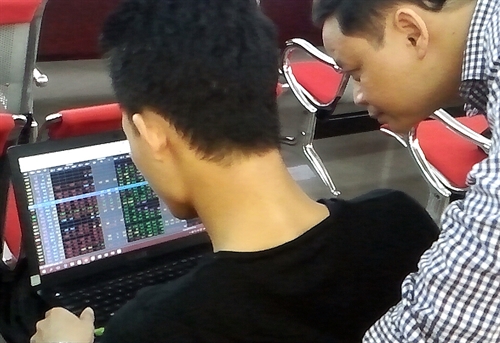

Vietnamese shares bounced back from Thursday’s declines on both local exchanges as banks and property developers recovered from their recent falls.

|

| Investors watch share movements on a personal computer. Banks rebounded after recent falls to lift local markets up yesterday. — VNS Photo Đoàn Tùng |

HÀ NỘI — Vietnamese shares bounced back from Thursday’s declines on both local exchanges as banks and property developers recovered from their recent falls.

The benchmark VN Index on the HCM Stock Exchange rose 0.6 per cent to finish at 608.11 points. The southern index closed down 1.1 per cent over the week.

The HNX Index on the Hà Nội Stock Exchange increased by 0.4 per cent to end at 81.39 points, losing a total of 0.4 per cent from the previous week.

Listed banks made some recoveries after they suffered losses in the previous sessions as investors were cautious amid fears over a possible US interest rate increase in June.

Those banks included Asia Commercial Bank (ACB), Vietinbank (CTG), the Bank for Investment and Development of Việt Nam (BID), Sài Gòn-Hà Nội Bank (SHB) and Sacombank (STB).

ACB gained 1.1 per cent, SHB added 1.6 per cent, CTG and BID advanced 1.7 per cent and 1.8 per cent, respectively, and STB increased by 2.7 per cent.

Local markets were also supported by property developers, including Vingroup JSC (VIC), Tân Tạo Investment Industrial JSC (ITA), Kinh Bắc City Development Share Holding Corp (KBC) and Sài Gòn Thương Tính Real Estate JSC (SCR).

Those shares rose between 0.7 per cent and 5.7 per cent.

Securities firms also recorded good gains. Sài Gòn Securities Inc (SSI), HCM City Securities Corp (HCM), Bảo Việt Securities Corp (BVS), Sài Gòn-Hà Nội Securities Corp (SHS) and VNDirect Securities Corp (VND) were among the biggest winners.

SSI moved up 1.5 per cent, SHS jumped 3.2 per cent, VND edged up 0.9 per cent, HCM was up 2.7 per cent and BVS gained 2.3 per cent.

Supporting business news also helped other companies see their stocks improve yesterday such as Đà Nẵng Rubber JSC (DRC) and TMT Motor Corp (TMT).

DRC rose slightly 0.8 per cent after the company announced the list of shareholders, who receive dividends for last year’s performance in cash and bonus shares, will be completed on June 10. The total dividend accounts for 60 per cent of last year’s net profit, which was VNĐ415 billion (US$18.4 million).

TMT gained 1.5 per cent after the Hà Nội Customs Department removed the company from the list of firms that have not completed paying taxes.

However, investors remained cautious during yesterday’s session, which resulted in lower market trading liquidity. Both local markets exchanged more than 162.7 million shares worth VNĐ2.3 trillion (US$102 million), a decrease of 12 per cent from Thursday’s trading value. — VNS