Economy

Economy

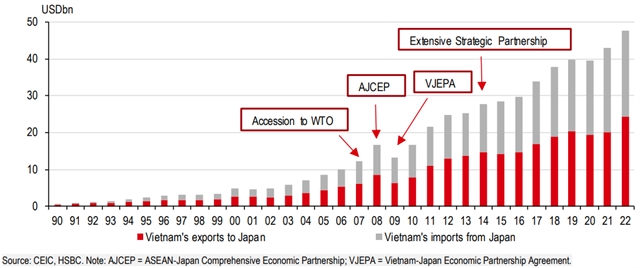

HCM CITY —Bilateral trade between Japan and Việt Nam has grown over 90-fold in the past three decades, thanks to proactive efforts in trade liberalisation, making Japan Việt Nam’s fourth-largest trading partner, according to a report from economists of HSBC Vietnam.

According to the report announced by HSBC Vietnam on Wednesday, Việt Nam’s 50-year diplomatic relationship with Japan has been featuring prominently in local media headlines. It is not as widely known as Việt Nam’s economic ties with either the US or with China. However, it is a key one that carries significant weight in Việt Nam’s fast growth on many fronts. Just as recently as last week, both sides have agreed to elevate their ties further to a “comprehensive strategic partnership” for potential avenues of cooperation.

Việt Nam’s significance in Japan’s trade has also risen compared to ASEAN peers. But it is more than just trade. Japan is also Việt Nam’s third-largest FDI provider, as well as the top official development assistance (ODA) donor and the main destination for Vietnamese overseas workers. Over the past three decades, these developments have helped lay solid foundations for Việt Nam’s impressive development story.

|

| Total trade between Viet Nam and Japan has flourished in the past 30 years. — Photo courtesy of HSBC |

Entrance of retail and finance

Beyond trade, it is no secret that Japan has been a key direct investor in ASEAN. For Việt Nam, in particular, Japan has been its third-largest source of FDI, reaching close to US$70 billion by 2022, trailing after Korea and Singapore.

Recently, it is not just greenfield investments in manufacturing. Rising income and the proliferation of discretionary spending have created opportunities in retail as well as financial services, subsequently attracting investment from Japanese firms.

Japanese retail group Aeon, which stands out as a notable example, announced its intention to expand its number of department stores in Việt Nam from six currently to 30 by 2030. Mizuho, one of Japan’s megabanks, has steadily made share purchases in Vietnamese companies such as leading digital payment provider M-Service, as well as State-owned Vietcombank.

While competition in these spaces is intensifying, as evident from global peers such as Thailand’s Central Group becoming similarly more involved, it is clear that the growing consumer potential in Việt Nam is an opportunity for a new group of Japanese firms looking to invest.

Enabling development

|

| Although falling in recent years, Japan’s ODA has been playing a key role. — Photo courtesy of HSBC |

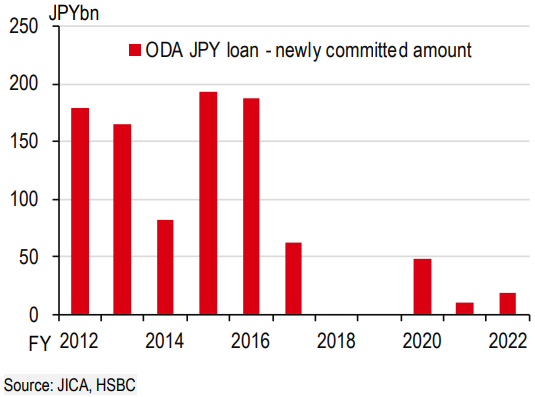

In addition, it is also important to remember that infrastructure and development have provided a platform for these opportunities to flourish. In this case, Japan has been the largest overseas development assistance (ODA) provider to Việt Nam.

Cumulatively, Japan has provided over JPY3 trillion in ODA to Việt Nam, making the latter one of the top five recipients of Japanese ODA. In fact, most of these loans have been used to develop critical infrastructure, such as Nội Bài International Airport and Nhật Tân bridge, just to name a few.

With preferential terms, including long maturity (typically 30-40 years) and low interest rates (typically 0.5-1.0 per cent), these development loans have played a key role in enabling Việt Nam’s recent growth.

The other key area worth highlighting is the remittance flows from Japan to Việt Nam, as an important source of steady foreign income. Japan, Taiwan, and South Korea are the top three destinations for Vietnamese overseas workers (ILO, 2023).

One factor driving the flow is thanks to Japan’s technical intern training program, which allows foreign workers to stay for a maximum of five years to develop competitive skills to bring back to their home countries. The largest source of trainees for this program has been Việt Nam, accounting for over half of all technical trainees.

Currently, the significant depreciation of JPY may lead to Vietnamese workers in Japan feeling the pinch, as money sent abroad is effectively less than before. In addition, recent controversies on how the trainee program is actually utilised by firms and the treatment of trainees have raised discussions among Japanese authorities on overhauling and improving the program, such as by potentially introducing more flexibility in workplaces as well as providing smoother pathways for permanent residency. In addition to raising the incentive for additional skills development for foreign workers, these reforms can potentially raise the inter-linkages between the two countries further.

All in all, Japan and Việt Nam’s economic relationship carries significant weights on many metrics. While Japanese firms originally approached Việt Nam as a cost-competitive offshore manufacturing base, the latter’s robust economic growth story has created new avenues for the relationship to develop, especially for higher value-added activities. — VNS