Economy

Economy

|

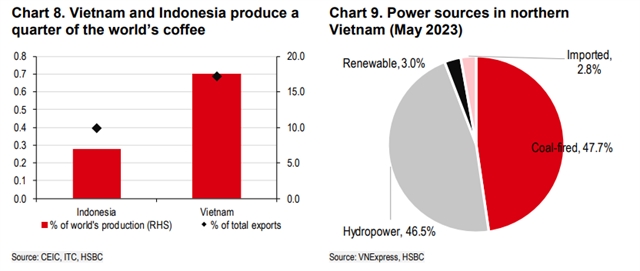

| Việt Nam and Indonesia supply 25 per cent of the world’s coffee. — HSBC graphic |

HÀ NỘI — In a recently published report, HSBC Vietnam posits that the recurring El Niño, after an absence of three years, could heighten the threat of droughts, water scarcities, and potential disruptions in trade across the ASEAN region.

This report, bearing the title “ASEAN Perspectives - the arrival of El Niño", was unveiled last week.

Economists working for HSBC believe that the yield of pivotal agricultural products in Việt Nam, including rice and coffee, could suffer significantly in the wake of the El Niño phenomenon.

The report underscores the primary peril posed to the agricultural sector, highlighting crops such as rice, palm oil, and coffee as particularly susceptible. However, it also draws attention to potential risks faced by the semiconductor industry.

Current severe heatwaves sweeping across ASEAN nations are suggestive of the resurgence of El Niño, a meteorological event usually correlated with drought and water shortages. The harsh manifestation of El Niño in 2015-16 had a detrimental impact on the region's economy. In its aftermath, rice production in countries such as Thailand and Việt Nam dropped by more than 10 per cent, exemplifying the potential threats posed by this phenomenon.

Whilst coffee might be considered a 'minor' commodity in comparison to others, its significance should not be underestimated, especially given the wide array of global consumers who perceive it as a daily essential. Despite the fact that it constitutes less than 1 per cent of total exports, on a par with palm oil, Việt Nam and Indonesia nonetheless supply a quarter of the world's coffee.

The majority of this contribution is in the form of Robusta beans, characterised by their bitter taste and heightened acidity. It's worth revisiting the 2015-16 period when coffee production in these economies slumped by 10 per cent, inciting speculation regarding the potential ramifications of El Niño this time around.

More pointedly, forecasts from the USDA suggest a decline in Robusta production in Indonesia by 20 per cent in the 2023/24 cycle, as the dry season has made an earlier appearance, impacting over 60 per cent of the coffee-producing region.

Moreover, ASEAN's global preeminence in the palm oil market is well documented. Indonesia and Malaysia collectively generate 85 per cent of the global palm oil supply, trailed by Thailand at 4 per cent. Notably, palm oil accounts for 10 per cent of total exports in each of these nations.

Whilst the El Niño phenomenon is still in its infancy, authorities in both Indonesia and Malaysia have raised alerts about potential disturbances to palm oil yields. Indonesia has declared emergency measures in seven provinces, predominantly those engaged in palm oil production.

It is noteworthy that palm oil yield traditionally experiences a drop during an El Niño year, and also contributes to air pollution as farmers resort to burning fields to make way for new crops. Concurrently, the Malaysian Palm Oil Board has cautioned that production could decrease by 1-3 million tonnes (6-17 per cent) during this episode.

However, the impact is anticipated to be less drastic than during the 2015-16 El Niño event, which saw a reduction of 20 per cent, due to better farming practices and enhanced labour conditions. Nonetheless, the full effect may not be evident for another 15-18 months, as per Malaysian officials, suggesting that this is a risk to monitor more closely in 2024 rather than 2023.

The HSBC reports indicate that the ripple effect of El Niño extends beyond the agricultural sector and could potentially cause disruptions to industrial production due to energy shortages. Both Việt Nam and Malaysia offer pertinent examples of such materialised risks. As of early June, a number of Việt Nam's northern provinces, which host major electronics manufacturers such as Samsung and Foxconn, have grappled with electricity shortages. These power disruptions are caused by a dearth of hydropower, a significant source of electricity in the region, as the heat and droughts associated with El Niño have led to reservoirs drying up, even causing major dams in the north to reach dead storage levels.

Fortunately, recent moderate rains have caused the water levels in all reservoirs across the nation to surpass the threshold required for safe electricity generation, according to state utility Việt Nam Electricity (EVN). Consequently, after several electronics manufacturers had to curtail production, power shortages have started to diminish recently, facilitating factories to extend their operating hours. However, economists at HSBC stress that El Niño-related energy risks require closer observation, as they may exacerbate Việt Nam’s manufacturing vulnerabilities, especially during a period when the country has been dealing with the escalating challenge of dwindling export orders.

Fortuitously, ASEAN policymakers demonstrate acute awareness of the implications of El Niño, issuing early warnings and proactively adopting measures to fortify against potential economic disruptions. Countries have turned to tactics such as cloud seeding, augmenting specific agricultural imports, and implementing partial manufacturing cutbacks to offset potential disruptions induced by El Niño, as indicated in the report. — VNS