Economy

Economy

|

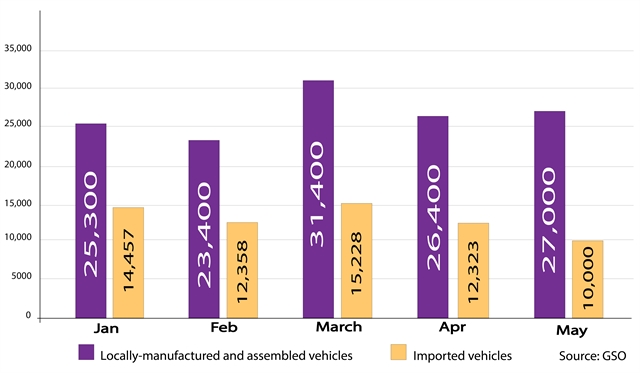

| Number of domestically- manufactured and imported vehicles in five months of 2023. - VNS graphic Doan Tung |

HÀ NỘI – Việt Nam spent nearly US$270 million on importing 10,000 completely-built automobiles (CBUs) in May 2023, a decrease of 6.3 per cent from a year earlier.

Automobile imports in May were down 5.2 per cent in quantity and 9.1 per cent in value compared to the same period last year.

Imported CBUs have had two consecutive months of decline in both quantity and value when compared to the previous month amid slumping demand.

However, the country imported 64,344 CBUs worth more than $1.4 billion in the first five months of this year, up 26.7 per cent in quantity and 16.4 per cent in value, according to statistics released by the General Statistics Office (GSO).

The statistics show that in the past three months, despite car manufacturers being focused on stimulating consumer demand by offering discounts and promotional programmers, car sales are still very low.

Specifically, the Vietnam Automobile Manufacturers Association (VAMA) and two major car manufacturers Hyundai Thanh Cong (TC Group) and ViaSat announced that only 30,799 units were sold in April, down 16.2 per cent compared to the previous month and 40.5 per cent against the same frame last year.

Automobile manufacturers are still waiting for support from the Government, specifically a cut of 50 per cent of the registration fee.

Recently, the Government has asked the Ministry of Finance (MoF) to consider conducting a plan for a car registration fee cut. However, the Ministry of Finance rejected the request for the 50 per cent registration fee reduction for domestically manufactured and assembled vehicles for fear of affecting local budget revenue and violating international commitments.

According to the finance ministry, a car registration fee cut should be applied to imported cars as well.

Before decisions are enacted, the domestic auto market will continue facing hard times as demand declines and inventories rise.

The finance ministry reports that purchasing power and consumption are low against the period during the COVID-19 pandemic. The ministry strongly believes that continuous implementation of the 50 per cent registration fee reduction for domestically manufactured and assembled vehicles will hardly stimulate local demand and promote growth in comparison with previous months.

The MoF said the request for the 50 per cent registration fee reduction for domestically manufactured and assembled vehicles will affect local budget revenue. In 2020, the registration fee cut made an impact on reducing State budget revenue of over VNĐ16 trillion.

In addition, the ministry said a 50 per cent cut on registration fees will violate international commitments. During a recent Vietnam Business Forum held in Hà Nội, local car importers and Eurocham proposed to reduce 50 per cent cut on registration fees for imported cars in line with internationally signed commitments. If this proposal is implemented, it can greatly affect the State budget revenues.

Moreover, the MoF reports that in the current context, purchasing power and consumption are different from the period between 2020 and 2022 because of low demand for buying cars. Meanwhile, the continuous implementation of a 50 per cent cut on registration fees for domestically- manufactured and assembled vehicles is forecast to be unlikely to stimulate the demand and growth as it was before.

The Ministry of Finance emphasised that the reduction of the 50 per cent registration fee can be applied in the short term only as most countries suffered from the serious burden during the COVID-19 pandemic, noting that the 50 per cent cut on the registration fee is no longer suitable in 2023.

To support businesses, the MoF has worked out a plan to ask authorised agencies to offer a finance package worth more than VNĐ186 trillion. Of the figure, tax exemption accounts for VNĐ65.5 trillion and tax extension is VNĐ121 trillion.

On the other hand, the ministry has worked with ministries and branches to compile a decree on extending excise tax on domestically-manufactured and assembled vehicles. VNS