Economy

Economy

|

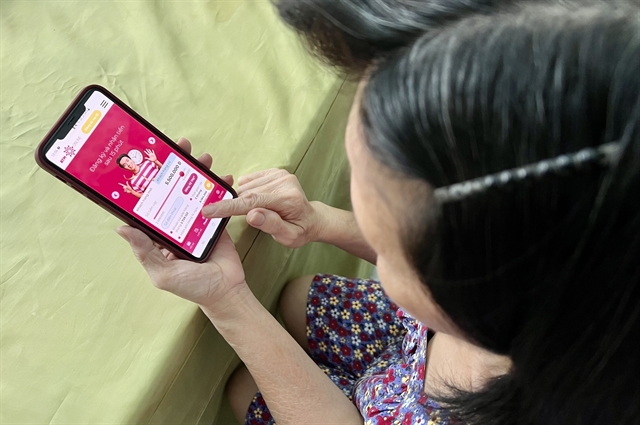

| A customer uses ATM Online app to get online loan. — Photo Courtesy ATM Online |

HCM CITY — Fintech company ATM Online has officially launched its ATM Online app that offers customers online installment-loans.

The company, which has been in the Vietnamese market for five years, said the app is now available on Android and will be available on iOS by the end of the first quarter of this year.

ATM Online app provides all services such as registering for a loan with simpler procedures. It takes less than two minutes to fill out all information, 15 minutes for new customers to get a loan and five to seven minutes for existing customers to get a loan.

Using the new app, customers are able to easily track their payment and transaction history. E-contracts will be available on the app.

New customers can download the app to have a loan from VNĐ2 million (US$80) to VNĐ6 million ($24) within three months with a 14-day grace period. Within 14 days after receiving the disbursement amount, customers have the right to consider their loan. In the event of a change of mind, the customer can completely refund the disbursed amount without paying interest, consulting fee or service fee.

With this programme, ATM Online and its partners want to make sure customers feel comfortable using the service. The 14-day period is considered a grace period to experience the product.

Đỗ Minh Hải, director of ATM Online said: “ATM Online and its partners continuously invest in developing technology to automate operations. We also focus on developing technology payment channels such as identification code, QR code.”

ATM Online is a financial technology company and a member of TM Online with headquarters in Singapore and is in three other markets including Việt Nam, the Philippines and Sri Lanka.

In Việt Nam, ATM Online was established in October 2017 with the brand name ATM Online. Targeting customers with low incomes, the company is a pioneer in applying technology in consulting and offering small online loans with a value of VNĐ2 million to VNĐ 20 million ($800) for a period of up to eight months.

In more than five years of operation in Việt Nam, more than 76 per cent of customers after applying for a first loan have returned to use the service provided by ATM to apply for a second loan. The rate of customers continuing to apply for third and fourth loans is up to 80 per cent. — VNS