Economy

Economy

|

| Võ Trí Thành |

*Võ Trí Thành

Global central banks are in a dash to raise interest rates to cool rampant inflation and their moves are challenging the State Bank of Việt Nam’s policymaking in a way to support the economic recovery while sustaining macroeconomic sustainability.

Last week, the US Federal Reserve (Fed) raised interest rates by another 75 basic points (bps) – the second straight month and its third this year – in an effort to fight inflation which hit a 40-year high of 9.1 per cent in June. That takes the cumulative June-July increase to 150 bps – the steepest since the early 1980s.

The European Central Bank on July 21 increased its benchmark interest rate by 0.5 per cent for the first time in 11 years and is signaling further hikes this year after consumer prices in the euro area are expected to rise to 8.9 per cent in July.

Data from Reuters showed seven central banks of the Group of Ten delivered 350 basis points of rate hikes last month – nearly half of the total 775 bps administered by policymakers across the group this year to date. Meanwhile, emerging market central banks have raised interest rates by 4,415 bps year-to-date, compared to 2,745 bps for the whole of 2021.

Among major central banks, only China and Japan have maintained loose monetary policy thanks to relatively low inflation and to boost the domestic economies.

The world economy is in a downward spiral with the risk of major economies falling into recession rising. The International Monetary Fund (IMF) last week again downgraded its forecast for global growth this year, from 3.6 per cent in the April report to only 3.2 per cent this year. In April, it cut its growth expectations for 2022 to 3.6 per cent from 4.4 per cent.

Facing rising risks of supply disruption, debt crisis, high food prices and worse-than-expected high inflation, global policymakers are rushing to tighten monetary policies but seeking a balance between curbing inflation and maintaining growth is a very difficult task.

In Việt Nam, the picture is very different. Việt Nam’s economy recovered spectacularly in the second quarter with a growth rate of 7.7 per cent – the fastest expansion in 11 years, lifting the six-month growth to 6.42 per cent. Inflation was kept at a relatively low level at 2.54 per cent in the first seven months.

Some international institutions have forecast Việt Nam’s economy will achieve and even surpass its growth target this year.

In its latest report last week, Standard Chartered Bank expects Việt Nam’s GDP growth at 10.8 per cent for the third quarter and 3.9 per cent for the last quarter, taking full-year growth to 6.7 per cent. Meanwhile, the Singapore-based United Overseas Bank (UOB) revised Việt Nam’s growth up to 7 per cent from 6.5 per cent.

However, pressure is building. Despite relatively low inflation in the first half, inflation is expected to rise towards the end of this year, though still within the target range but likely reaching 4 per cent or slightly higher. This rate will be much lower compared to many countries but will pressure the foreign exchange rate.

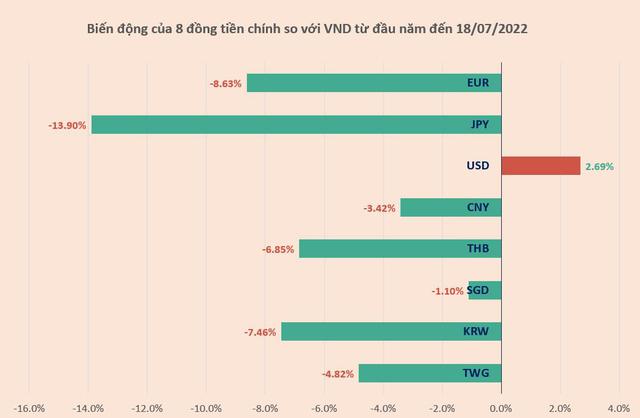

Never before has the world witnessed major foreign currencies weakening sharply against the US dollar (USD) like this year. The Japanese yen has lost about 20 per cent of its value against USD, followed by the euro, down 12 per cent. Other currencies such as GBP (British Pound), THB (Thai Baht) and Won (South Korea) also fell by more than 10 per cent.

In Việt Nam, the Vietnamese đồng (VND) has lost about 2.5 per cent against the USD by the end of July and is seen as relatively stable amid global currency volatility. However, exchange rate management is facing challenging choices.

|

| Movements of 8 major currencies against VND until July 18, 2022. Source: Tradingview data compiled on nhipsongkinhte.com |

Relative stability or higher depreciation?

According to the principle of relative purchasing power parity, a country with high inflation is expected to depreciate its currency relative to other currencies as inflation will reduce the real purchasing power of that country’s currency.

In Việt Nam, pressure on currency depreciation is not derived from inflation (as inflation is still relatively low in Việt Nam) but from unstable external factors. Although US inflation was high, it was accompanied by the Fed's hawkish action to increase interest rates by a large margin, causing the USD to appreciate strongly against other currencies.

If Việt Nam devalues its currency too quickly, it will benefit exports but harm imports and put more pressure on inflation, challenging the Government’s efforts to keep inflation under the target. On the contrary, if the exchange rate is restricted too much, it will also affect Việt Nam's trade, making our exports less competitive in the context that the currencies of our trading partners and competitors have weakened sharply against the USD since the beginning of the year.

However, looking at the recent actions of the policymakers, keeping the exchange rate relatively stable is taking priority. At a meeting with the Government last week after the Fed’s meeting, Prime Minister Phạm Minh Chính reaffirmed curbing inflation, ensuring macroeconomic stability and safeguarding major balances would still be Việt Nam’s top priorities.

The State Bank of Việt Nam (SBV) therefore is focusing on maintaining flexible policy and proactively managing the exchange rate in line with the market developments to both fight inflation and ensure the policy is supporting economic growth

As world commodity prices have continuously escalated, Việt Nam is one of the economies with large openness and is heavily dependent on imported raw materials and fuels. That’s why keeping the exchange rate reasonably stable to curb input prices for businesses is important.

However, the Fed’s rate hike is still expected to have adverse impacts on emerging markets when foreign capital may be withdrawn from these markets to fly back to the US. So far, this situation is relatively stable in Việt Nam thanks to flexible interventions of the market regulator.

Since the beginning of this year, SBV has pumped US$12-13 billion into the market to help stabilise the exchange rate. The central bank has shifted to selling USD in the spot market instead of forward contracts to cool the pressure. Especially over the past month, it has continuously attracted đồng through the issuance of bills of exchange, narrowing the difference between the USD and đồng interest rates through Open Market Operations (OMO), thereby helping increase the value of the đồng.

In addition, trade surplus, FDI, remittances, expected balance of payments surplus and a somewhat strong foreign exchange reserve of about $110 billion are positive factors likely contributing to the relatively stable value of Vietnamese đồng.

Given rather low inflation and stable macroeconomic condition, the SBV is believed to have enough capacity to keep interest rate and foreign exchange policies steady for now to fight inflation and support economic recovery. However, building pressure will likely drive the SBV to increase interest rates in late-Q3 or Q4, though the rate hikes will be limited around 0.25-0.5 per cent and VND may depreciate by about 3 per cent or a little bit higher this year. — VNS

*Võ Trí Thành is a former vice-president of the Central Institute for Economic Management (CIEM) and a member of the National Financial and Monetary Policy Advisory Council. The holder of a doctorate in economics from the Australian National University, Thành mainly undertakes research and provides consultation on issues related to macroeconomic policies, trade liberalisation and international economic integration. Other areas of interest include institutional reforms and financial systems.