Economy

Economy

GENEVA — The World Economic Forum’s Community of Chief Economists expects lower economic activity, higher inflation, lower real wages and greater food insecurity globally in 2022, pointing to the devastating human consequences of the fragmentation of the global economy.

Reversing previous expectations for recovery, the majority of respondents to the latest survey expect only a moderate economic outlook in the United States, China, Latin America, South Asia and Pacific, East Asia, sub-Saharan Africa and the Middle East and North Africa in 2022. In Europe, the majority expect the economic outlook to be weak.

The choices of both business and government are expected to lead to greater fragmentation in the global economy and unprecedented shifts in supply chains, creating a perfect storm of volatility and uncertainty. These patterns are expected to create further difficult trade-offs and choices for policy-makers, and – without greater coordination – shocking human costs. These are the key findings of the World Economic Forum’s quarterly Chief Economists Outlook, published today.

“We are at the cusp of a vicious cycle that could impact societies for years. The pandemic and war in Ukraine have fragmented the global economy and created far-reaching consequences that risk wiping out the gains of the last 30 years. Leaders face difficult choices and trade-offs domestically when it comes to debt, inflation and investment. Yet business and government leaders must also recognise the absolute necessity of global cooperation to prevent economic misery and hunger for millions around the world. The World Economic Forum’s Annual Meeting this week will provide a starting point for such collaboration”, says Saadia Zahidi, Managing Director at the World Economic Forum.

Higher inflation, lower real wages and food insecurity

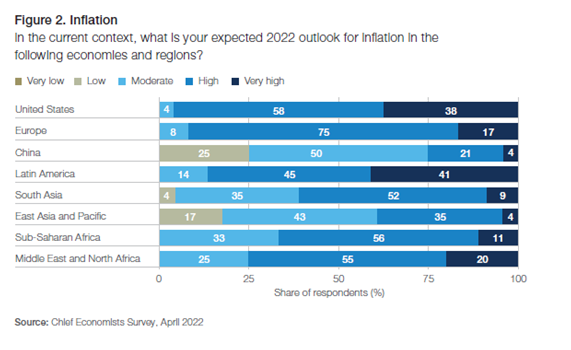

The war in Ukraine, continued surges of COVID-19 variants and associated supply shocks are impacting expectations on inflation. The majority of chief economists surveyed by the Forum expect high or very high inflation in 2022 in all markets except China and East Asia – with 96 per cent expecting high or very high inflation in the US, 92 per cent for Europe and 86 per cent for Latin America. In parallel, two-thirds of chief economists expect that average real wages will decline in the near term in advanced economies, while one-third are uncertain. Ninety percent of those surveyed expect average real wages to fall across low-income economies.

|

| Inflation expectation |

With wheat prices expected to increase by over 40 per cent this year and prices for vegetable oils, cereals and meat at all-time highs, the war in Ukraine is exacerbating global hunger and a cost-of-living crisis. Over the next three years, chief economists expect food insecurity to be most severe in sub-Saharan Africa and in the Middle East and North Africa. At the current trajectory, the world is on track for the worst food crisis in recent history, compounded by the additional pressure of high energy prices.

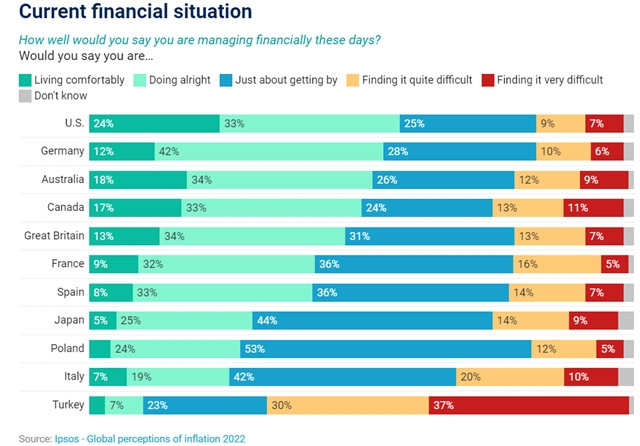

These expert predictions are echoed in the experience of the general public. A recent 11-country survey, conducted by Ipsos with the World Economic Forum, reveals high levels of public economic pessimism in the face of a cost-of-living crisis. Twenty-five per cent of the public say they are finding it quite or very difficult to manage financially, ranging between two-thirds of Turkish citizens and 16 per cent of those in the US and Germany. The largest group (34 per cent) say they are “just about getting by”. Only 11per cent say they are living comfortably while three in ten (29 per cent) feel they are doing alright.

Expectations of price rises are also widespread across all 11 countries – almost four in five people expect the cost of their food shopping to increase, while three-quarters expect rises in utility bills such as gas and electricity. For most countries, a rise in food prices is the area households say would have the biggest impact on their quality of life – this is the case for the US, Canada, Italy, Japan, Australia, Poland and Turkey. In the remaining four countries (Britain, Italy, Germany and Spain) an increase in utility bills would have the biggest effect.

|

A difficult balancing act for policy-makers

Faced with the challenge of containing inflation without tipping economies into recession, chief economists are divided. While a majority (57 per cent) agree that the risks associated with higher inflation in low-income economies outweigh those associated with short-term contraction due to monetary tightening, opinions of the effects in high-income countries are more divided.

With fiscal spending set to increase in many countries to deal with current developments, balancing the risks of a cost-of-living crisis with higher debt is a key challenge for policy-makers. In advanced economies, 54 per cent of chief economists expect energy price subsidies while 41 per cent expect food price subsidies. In low-income economies the vast majority feel that food price subsidies will be necessary (86 per cent), while 60 per cent expect energy price subsidies. However, this necessity will need to be squared against a higher risk of debt default (81 per cent see an increased risk of this for developing economies).

With the World Bank expecting energy prices to rise by more than 50 per cent in 2022, before easing in 2023-24, policy-makers are faced with balancing the risks of energy insecurity against the transition to greener energy. Most chief economists surveyed expect policy-makers to try and tackle both challenges simultaneously. However, a clear majority of respondents expect a prioritization of energy security based on carbon-intensive sources rather than greener sources across all regions except Europe and China.

Fragmentation and politicization of supply chains

As supply chains enter their third year of disruption, governments and business are rethinking their approach to exposure, self-sufficiency and security across their supply chains. Chief economists consider it likely or highly likely that multinational companies will both localize and diversify their supply chains in the next three years, realigning them along geopolitical fault lines.

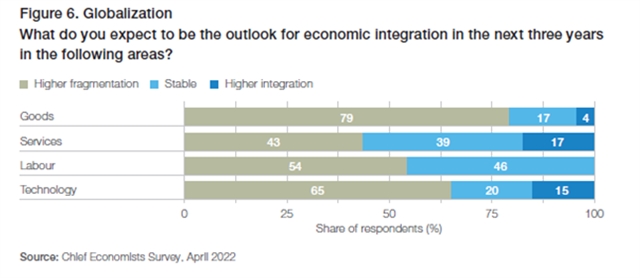

The November 2021 edition of the Chief Economists Outlook identified “deglobalization” as an emerging trend driven by the impact of the pandemic. The war in Ukraine and its geopolitical and economic fallout is accelerating these trends, with declining physical integration and increasing friction in the virtual space. A majority of the chief economists polled for May’s Outlook expect higher fragmentation in the markets for goods, technology and labour in the next three years, while most expect services to remain stable or be more globalized.

|

Four futures for economic globalization

An additional World Economic Forum report, published today, maps out possible trajectories for globalization in the coming five years. Four Futures for Economic Globalization: Scenarios and Their Implications outlines how the nature of globalization may shift as economic powers choose between fragmentation or integration in both the physical and virtual dimensions of the world economy. The four scenarios are as follows:

The report calls for “no-regret actions” by policy-makers such as: global cooperation on the climate crisis; investment in human capital to prepare populations for a range of economic futures; and developing resilience through greater economic integration, knowledge-sharing and diversification.

| The Annual Meeting 2022 taking place 22-26 May in Davos, Switzerland, will embody the World Economic Forum’s philosophy of collaborative, multistakeholder impact, providing a unique collaborative environment in which to reconnect, share insights, gain fresh perspectives, and build problem-solving communities and initiatives. Against a backdrop of deepening global frictions and fractures, it will be the starting point for renewing global responsibility and cooperation. |