Economy

Economy

|

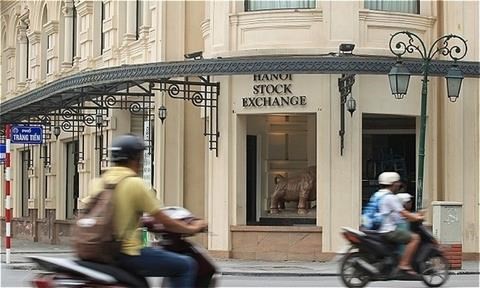

| Hà Nội Stock Exchange headquarters in Hà Nội. A total of 357 enterprises are trading shares on the northern bourse with listing value of more than VNĐ137 trillion (nearly $6 billion). — Photo tinnhanhchungkhoan.vn |

HÀ NỘI — Liquidity on the Hà Nội Stock Exchange (HNX) grew steadily in the first six months of 2020 as foreign investors returned from May, despite a decline in newly listed companies due to economic uncertainty.

In a meeting on July 9 to review the exchange’s operation in the last six months, deputy general director Nguyễn Như Quỳnh said Việt Nam’s stock market suffered a steep decline at the end of the first quarter due to catastrophic consequences of the COVID-19 outbreak. The situation has improved since May when the economy gradually returned to normal along with prompt support measures of the Ministry of Finance and the State Securities Commission.

Ending June, a total of 357 enterprises are trading shares on the northern bourse with listing value of more than VNĐ137 trillion (nearly US$6 billion). The bourse welcomed only four new listings in the last six months while 13 companies left the market.

The average trading value reached VNĐ547 billion per session, up 33 per cent year-on-year.

On the Unlisted Public Company Market (UPCoM), 903 companies are trading, including 42 new listings in the past six months, with average trading value of VNĐ312 billion, up 5.7 per cent compared to the same period of last year.

In the first half, HNX held 85 auctions of government bonds, mobilising more than VNĐ54.4 trillion for the State Treasury. The secondary market also attracted investors with average trading value rising 10 per cent to VNĐ9.47 trillion per session. Foreign trading accounted for 2.6 per cent of the total value.

The derivatives market has also developed after three years of opening. Average trading volume of the first six months reached 162,000 contracts per session, an increase of 83 per cent compared to the 2019 average. Open Interests (OI) volume maintained an upward trend, reaching 27,068 contracts as of June, up 67.3 per cent since the beginning of the year. — VNS