Economy

Economy

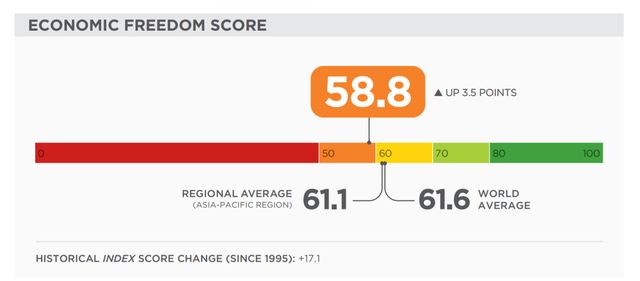

Việt Nam jumped 23 places from last year to reach 58.8 points, ranking 105th place in the economic freedom index this year.

|

| Việt Nam got 58.8 points this year in the economic freedom index. — Photo heritage.org |

The Heritage Foundation has released the 2020 Index of Economic Freedom report.

The country’s overall score has increased by 3.5 points due to a dramatic gain in fiscal health.

Việt Nam is ranked 21st among 42 countries in the Asia–Pacific region, and its overall score is slightly below the regional and world averages.

The Vietnamese economy has gradually been climbing the ranks of the mostly unfree since 2011.

Strong GDP growth over the past five years has mirrored this improvement, driven by export-focused manufacturing and processing sectors.

Economic freedom will be enhanced in Việt Nam if the government can successfully expand economic liberalisation by promoting international trade and restructuring state-owned enterprises, said the report.

“Improvement of the investment climate will be slow without improvements in judicial effectiveness and stronger efforts to fight corruption.”

Although all land is collectively owned and managed by the state, as of September 2018, the government had issued land-use rights certificates for 96.9 percent of land in Việt Nam.

The top personal income tax rate is 35 per cent, and the top corporate tax rate is 22 per cent. Other taxes include value-added and property taxes. The overall tax burden equals 18.6 per cent of total domestic income.

Government spending has amounted to 28.3 per cent of the country’s output (GDP) over the past three years, and budget deficits have averaged 4.7 per cent of GDP. Public debt is equivalent to 57.5 per cent of GDP.

“Starting a business has become easier, and the cost of business registration has been cut. Corporate governance standards and the enforcement of labour laws are weak,” said in the report.

Price stabilisation controls remain in effect for fuel, energy and water utilities, natural resources, and pharmaceuticals.

The total value of exports and imports of goods and services equals 187.5 per cent of GDP.

The average applied tariff rate is 2.7 per cent, and 80 non-tariff measures are in force.

The overall investment framework has been modernised and facilitates foreign investment, but it lacks efficiency.

The financial sector continues to evolve, and directed lending by state-owned commercial banks has been scaled back in recent years. — VNS