Economy

Economy

|

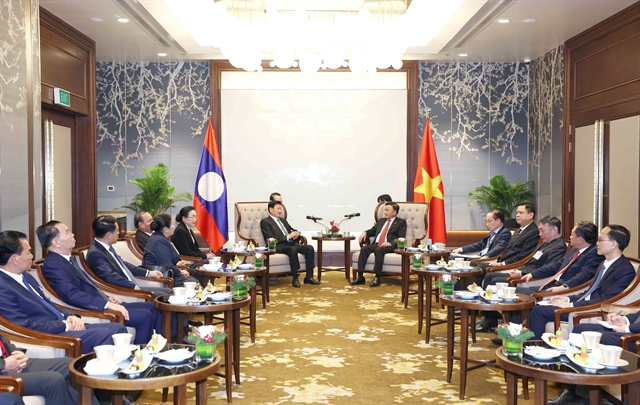

| Many companies in the country offer online services to encourage people to stay at home and reduce the use of cash. — VNS Photo |

HCM CITY – Companies in various sectors are seeking to help people limit physical contact with others, not use cash or leave home as the COVID-19 epidemic rages.

Shopee, the leading e-commerce platform in Southeast Asia and Taiwan, has launched a campaign called “Ở nhà không khó, có Shopee lo” to provide people with daily necessities.

From March 11 to March 22 it offers a number of products at discounted prices.

To encourage people to stay at home, it offers daily free shipping vouchers to offset delivery costs.

Trần Tuấn Anh, managing director of Shopee Vietnam, said: “We are committed to doing what we can to ensure the well-being of our consumers during this outbreak. In light of the rising concerns about the outbreak, we have stepped up efforts to provide consumers with convenient and affordable access to essential supplies and other shopping needs on our platform. With this campaign, consumers can enjoy one-stop access to all their shopping needs from the comfort of their homes and also greater cost savings.”

Banks are making efforts to bring customers more online services so that they can limit the use of cash, which could spread the infection.

An Orient Commercial Joint Stock Bank spokesman told Việt Nam News the bank is offering loans at low-interest rates to micro, small and medium-sized enterprises, and online services so that customers do not need to visit the bank or use cash.

Customer can easily open savings accounts online and even get 0.1 percentage point higher interest.

Many fees are waived including for money transfer and online payment of power, water and internet bills and school fees.

Customers can also get loans online.

Nguyễn Thiện Tâm, strategy director of OCB, told Việt Nam News that since the COVID19 outbreak began, the number of transactions on the bank’s OMNI channel has increased by half.

Other banks in the country are also upgrading their systems to enable more cashless payments and internet banking transactions.

Sacombank developed a system of contactless payment over the last several years and it has become extremely useful now.

To encourage the use of cashless payment, many banks have cut online transaction fees.

Người Lao Động (The Labourer) newspaper reported that 32 banks have announced cuts in inter-bank transaction fees.

BIDV has cut the fees on transfers of under VNĐ500,000 by 70 per cent.

New customers are offered e-banking services for free. – VNS