Economy

Economy

|

| Three key factors support the prospects for digital assets in Việt Nam: a large retail trading base, one of Asia’s fastest growing economies, and a government determined to bring crypto activity onshore. — Photo from the internet |

HCM CITY — Việt Nam is laying the groundwork for a digital economy that extends well beyond the trading of cryptocurrencies and into integrating digital assets into the country’s markets and services, according to VinaCapital Fund Management JSC.

On September 9, the Government issued Resolution 05 to launch a five-year trial of a digital asset market.

The long-awaited decision follows years of debate and dovetails with rising public enthusiasm for digital assets.

In a recent note on “Formalising Việt Nam’s Digital Asset Markets,” Michael Kokalari, CFA, chief economist at VinaCapital, said as many as 17 million Vietnamese are engaged in cryptocurrency trading, with annual digital asset transactions estimated at more than US$100 billion, with nearly all that activity taking place on offshore exchanges such as Binance, Bybit and others, in Singapore, South Korea, Hong Kong, and others.

“The Government aims to move Việt Nam’s crypto activity from large informal markets reliant on offshore channels to formal, taxable onshore channels integrated into the domestic financial system.”

In July the National Assembly passed the Law on Digital Technology Industry, which recognises digital assets and requires platforms to obtain local licences and provide direct Vietnamese đồng on- and off-ramps by January 1, 2026.

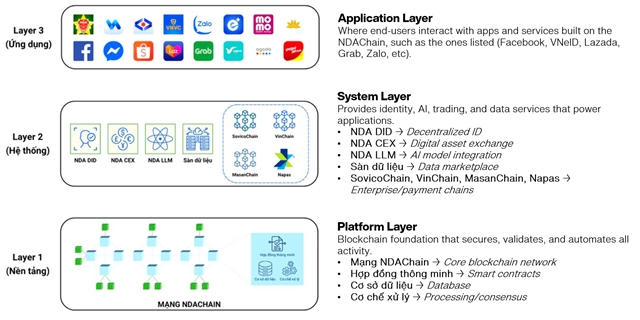

That same month, the Government introduced Việt Nam’s national blockchain platform, NDAChain, to support secure financial transactions and safe online shopping.

In August, news sources reported that Việt Nam plans to pilot five licensed digital asset exchanges that support trading in Bitcoin, Ethereum and around 50 other tokens.

According to senior officials, the Government is focusing on three core objectives: repatriating and taxing trading by shifting billions of dollars in trading activity from offshore venues to the domestic system, integrating digital assets into the broader financial system and thus opening new channels for raising capital and supporting a more digital, less cash-dependent economy and strengthening investor protection and oversight by setting standards for custody and reporting while bringing digital assets under existing anti-money laundering and counter-terrorist financing regulations.

Việt Nam is looking to other countries’ experiences in integrating digital assets into their financial systems.

While Việt Nam has previously made cautious progress, VinaCapital believes the current pace is different. There is clear acceleration with more frequent discussions among regulators, industry events and the launch of NDAChain, signalling a shift toward recognising crypto-assets as a legitimate part of the financial system.

|

| Việt Nam’s national blockchain platform, NDAChain, features a three-layer infrastructure architecture. — Source: Saigon News, VinaCapital |

The roll-out of NDAChain will support tokenisation, allowing familiar financial assets such as bonds, fund units, trade invoices, and carbon credits to be issued and traded as digital tokens.

NDAChain provides shared identity and record-keeping, enabling licensed platforms to make transactions in đồng and automate issuances, payouts and ownership transfers. Enterprises can connect to NDAChain for merchant payments, escrow and bill pay, and, once permitted, regulated stablecoins would enable 24/7 low-fee transfers between everyday payments and tokenised assets.

Kokalari highlighted three factors underpinning Việt Nam’s prospects for digital assets: a large retail trading base, one of Asia’s fastest growing economies and a government committed to bringing crypto activity onshore.

These conditions create opportunities for licensed exchanges to capture volumes, fees and data from offshore platforms, while paving the way for Việt Nam-domiciled funds, including Bitcoin and diversified digital asset funds, to finally tap demand from insurers, pensions and other domestic institutions.

Leveraging the State‑backed NDAChain and the forthcoming pilot exchange will enable tokenisation of trade invoices, carbon credits and other real‑world assets.

Licensed exchanges will connect with domestic banks and State Bank of Vietnam-approved e-payment systems for đồng on- and off-ramps, giving early movers access to payment fees and valuable user data.

This could evolve into a “crypto bank” model, where banks provide custody, settlement and lending services for digital assets.

Việt Nam is thus laying the groundwork for a digital economy that extends beyond cryptocurrency trading and into integrating digital assets into the country’s markets and services.

The pilot programme and licensing regime could create a more liquid, transparent and trusted market, pulling capital back onshore, generating revenues for banks and securities firms, and opening space for service providers in custody, compliance and analytics.

“Beyond finance, the broader economy stands to benefit from tokenisation and blockchain applications,” Kokalari said.

“Sectors such as supply chains, renewable energy and real estate could see new funding models through tokenised assets, while carbon credits, trade invoices, and other instruments gain liquidity.

“If implemented effectively, Việt Nam’s push to regulate digital assets not only promises to capture existing activity but also to embed crypto into the broader financial system.” — VNS