On the afternoon of February 10, 2022, at the first meeting of the year with investors and securities analysts, Vietnam International Commercial Joint Stock Bank (VIB) shared the bank’s business results in 2021 as well as the strategic direction for 2022-2026, aiming for profits exceeding the billion-dollar mark while increasing market capitalization five-fold to over 14 billion dollars.

On the afternoon of February 10, 2022, at the first meeting of the year with investors and securities analysts, Vietnam International Commercial Joint Stock Bank (VIB) shared the bank’s business results in 2021 as well as the strategic direction for 2022-2026, aiming for profits exceeding the billion-dollar mark while increasing market capitalization five-fold to over 14 billion dollars.

Nearly 300 guests from domestic and foreign investment funds, securities companies, and independent analysts attended the exchange organized by VIB through face-to-face and online formats. VIB representatives of the Bank's Board of Directors included Han Ngoc Vu - Chief Executive Officer, Hoang Linh - Deputy Chief Financial Officer, and Tran Thu Huong – Strategy Director & Head of Retail Sales Banking Division.

Impressive growth target based on economic recovery expectations

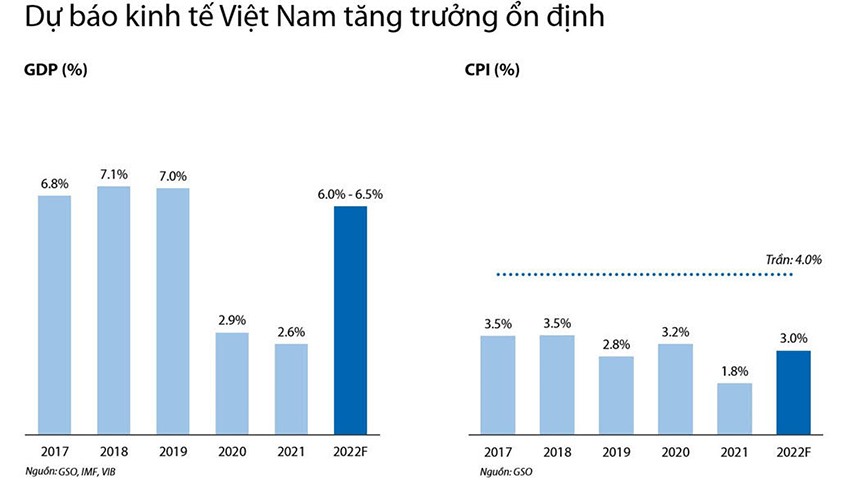

At the beginning of the meeting, Han Ngoc Vu shared the company’s views on economic growth in the world as well as in the region. According to the IMF and Bloomberg forecasts, GDP growth in the ASEAN region will recover strongly and is estimated at 5.6-6 per cent in the next two years.

Meanwhile, inflation will increase slightly but is well controlled. Viet Nam is forecasted to be one of the countries with the highest level of recovery with an estimated GDP of 6.0-6.5 per cent thanks to a solid economic foundation and appropriate regulatory macroeconomic policies.

|

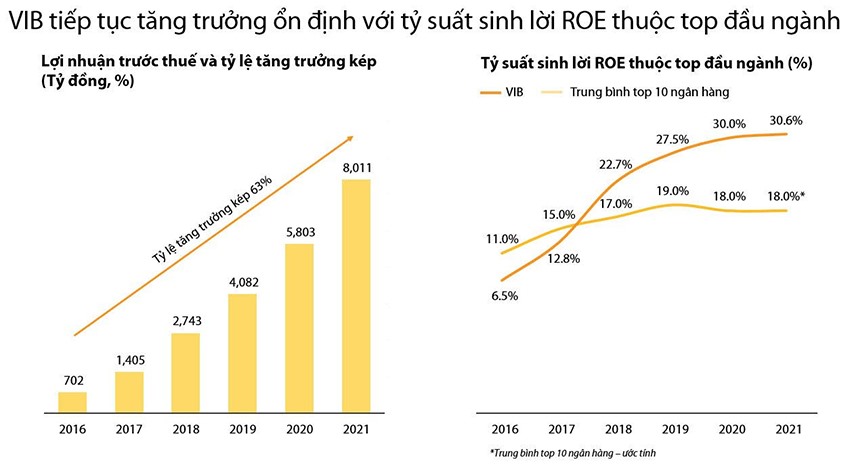

Based on both the general background of the economy and the solid internal strength that has been built through phase 1 (2016 - 2021) of the 10-year transformation journey, VIB has set a target of strong growth in the next stage with a double growth in profit of over 30 per cent each year, capitalization to increase by five-fold, and network development to more than 10 million customers.

Sustainable growth with ROE continuously at the top of the industry

Hoang Linh reviewed the outstanding financial indicators achieved by VIB in the past year. With the profit before tax reaching more than VND 8,000 billion, gained 38 per cent growth compared to 2020, VIB maintained a compound growth rate of profit over the past five years of over 60 per cent. Starting from 2018, VIB has continuously been at the top of the industry in terms of operational efficiency with ROE in 2021 reaching 31 per cent, 1.7 times higher than the industry average at 18 per cent.

VIB continues to affirm its position as a leading retail bank in the market with a credit growth rate of 24 per cent in 2021 while retail lending contributes nearly 90 per cent of the credit portfolio, of which 95 per cent has guaranteed assets. VIB holds a large market share in many areas such as bancassurance, cards, home loans, and car loans. In addition, VIB affirms its leading position in the card trend with unique credit card lines, bringing superior benefits for all spending, leading modern card technology in Viet Nam and the region.

Expected breakthrough growth thanks to outstanding competitiveness based on modern digitalization platform

Sharing about the orientation for 2022, Tran Thu Huong said VIB will continue to promote the retail segment in terms of scale and quality. Following the 30-fold growth in profit from 2016 to 2021, which contributes more than 60 per cent of the entire line's profit, VIB has set a target of average credit growth of more than 20 per cent in the next period. Regarding mobilized capital, VIB expects the CASA ratio to exceed 30 per cent with the growth motivation coming from the expansion of the customer network, while more than 65 per cent of savings deposits will come from the online channel.

As for the bancassurance business, which still has huge room for growth, a representative of VIB revealed the plan to deploy the Digital Wealth Platform in the third quarter of this year to increase the convenience for customers.

The number of customers using MyVIB Digital Banking products and services also increased significantly in the context of social distancing. These numbers will grow even more strongly when VIB promotes the company’s strategy of diversifying its product and service portfolio, focusing on technology and customers’ experience factors.

In addition, VIB also aims to pioneer personalized products to meet the increasing demands of the market, targeting young customers (Millennials and Gen Z) - a segment that will account for about 85 per cent customer portfolio for the next five years.

The year 2022 is forecasted to be full of challenges as the whole world enters the post-pandemic recovery phase and transforms strongly to adapt to the new context. For VIB, this year's economic picture will be an opportunity for businesses with firm foundations to assert their leading position. Meanwhile, according to international standards, technological advantages, the operating platform and management model will be the three main pillars for VIB's steady development.