Economy

Economy

The Ministry of Finance (MoF) said the ministries and localities supported its proposal to raise environmental protection tax on oil and petroleum products.

|

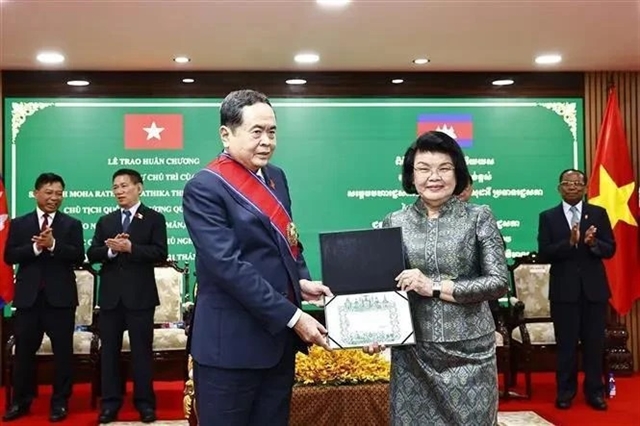

| The tax hike will improve awareness of environmental protection by encouraging the saving of energy and natural resources. — Photo laodong.com.vn |

HÀ NỘI — The environmental protection tax increase would make Consumer Price Index (CPI) in July rise by 0.27-0.29 per cent from the previous month, said Vũ Thị Mai, deputy minister of Finance at the monthly Government meeting held in Hà Nội on Monday.

The whole year’s CPI would be increased by 0.11-0.15 per cent due to the increase in tax but would still remain under the target of less than four per cent assigned by the National Assembly.

The Ministry of Finance (MoF) said the ministries and localities supported its proposal to raise environmental protection tax on oil and petroleum products.

MoF has proposed to raise tax on these products from the current VNĐ3,000 (13 US cents) to the ceiling level of VNĐ4,000 (17 cents) per litre.

The environmental protection tax has been proposed to be increased by VNĐ500 per litre of diesel oil to VNĐ2,000 and by VNĐ1,100 per litre of other oil products to VNĐ2,000.

Plastic bags are also expected to see higher environmental taxes, increasing from the current VNĐ30,000-VNĐ50,000 per kilo, if the draft is approved.

MoF had released a report to collect feedback on the tax hike, which will come into effect from the beginning of July.

The ministry sent the draft decree to other ministries and localities in February.

It said it had received 60 comments from 14 ministries, 42 localities and four associations and businesses, of which 40 agreed with the ministry. However, the ministry has not collected opinions from people.

According to MoF, the tax hike will improve awareness on environmental protection by encouraging the saving of energy and natural resources. It will contribute to ensuring sustainable development, following Việt Nam’s international commitments to environmental protection, MoF said.

Experts suggest the ministry publish the collection and spending from environmental protection taxes.

The ministry said the entire tax amount, including environmental protection tax, would be paid to the State budget and utilised for socio-economic development.

MoF said the State spending on environmental protection had always been higher than the tax collection. It said the spending on environmental protection during 2012-16 was some VNĐ131.8 trillion or VNĐ26.4 trillion per year. The collection of environmental protection tax during the period was VNĐ21.2 trillion per year.

Tax hike for sustainable development

Nguyễn Viết Lợi, director of MoF’s Institute for Financial Strategy and Policy, said the tax should be raised to the ceiling level with an aim to complete financial policies towards sustainable development and restructuring the State budget collection.

The Law on Environmental Protection, promulgated in 2010, has been one of the policies to improve people’s awareness on the issue as well as to timely respond to the changes in global petrol prices and ensure national benefits in the international integration with import tax cuts, Lợi said.

However, he said the retail petrol prices in Việt Nam have been at the lower level, with the country ranking 44 out of 180 countries in the world.

The World Health Organisation, meanwhile, said Việt Nam is one of the countries in Southeast Asia with the worst pollution.

“This is the reason why environmental protection tax should be revised to meet international norms while implementing reforms of environmental protection policies,” Lợi said.

He added that the collection from the tax increase would restructure the State budget in the context of gradually reducing petroleum imports to zero.The tax on petrol imported from ASEAN will be sharply reduced from 20 per cent to eight per cent in 2021, to five per cent in 2023 before becoming zero per cent in 2024, Lợi said. — VNS