Opinion

Opinion

|

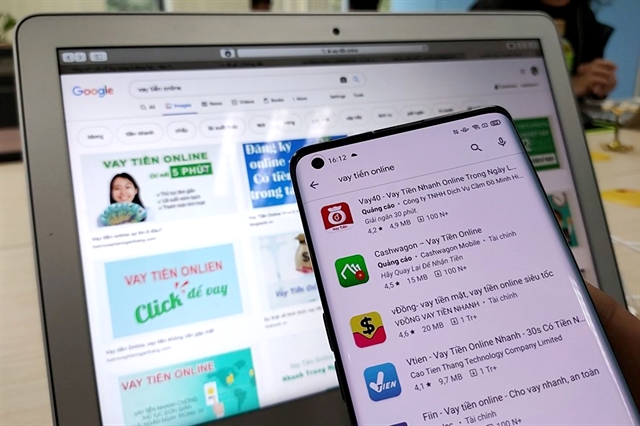

| Online lending applications are very popular currently. Photo laodong.com.vn |

Although black credit has been curbed, there are still potential complications, despite the many solutions that have been drastically implemented by ministries and sectors. Nguyễn Thanh Hà, Chairman of the Board of Directors of SBLAW Law Firm talks to Vietnam News Agency about the issue.

Black credit has been existing not only in rural and mountainous areas but also in urban areas. Could you share about cases where clients sought out a lawyer to help get out of the black credit trap?

I have received many requests from people caught up by black credit. Especially recently, borrowing money through online applications (apps) has increased. People when using an app to borrow money are often promised a fairly simple procedure without collateral.

However, when signing a loan contract on the app, a lot of fees are deducted, making the actual amount received very low. There is a case of borrowing VNĐ10 million, but in the end receiving only VNĐ7-8 million with a relatively high interest rate. After the loan is due, if it is late to repay the loan, the borrower may have their personal information or information of relatives exposed on social networks.

In addition, many criminal groups also lend at very high interest rates from VNĐ5,000-7,000 per VNĐ1 million per day. With such high interest rates, especially during the current pandemic, it is very difficult for borrowers to repay their loans. And when they can't pay, many people will come to harass borrowers and their families, putting mental pressure on them, and even use violence to get back the money.

Black credit directly affects many classes of people, from businessmen who need money to reverse bank debts and handle personal problems to students or people who need money for urgent needs.

Black credit currently lurks under online money-lending applications with very low starting interest rates. Can you tell me more about this?

If in the past, we often saw “utility pole banking" with many advertisements for quick loans with low interest rates on leaflets posted along the walls and poles. Now, with the development of the internet, people create different apps where borrowers can use smartphones to borrow money simply by providing their identity card.

However, the financial technology (Fintech) operation is currently still in the beta stage and very few businesses are licensed for this activity. Therefore, most of the apps that provide online lending services are apps that violate the law.

They give loans with relatively simple procedures and claim to have low interest rates, but they use other tricks such as deducting management costs, filing fees.

Through the internet, these apps have blossomed and grown so much that it's very difficult for the authorities to control. Meanwhile, borrowing through the app is relatively easy, so people who need money are easily lured to take a temporary loan to solve their personal needs. But only after taking the loans do they know that the actual amount received is lower than they expected and the interest rate very high.

And, when the debt is due and people can't pay it, they are introduced to another app to borrow again. People keep getting caught up in the cycle of borrowing through apps after apps when they can't pay their previous debts.

How will this kind of black credit affect financial technology companies and banks that are also deploying to build an official online lending system?

In Việt Nam, the legal corridor for Fintech model, P2P (peer-to-peer lending) or online lending form of banks is still lacking, the Government and State Bank are still building regulations.

These applications currently are not subject to any legal constraints. If they are suspected and asked about by law enforcement, the apps builders can simply make them disappear. Many apps use foreign capital or set up servers abroad, making it very difficult for the authorities to handle. That greatly affects the market share of legal loans from banks' apps or Fintech companies that are in the process of being tested.

In addition, consumers cannot distinguish between real apps of banks, legal credit institutions and illegal apps, leading to a loss of trust in society towards the lending model through apps.

What should be done to address this situation?

The Government and the State Bank of Việt Nam should soon issue regulations and legal corridors for Fintech, P2P (Peer-to-peer) models, because this is an inevitable trend in the world when deploying consumer loans for small amounts.

It is possible to allow many companies to participate in this market and these companies must meet the conditions and standards prescribed by law, and at the same time, put the app model into management to avoid illegal apps.

Local and grassroots governments at all levels need to have strict management policies, propagate at pawnshops about the legal regulations on interest rates, legal debt collection, etc. because this is currently the most popular source of black credit in the market.

Many cases have been prosecuted by investigative agencies, but these are just typical cases, on the surface. The situation of usury is still relatively common, but not handled thoroughly. Therefore, it is necessary to educate people to be aware of the black credit, to distinguish between legal and illegal apps. Banks, credit institutions, and Fintech also need to provide competitive lending products and services to repel "black apps." VNS