Economy

Economy

|

| An FPT Shop store. The retail sector is forecast to record modest gains in total revenue this year. — Photo vnreview.vn |

HÀ NỘI — Vietnamese shares are on the edge of declining this week as worries about the second wave of coronavirus spread increased after new cases were reported over the weekend.

The benchmark VN-Index on the Hồ Chí Minh Stock Exchange (HoSE) lost 4.91 per cent to finish last week at 829.16 points.

The sharp decline was attributed to a market collapse on Friday when the VN-Index had its worst day since June 29 as it tumbled 3.22 per cent.

The hard landing came after a suspected coronavirus infection case was reported in the central city of Đà Nẵng, according to Đinh Quang Hinh, head of market strategy at VNDirect Securities Corp.

On Saturday, the 416th case was confirmed positive and became the first community transmission in Việt Nam after 99 days.

Another similar case was reported on Sunday, raising the total number of positive cases in Việt Nam so far to 418.

The last two virus infection cases in the community in Đà Nẵng are quite serious as “the return of coronavirus may drag on Việt Nam’s efforts to bring its socio-economic development back on track,” Hinh told Việt Nam News.

“If the second wave of COVID-19 is really coming, it will strike Việt Nam’s economic activities, especially the services sector, and dampen investors’ confidence in the stock market,” he said.

Rising worries may drive attention away from risky assets like stocks into safe ones such as gold, Hinh added. Gold prices on Friday beat VNĐ56 million (US$2,430) per tael.

The latest infection cases in Đà Nẵng may remind investors of the same market move in early March when the 17th COVID-19 patient was reported in Hà Nội.

On March 6, the 17th COVID-19 case was reported and the VN-Index plunged 6.28 per cent in the next trading day on March 9.

“It’s still early to conclude the latest cases in Đà Nẵng will have the same impact on the market as the case of the 17th patient did in early March,” Hinh said.

“I hope the situation will soon be under control,” he said. “The city authorities in Đà Nẵng have had an instant response to the cases and Việt Nam has experience in dealing with COVID-19.”

The city of Đà Nẵng on Sunday afternoon activated its social distancing measures, which will last for 14 days.

Travellers from Đà Nẵng have also been asked to file medical declarations and self-quarantine for 14 days to minimise the risk of virus spread to the community. All vehicles will also be checked more carefully.

“Pressure on the local market will increase this week,” Hinh said. “Short selling will dominate the market sentiment and the VN-Index may retreat to 780-800 points.”

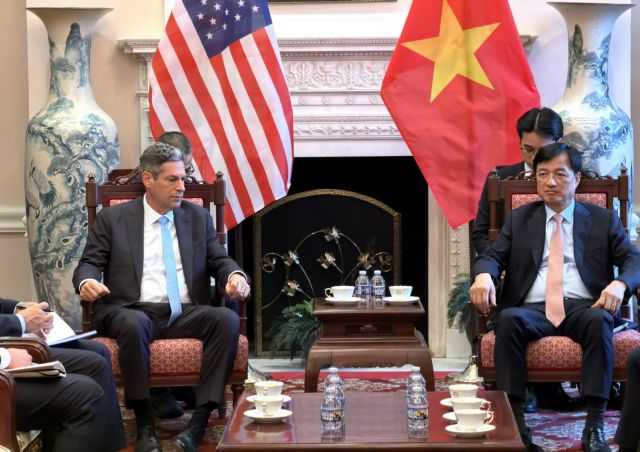

Other factors that will have an impact on the market include second-quarter corporate earnings reporting and new developments in the relations between China and the US, he added.

“But corporate earnings reporting will not be a major driving factor because it has been priced in before,” he warned.

“Investors will now focus on how firms will perform in the second half of the year and how the Vietnamese economy rebounds amidst the threat of the second coronavirus wave.”

“Investors should not panic,” he urged.

According to the latest report on first-half corporate earnings and prospects in the next six months released by data mining firm StoxPlus, 1,427 of 1,743 companies trading shares on HoSE, HNX and UPCoM have released earnings plans for 2020.

Some 1,400 non-banking firms forecast their post-tax profit in 2020 will fall 13 per cent on-year, StoxPlus said.

Domestic-consumption-related companies are forecast to raise their revenues in 2020, the data mining firm said. Insurers are expected to raise total revenue by 18.8 per cent on-year, followed by consumer staples (16.9 per cent), real estate (15.8 per cent), information and technology (11.1 per cent), and telecommunications (7.6 per cent).

Construction and building materials, financial services, retail, and pharmaceuticals are the sectors that will see modest gains in total revenues.

On the opposite side, oil and gas, tourism-transportation and entertainment, home appliances, automobiles and spare parts, and utilities will see their revenues fall between 2.1 per cent and 34.9 per cent on-year.

In terms of profit growth, telecommunications, information and technology, and petrochemicals will have strong gains of 9.4 per cent-59.6 per cent while oil and gas, and tourism-transportation and entertainment will be the worst-hit industries (down 59.2 per cent and 94.4 per cent on-year). — VNS