Economy

Economy

|

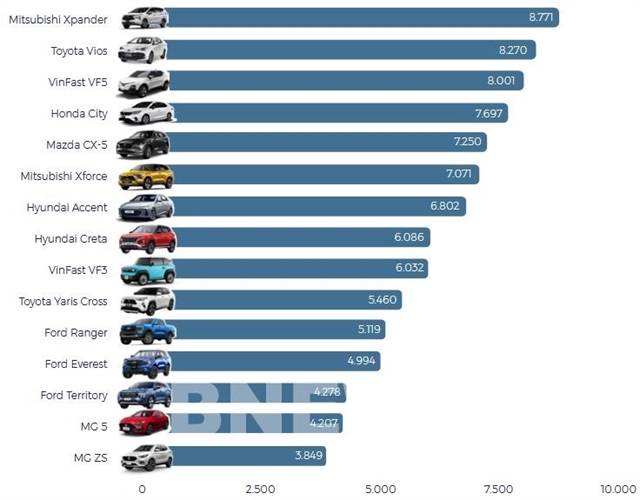

| The most searched car brands in Việt Nam last year . — Photo courtesy of Bnews |

HÀ NỘI — The return of Chinese car brands to Việt Nam, particularly with a focus on affordable electric vehicles (EVs) and modern features, represents a significant evolution in their market strategy. This trend raises the question of whether this shift signals a long-term opportunity or merely a temporary resurgence, according to oto.com.vn.

By offering budget-friendly EVs and aggressively pricing models like the MG5 at VNĐ300 million (US$12,000), Chinese manufacturers are lowering the entry barrier for Vietnamese consumers. This pricing strategy disrupts traditional market dynamics, making owning EVs more accessible.

With increasing interest in green transport and governmental goals for reducing emissions, the focus on small electric cars aligns well with national priorities. Brands like Wuling and BYD capitalise on this trend by offering affordable and practical EV options.

Data shows 18,000 Google searches for the Wuling Bingo, reflecting a growing awareness and interest among Vietnamese consumers. The inclusion of models like the MG5 and MG ZS in the top 15 most searched-for cars of 2024 suggests that Chinese brands are gaining ground in terms of potential buying interest.

Chinese cars are equipped with advanced features, often rivalling or exceeding competitors in the same price range. This appeals to younger, tech-savvy buyers looking for value-for-money vehicles.

Chinese car models like the MG5 and MG ZS have gained notable traction in 2024, with 4,207 and 3,849 contacts, respectively, due to a combination of affordability, modern aesthetics and advanced technology. These models appeal to budget-conscious buyers seeking vehicles with competitive features.

Key factors driving the popularity of Chinese cars are attributed to low pricing, high value features and aggressive discounts.

For instance, the MG ZS STD, priced at VNĐ418 million after a VNĐ120 million discount, is comparable to the Hyundai Grand i10 AT. And the MG5 MT version costs approximately VNĐ300 million, rivaling A-class hatchbacks like the the Kia Morning or Hyundai i10.

Challenges

Chinese cars in Việt Nam, particularly MG, are facing challenges in maintaining their resale value, as highlighted by the following points such as high depreciation rate, psychological barriers and lower liquidity. For instance, the MG HS model (2022) depreciated by 33 per cent within two years, compared to only 17 per cent for competitors like the South Korea Hyundai Tucson. Meanwhile, price reductions for new MG models, such as the MG ZS STD, which saw a cut of up to VNĐ120 million, directly impacted the resale prices of used MG cars.

Many Vietnamese consumers remain skeptical about the quality and durability of Chinese cars, contributing to slower sales in the used car market. On average, it takes 23-29 days to sell a used MG in 2023, while competitors like the Hyundai Creta or Kia K3 sold in 16-20 days during peak market periods.

Despite these hurdles, there are signs of Chinese progress. The resale liquidity gap narrowed in 2024, with Chinese cars now selling only 2-3 days slower than competitors in a stagnating used car market. This indicates that Chinese brands, like MG, are slowly gaining consumer trust and market presence.

To further address these challenges, Chinese car manufacturers should avoid frequent price reductions to protect the value of used cars. They need to focus on reliability and after-sales services to improve consumer perceptions and launch campaigns to build confidence in Chinese brands' quality and long-term value.

If successful, these measures could strengthen their foothold in Việt Nam's car market. — VNS