Economy

Economy

|

| Imported cars parking at a local port before making custom clearance . — Photo cafebiz.vn |

HÀ NỘI — Việt Nam's automotive market has seen significant growth in recent years, thanks to Government initiatives aimed at encouraging domestic production, according to the Vietnam Automobile Manufacturers Association (VAMA).

Sales of new vehicles have surpassed 400,000 units annually, showcasing the expanding market. However, despite these efforts, imported cars continue to dominate over domestically assembled vehicles. The growth of the auto industry has had a positive impact on the economy, generating numerous jobs and contributing to the development of supporting industries.

The growing preference for imported cars in Việt Nam's auto market is evident. From 2016 to 2023, the proportion of imported cars rose significantly, from 22.1 per cent to 30.8 per cent. This trend has continued in 2024, as shown in the sales report from the VAMA.

In the first nine months of 2024, domestically assembled car sales dropped by 7.5 per cent, with 113,641 units sold. Meanwhile, imported cars saw a sharp rise, with 111,942 vehicles sold, up 28.5 per cent compared to the same period in 2023. This reflects the strong consumer demand for imported vehicles.

The automotive market in Việt Nam is experiencing significant growth in both the new and used car segments, particularly with imported models. New car models such as Mitsubishi Xpander, Ford Everest, Hyundai Stargazer and Toyota Yaris Cross are popular choices among buyers. These imported vehicles often dominate the sales charts.

According to the Market Research and Analysis Department of Nextgen Vietnam Joint Stock Company (oto.com.vn), in the used car market, the trend is also notable. From 2019 to 2022, around 37 per cent of used car listings were for imported models. However, this number surged to about 50 per cent in 2023 and remained at around the same level in the first nine months of 2024.

|

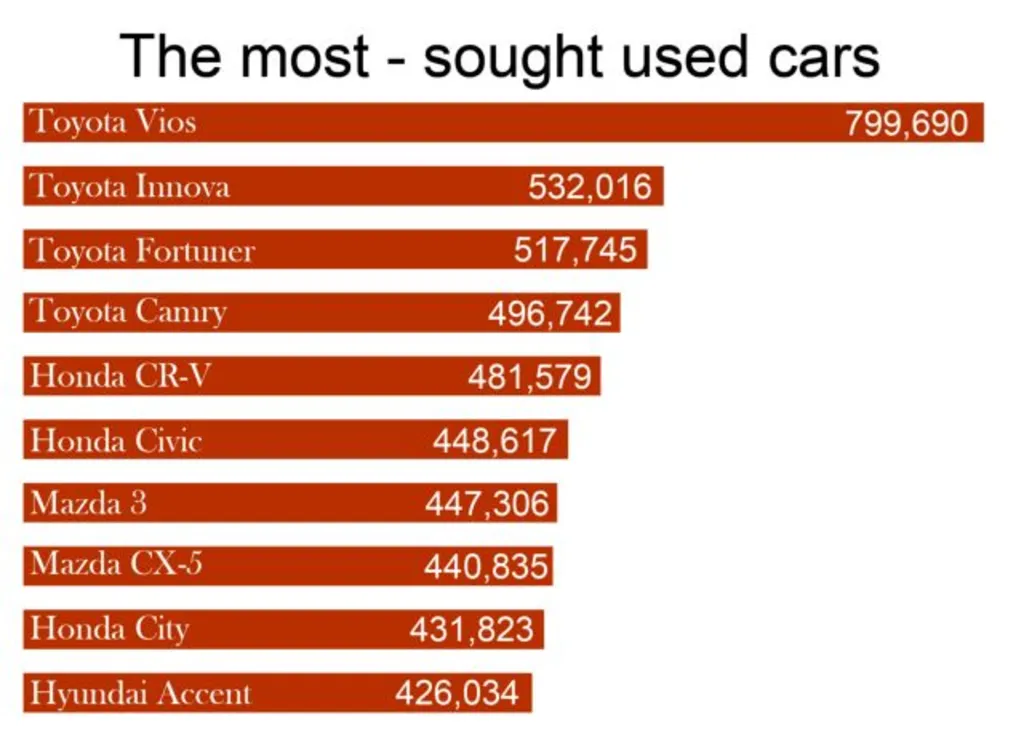

| VNS graphic design by Doan Tung |

Larger vehicles like MPVs, SUVs and pickup trucks are highly sought after in Việt Nam, with models like the Mitsubishi Xpander being a prime example. The Xpander is available in both imported and locally assembled versions, but the used market saw a significant preference for imported models, with nearly 4,000 advertisements for used imported Xpanders in the third quarter of 2024 alone. This surpassed the number for domestically assembled versions, indicating the lasting appeal of imports.

Similarly, despite the switch to domestic assembly for SUV models like the Toyota Fortuner and Ford Ranger since 2019 and 2020, these imported versions continue to attract attention, reflecting their sustained popularity in the market.

For smaller cars like the Kia Morning and Hyundai Grand i10, which are now fully assembled in Việt Nam, older imported models from South Korea, particularly those from 2015 and earlier, remain in demand, with almost 7,000 ads for sale in the same period. This highlights a robust second-hand car market across both large and small vehicle segments.

According to car experts, the origin of a car plays a significant role in the Vietnamese car market, where many consumers tend to favour imported vehicles from countries like Thailand, Indonesia, Japan and South Korea, believing them to be of better quality than domestically assembled models. This perception contributes to the ongoing popularity of imported cars, even as domestic assembly improves.

Thailand and Indonesia, both with well-established automobile industries, exported large numbers of vehicles to Việt Nam over the past few years. In 2023, Thailand and Indonesia sold 775,700 and one million vehicles to Việt Nam respectively. These countries are Việt Nam's top sources for car imports.

Many car buyers in Việt Nam place a high value on the car’s origin, with over 372,000 searches for this factor in the third quarter of 2024, surpassing the number of searches related to car colour. This preference affects the market for used cars, with buyers often willing to pay a premium for imported vehicles.

Some models, such as the Mitsubishi Xpander, Ford Ranger and Toyota Fortuner, have both imported and assembled versions available at similar prices when new. However, in the used car market, imported versions tend to be priced higher. For example, a 2022 Hyundai Creta imported before domestic assembly started commands a resale price VNĐ5 million higher than its 2023 assembled counterpart.

The price gap becomes more noticeable with models like the 2021 Ford Ranger and Toyota Fortuner, where imported used cars generally fetch higher prices than their domestically assembled versions, highlighting the enduring perception of better quality associated with imported vehicles. — VNS