Economy

Economy

HCM City is publishing information on the activities of several real estate investors that have applied for mortgage loans secured by their property and land-use rights.

|

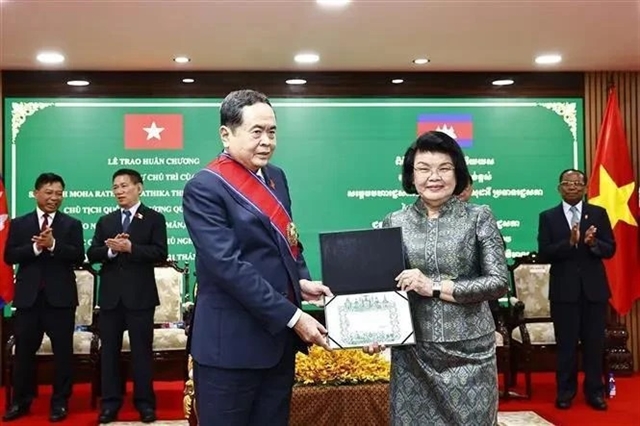

| The An Phú Long Real Estate Company has applied for a mortgage loan for its D-Vela project in District 7 in HCM City. — Photo news.zing.vn |

HCM CITY — HCM City is publishing information on activities of several real estate investors that have applied for mortgage loans secured by their property and land-use rights.

The city said it wanted to provide customers with more information about what investors were doing with their properties.

For instance, Hoàng Phúc Real Estate Management Ltd applied for a mortgage loan for its The Western Capital project in District 6 with VPBank, while An Phú Long Real Estate Company applied for a mortgage loan for its D-Vela project in District 7 with the Joint-Stock Commercial Bank for Investment and Development of Việt Nam.

Several real estate experts noted that, as the property market in HCM City has become more active, it is normal to see many real estate companies applying for loans for projects and using their projects as their own security.

However, there have been cases of companies using their mortgage loans for other projects rather than the projects used as security for those loans.

In addition, some companies are using property currently owned by customers for mortgage loans, or are selling properties used as security to buyers.

For example, many customers that had bought land plots in the Everluck Residence Project are involved in a dispute with the investor the Tường Phong Real Estate Company.

They said the company had not provided them with red books (house-ownership certificates) and had used land plots sold to customers as security for mortgage loans for the company’s other projects.

The Everluck Residence project is seized for sales by a bank that Tường Phong is borrowing capital, and many customers have voiced their complaints over the possibility of losing their land.

Real estate customers have been urged to carefully investigate the reputation and capability of real estate investors before making decisions on buying property or land. — VNS