Economy

Economy

This week, we take a look beyond shares and bonds at some of the more unusual and potentially lucrative alternative investment opportunities.

32242031PM.JPG) |

| Brian Spence |

by Brian Spence

This week, we take a look beyond shares and bonds at some of the more unusual and potentially lucrative alternative investment opportunities.

“Alternative” investments is a catch-all term for anything that is not shares, bonds, mainstream property or cash.

Beyond these traditional asset classes, Vietnamese investors can invest in everything from stamps and fine wine.

Of course, the fact that alternative investment opportunities exist does not mean these investments are safe or advisable. Before you even consider an alternative investment opportunity, you need to understand the risks.

When you’ve understood some of the dangers, take a look at some of the alternative investment ideas below. All of them are available to Vietnamese investors, although not all are Việt Nam-based.

We’ve put them roughly in order of risk, starting with the “safest” and ending with those you should definitely steer clear of. This is just our opinion and you should note that all of them are significantly riskier than the majority of shares and bonds.

Structured products

Structured products are “alternative” investments in the sense they’re not shares, bonds or cash, but they are a lot less risky than everything else mentioned in this article.

A structured product is basically a contract with a financial institution like HSBC or Investec Bank to pay you a defined return at a defined time depending on the performance of the stock market. For example, a structured product might offer you a return of 25 per cent on your US$1,000 (i.e. $250) in five years’ time if the VNINDEX is at or above the level it is today.

It’s important to distinguish between structured deposits, which guarantee to return your original $1,000 under all circumstances except HSBC or Investec going bust, and structured investments, which protect your $1,000 unless the stock market performs catastrophically badly, in which case you stand to lose money.

Bridging loans are short-term loans used by property buyers who are expecting to get a mortgage from the bank but cannot wait for the approval. For example, a landlord might need to convert or refurbish a property for the rental market, but would not qualify for finance until after the work is done. As a private investor, you can invest in funds that pool bridging loans, in order to spread the risk across several borrowers. It’s a well-established business, but the minimum investment in these funds is typically around $25,000.

Peer-to-Peer lending and Crowdfunding

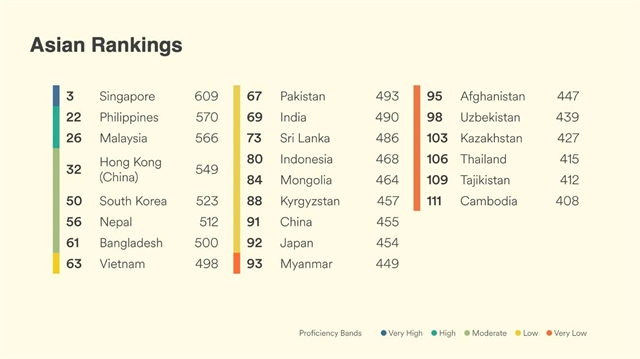

Access to and use of formal financial services is low in Việt Nam compared with other countries in the region, with only 31 per cent of all adults having formal bank accounts in 2016, according to the World Bank.

In 2016, 14.6 per cent of Vietnamese had saved money with a formal financial institution, 18.4 per cent had a loan with a formal financial institution, and only 26.5 per cent had access to a debit card. Interestingly, about 30 per cent of adults borrowed from friends or family in 2016 in Việt Nam, against 18.4 per cent who have borrowed from a financial institution.

Small and medium-sized enterprises (SMEs) have also been struggling to borrow from banks, with only one-third of SMEs having gained access to credit, according to data of the Việt Nam Chamber of Commerce and Industry.

Lending to SMEs has been tightened given a high bad debt ratio in the banking system. Furthermore, interest rates in Việt Nam are much higher than in regional countries (around 8 per cent for đồng saving deposits).

In recent years, peer-to-peer (P2P) lending platforms have emerged to provide an alternative financing method to businesses and individuals in Việt Nam.

P2P lending is the practice of lending money to individuals or businesses through online services that match lenders directly with borrowers. P2P lending has surged in popularity. The global P2P lending was worth $26.16 billion in 2015.

According to Transparency Market Research, the market valuation will reach $897.85 billion by 2024, as it expands at a significant CAGR of 48.2 per cent from 2016 to 2024.

Philately (rare stamps)

As long as there are stamp collectors, rare stamps will have a value. The most valuable can fetch six- or even seven-figure sums. Stanley Gibbons dominates the market for collectable stamps and offers private investors ready-made portfolios of rare stamps starting at about $10,000.

Numismatics (the accumulation and study of coins)

Việt Nam has been the only country to rival China in the production of cash coins, issuing a vast variety over a 1,000 year period. The collecting of coins is one of the oldest hobbies in the world.

Việt Nam’s “richest man” is a coin specialist. The Hanoian boasts a collection of some 400 various rare coins and notes from both inside and outside Việt Nam, the oldest of which is a coin called Thái Bình Hưng Bảo, issued during the Đinh Dynasty in 968. But it’s his Kiến Phúc coin from Nguyễn Dynasty (1884) that is cherished most and is extremely sought-after among foreign collectors.

His collection also includes coins and notes from more than 150 countries, most of which come from France, Italy and Denmark. It’s taken him a lifetime to amass such a collection, for which he’s parlayed his background as a history teacher into his vast knowledge of notes and coins. Today he’s considered one of the country’s foremost experts in the field.

So why not take up a hobby that could make you a fortune without trying?

Fine wine

Wine as a serious investment is typically confined to wines from the Bordeaux region, such as Château Lafite and Château Latour. The traditional way to invest is through established wine merchants, such as Justerini & Brooks, and you will probably need at least $5,000 to $10,000 to get started.

More recently, wine funds have been launched which offer an alternative way to access the market. Minimum investment amounts are still likely to be in the thousands, however.

Business angel investing

As a “business angel”, you invest in smaller companies that are not quoted on the stock market – if the business fails, you won’t get your money back; if it succeeds, you could make several times the amount you invested. Typically, you won’t see any return until the business is sold or floats on the stock market, which could take years, or not happen at all.

VAIC (Vietnam Angel Investors Circle) is a Delaware-based LLC with the vision of nourishing, empowering, and inspiring a new generation of Vietnamese entrepreneurs.

VAIC seeks to provide seed and angel capital to budding entrepreneurs to take their businesses off the ground via the Manipadhum LP investment fund in exchange for equity. VAIC also aims to bridge the gap between investors and start-ups through various fee-based additional services.

Their vision is to eventually build the next class of Vietnamese capitalists through leveraging and capitalising on the many exciting opportunities arising in Việt Nam as an emerging market environment. They hope to work with entrepreneurs and teams who are well educated, energetic, hardworking, and who have high potentials for success in this new era economic development to help build an even stronger Việt Nam for the twenty-first century.

Diamonds

Gemstone-grade diamonds have increased nearly tenfold in value since 1961. The diamond price is much less volatile than the price of gold, partly because one company – De Beers – produces over a third of the world’s diamonds and has a strong grip on the market.

However, it’s a very difficult market for investors to access because diamonds need to be valued by experts, and even the experts may disagree widely on the price. Don’t expect to make a profit on a diamond you bought in Tiffany because there’ll already be a huge mark-up.

Carbon credits

A carbon credit is essentially a permit to release one tonne of carbon dioxide into the atmosphere. Companies that exceed their allowances are supposed to buy more credits. However, the whole system is based on global cooperation, and the US and China have not signed up to the scheme.

Việt Nam, on the other hand, is committed to the serious reduction of greenhouse gasses. In recent years, private investors have been targeted by firms trying to sell them carbon credits, but this is a highly specialist market and best left to professional traders. It has also been a breeding ground for scams.

So, are alternative investments for you?

As you might have gathered, alternative investing is a highly-variegated world and each sub-category can carry serious risks that could catch out the unwary. However, as the name denotes, alternatives are arguably a far more interesting way to invest than restricting yourself to traditional asset classes – and can certainly generate far more interesting returns.

The key is only investing in alternatives to a degree that aligns with your investment profile and risk tolerance. We’d be delighted to help investors work that out, so please get in touch if you would like to ascertain if alternative investments should form part of your portfolio. — VNS

* Brian Spence is Managing Partner of S&P Investments. He has over 35 years of experience in the UK financial services industry as an investment manager, financial planner, and M&A specialist. He is a regular contributor in the UK financial press and has a deep understanding of the financial services community. Brian’s column will reflect on all the challenges and opportunities within the Vietnamese market, bringing a fresh perspective to today’s hottest issues. The columnist’s email address is brian@sandpinvestments.com.