Society

Society

When should you retire? When do you want to retire? These are not personal questions anymore.

|

| Elderly Hà Nội locals relax near Hoàn Kiếm Lake. The official retirement ages will be raised from 60 to 62 for men and from 55 to either 58 or 60 for women, following a new proposal.— VNS Photo Việt Thanh |

by Vũ Thu Hà

When should you retire?

When do you want to retire?

These are not personal questions anymore.

For argument’s sake, let’s assume that most people do not want to keep working for long, that they want to put their feet up and relax after putting in the long hours for a long, long time.

Well, some bad news have come their way.

Population experts and economists are saying current official retirement ages, for men and women, will prove too costly for the economy and the social insurance system.

Việt Nam has started to feel the heat of the problem even though it is still enjoying a “golden age” population.

So a proposal to increase the retirement age for both men and women is on the anvil again, the third time in four years, the two previous attempts having failed.

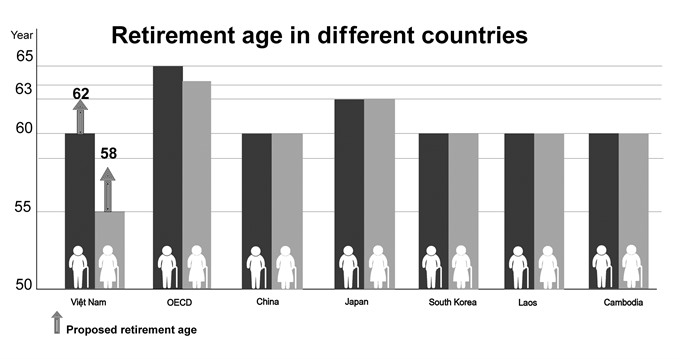

According to the new proposal - part of a bigger draft revision of the Labour Code 2012 , the official retirement age should be raised from 60 to 62 for men, and from 55 to either 58 or 60 for women.

The Ministry of Labour, War Invalids and Social Affairs (MoLISA), which is working on the proposal in order to submit it to the National Assembly next year, has mentioned two main reasons for the move: to mitigate the impacts of a rapidly aging population and avoid exhausting the social insurance fund, which is said to be something that could happen in the near future.

Given the sensitive nature of this issue, the proposal has, not surprisingly, generated mixed public reactions, with much opposition from labourers, those among over 12.3 million people enrolled in the national social security scheme.

An online survey by vnexpress found 81 per cent of more than 3,400 respondents disproving the idea. Another survey by vietnamnet had 87 per cent opposing it.

Online comments showed that many people are not willing to accept the idea of working for an additional two to five years before getting social security benefits, and many also said raising the retirement age would steal jobs from younger generations.

Bùi Sỹ Lợi, deputy chairman of the National Assembly’s Social Affairs, said in a recent debate on this issue that any changes made should take into consideration “the balance of the job market.”

He asked: “In the first six months of the year, about 191,000 students were left unemployed after graduating from college. We are in a period where workers are in high supply. If we raise the retirement age, where are the jobs for young and qualified labourers?”

|

Another view

Celine Peyron-Bista, an expert with the International Labour Organisation, presented another view.

“In reality, soon, Việt Nam will face the opposite problem: not so many young people entering the labour market,” said Bista, who is the chief technical adviser (CTA) of an ILO project on income security and employment in Asia.

The World Bank, meanwhile, has reported that although Việt Nam is not an aged society yet, it has aged incredibly fast. In fact, it has one of the world’s fastest ageing rates.

People aged 60 or older currently make up about 10.5 per cent of the country’s population of over 90 million. It is projected that one in six Vietnamese will be 60 years old and older by 2030, and if the trend continues, the figure would become one in four about 50 years from now.

According to the ILO, if retirement ages stay at 60 for men and 55 for women, the proportion of pensioners over the working population would increase from 19.4 per cent in 2009 to 59.5 per cent in 2049 and to an alarming 77.7 per cent in 2099.

“Under the ageing trends, increasing the retirement age is important in order to have a sufficient labour force to offset the decrease of the working-age population as well as to maintain the financial sustainability of the social security scheme,” Bista said.

She said she believed there would not be a direct trade-off between jobs occupied by senior workers and those by new entrants to the labour market, “because they both have very distinct skills and qualifications, and they do not necessarily apply for the same jobs.”

41842912PM.jpg) |

| VNS Infographics by Đoàn Tùng |

Social insecurity

The other factor that favours an increase in the retirement age, according to experts, is that the nation’s social security fund is in jeopardy.

According to Việt Nam Social Insurance, if the current retirement age is maintained, the pay-ins will equal the pay-outs in 2020. The reserve fund will then gradually reduce and will completely run out of money in 2037.

This means that the current working population, women around 35 and men around 40, could face the dark future of not receiving any pension when they retire two decades from now.

One way around this problem is that the Government uses the State Budget to compensate for the eventual deficit. Given that the burgeoning public debt is already a matter of serious concern, how this solution can work out is anybody’s guess.

From 1995 until now, the social security system has applied the ‘pay as you go’ mechanism, which means that those working now are paying for those retiring now. When this policy was introduced, the average life expectancy of Vietnamese people was 67 and the average retirement age was 54. So, on average, a person received social security benefits for 13 years.

“Now, the average life expectancy has become 73 while the retirement age and the number of years of paying into the social security system remain the same. So, the number of years one receives a pension has been prolonged to about 20 years. It will be hard for the fund to bear this,” said Trần Đình Liệu, Deputy Director of Việt Nam Social Insurance.

Another problem is that the amount of pension in relation to a worker’s last earnings, or the replacement rate, has been too high, Liệu said.

The current system allows a pensioner to receive a maximum of 75 per cent of their on-the-job salary after 30 years of contribution for males and 25 years of contribution for females. (The reference on-the-job salary, however, differs between State and private sectors.)

Worldwide, pension systems usually provide a rate of between 40 and 60 per cent.

According to an ILO report submitted to the Government in 2013, this higher-than-usual rate favours early retirement and discourages long-term employment, and places an additional burden on the social insurance fund.

Liệu said there were three ways to rebalance the social security fund: increase the contribution rate; reduce the pension receiving rate; and increase the number of contribution years, which means raising the retirement age.

The Social Insurance Law 2014 reflects the State’s effort to increase the contribution rate, with the regulation that starting 2016 to 2018, the reference for paying social security will include the basic salary, plus allowances and bonuses, instead of just the basic salary.

Since workers would find it very difficult to accept a reduction in the pension receiving rate, raising the retirement age is “a reasonable choice” Liệu felt. However, the increase should neither be sudden nor drastic, he added.

“We suggest a gradual change over a certain period of time. We also propose that the retirement age is adjusted depending on certain groups of workers and types of labour, so that it accounts for their working and health conditions,” he said.

Raising the retirement age across the board would hit blue-collar workers, especially those with physically demanding jobs, far harder than those with desk-bound jobs, he explained.

Nguyễn Hữu Dũng, former director of the Institute of Labour Science and Social Affairs, and now a labour consultant for various organisations, agreed that there should not be a “one-size-fits-all” plan.

“The increase (in retirement age) should apply only to highly skilled workers with expertise-demanding jobs, those at management levels, or civil servants. Those who are directly involved in physically demanding or onerous jobs, such as garments and textiles, shoe-making, electrical assembly and coal mining, should not be subject to the change.”

Not now

While agreeing that raising the retirement age is necessary in the long term, Dũng said the timetable for such a plan should be carefully studied.

“It should not be implemented now,” he said, citing several reasons.

First, although the ageing speed is high, the proportion of senior citizens (over 60) is still reasonable at 10.5 per cent, so the number of working people is still large.

“Việt Nam will still suffer from labour surplus in the near future. According to economists, the annual growth of jobs is about 2 per cent while that of labour supply is 2.8 – 3 per cent,” he said.

“We should wait until 2021, when the number of senior citizens is projected to make up more than 15 per cent of the population, in other words, when the sign of an aged population is more imminent.

“Moreover, the Government is implementing a programme to trim the number of public servants on the State payroll, and this is expected to last until 2020. An increase in retirement age starting after 2020 will help avoid a conflict between the two programmes.”

Other measures

Dũng added that increasing retirement age, however, is only one of various measures needed to solve the social security fund imbalance. This measure should be associated with other reforms in the future, such as improving investment efficiency of the social insurance fund’s reserves, expanding the scheme to cover more workers or diversifying the types of social insurance, he said.

Currently, the reserves are concentrated in government bonds with low interest rates, so the rate of return on investment is not satisfactory, Dũng said.

Bista of ILO agreed that further reforms are needed to enforce compliance of social security laws and increase coverage among workers of the informal sector.

Despite considerable effort by the Government, the number of people joining the social security scheme remains low compared to the national workforce, at around 12 million of 54 million, or about 23 per cent. About 20 per cent of labourers who are legally bound to join it haven’t done so, and is true of a majority of workers in the voluntary group. — VNS

Phạm Minh Huân, former Deputy Minister of Labour, Invalids and Social Affairs “Increasing retirement age is a world story, not just in Việt Nam. The ministry will continue to gather opinions from experts and scientists in drafting the proposal. Different schemes for different occupations, including not increasing retirement age for hard and hazardous jobs, are also being considered. To avoid “shock”, the ministry is considering a gradually increasing road map, perhaps increasing the (retirement) age by one year every three to four years, even every five years. Other options are being studied as well, such as adjusting the age to make men and women more equal.”

Celine Peyron-Bista, CTA of “Promoting Income Security and Employment Support in Asia” project, ILO “It is also important that the retirement ages for men and women are gradually equalised so that Việt Nam can fully utilise the human resources available in the country and ensure more equality between men and women. Usually there is a tendency to think that a lower retirement age is a benefit for women. However, what happens in the current context is that women end up having shorter periods of contributions, impacting quite significantly their pension level.”

Nguyễn Hữu Dũng, former director of the Institute of Labour Science and Social Affairs “Besides increasing the retirement age, Việt Nam should also consider other measures to avoid a depleted social insurance fund in the long term, due to an aging population and irrational pay-in and pay-out rate. For example, Việt Nam should consider changing from the current ‘pay-as-you-go’ mechanism, which means the currently working pay for the currently retiring, to a ‘nominal individual account’ mechanism, which means a worker’s pension will depend on the total amount he/she pays to the fund during their working lives. This system has been applied in some countries like Sweden and China.” |