Economy

Economy

|

| A vessel lays at anchor at Gemalink International Port in Bà Rịa Vũng Tàu Province. — VNA/VNS Photo |

By Ly Ly Cao

As tensions between the United States and countries like China, Canada and Mexico escalate with tariff retaliations, Việt Nam is poised to benefit from the shifting global supply chain, experts say.

With the US imposing additional tariffs of 10 per cent on Chinese imports and China retaliating in kind, along with a proposed 10–20 per cent import tax on all countries, global trade dynamics are being reshaped.

This presents opportunities for certain Vietnamese industries and publicly traded companies to gain from increased exports, foreign direct investment (FDI), and supply chain realignments.

Given higher tariffs on Chinese goods entering the US, American importers are actively seeking alternative supply sources, and Việt Nam has emerged as a leading contender.

In 2024, US–China trade reached approximately US$582.4 billion, with the US running a trade deficit of $295.4 billion.

As American companies look to mitigate rising costs, Việt Nam’s cost-efficient and business-friendly environment has made it a prime destination for manufacturing shifts, an analyst team from Việt First Securities told Việt Nam News.

Companies previously reliant on China are increasingly establishing operations in Việt Nam, driving demand for industrial real estate, manufacturing, and logistics services.

Stocks likely to benefit

Việt Nam’s industrial real estate market is booming as multinational corporations seek alternative manufacturing hubs outside China. Businesses such as Sonadezi Châu Đức, Sài Gòn VRG Investment Corporation, and Kinh Bắc City Development Holding Corporation are set to benefit from this trend.

The proposed import tariffs on all countries, including Việt Nam, could weaken the competitiveness of Vietnamese goods in the US market. Additionally, stricter investigations to prevent tariff evasion will increase costs and complicate business for Vietnamese exporters.

However, higher tariffs on Chinese goods, potentially up to 60 per cent, could open opportunities for Việt Nam to expand exports and capture a larger share of the US market.

Markets witnessed similar developments in 2018, and export data confirms this trend, according to Trương Đắc Nguyên, head of Market Strategy Analysis at Tiên Phong Securities.

Việt Nam’s exports to the US have surged 167 per cent to $114–117 billion per year, nearly 2.5 times pre-Trump levels.

Meanwhile, China’s exports fell 9 per cent, while Europe and North America saw a 50 per cent rise, and South America and Mexico increased 3.6 per cent.

According to Việt First’s analyst team, the country has solidified its position as the second-largest textile and garment exporter in 2024, following China, with orders to the US rising by 11.65 per cent.

US apparel inventory has also decreased by 0.6 per cent since early fourth quarter of 2024 due to a surge in year-end holiday shopping, indicating a return to demand for restocking.

Given Việt Nam’s strong presence in the US market, capturing over 20 per cent of consumer demand, and trade disruptions, orders for Vietnamese textile products were expected to surge, the securities firm said, adding that companies like May Sông Hồng and TNG Investment and Trading were expected to benefit significantly.

|

| Workers processing pangasius for export at a plant in An Giang Province. — VNA/VNS Photo |

Việt Nam’s seafood industry, particularly the pangasius sector, stands to gain from the US–China tensions. The imposition of higher tariffs on Chinese seafood exports has led American importers to seek alternative sources, and Việt Nam is well-positioned to fill the gap, according to analysts.

Seafood exporters like Vĩnh Hoàn Corporation, one of the country’s largest seafood exporters, and Sao Ta Foods are expected to see rising demand from US buyers.

As China’s seafood exports face headwinds, Vietnamese companies could experience an upward trajectory in both volume and pricing power.

Other key exported commodities, like the wood and furniture industry, are also expected to benefit.

Additionally, the logistics and transportation sector stands to gain significantly from the export boom. With trade volume increasing by 165 per cent, the demand for cargo transportation is rising in tandem, presenting substantial opportunities for businesses in this industry, such as Hải An Transport & Stevedoring and Gemadept Corporation.

FDI Surge and market implications

|

| Source: Việt First Securities and Fiinpro |

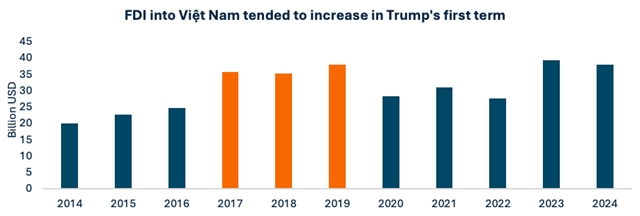

The shifting trade landscape has also contributed to a surge in FDI inflows into Việt Nam.

In January 2025 alone, total FDI registrations reached $4.33 billion, marking a 48.6 per cent increase compared to the same period in the previous year. This influx of foreign investment is a strong indicator of the country’s growing appeal as a manufacturing and export hub.

From a stock market perspective, increased FDI and rising exports are likely to drive improved corporate earnings, boosting investor sentiment.

Nguyễn Vũ Thạnh, director of Retail Brokerage at TPS Securities, said that market liquidity had already shown signs of strengthening.

By early 2025, daily trading volume on the Hồ Chí Minh Stock Exchange had recovered to an average of VNĐ13 trillion ($509 million), signalling a potential bullish phase for Việt Nam’s equity market.

While Việt Nam stands to benefit from the trade disruptions, investors should remain cautious of potential risks, according to Thạnh.

The US government has previously scrutinised Việt Nam’s trade surplus, raising concerns about possible tariff measures.

However, given Việt Nam’s strategic importance as a low-cost manufacturing hub and a key trade partner, the likelihood of severe trade restrictions remains limited.

Additionally, global economic conditions, exchange rate fluctuations, and geopolitical developments could impact investor sentiment and stock performance.

Investors should closely monitor policy shifts, particularly in the US, where the new administration’s stance on trade could influence future developments. BIZHUB/VNS