Economy

Economy

|

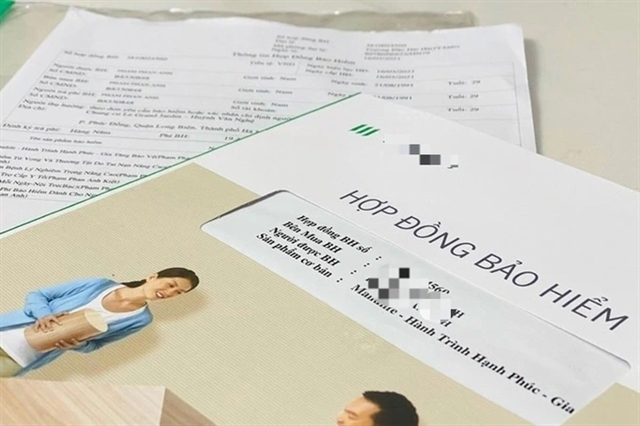

| A contract of a life insurance policy purchased through a bank. Under the Law on Credit Institutions, bancassurance activities will be more strictly managed, which will cause the growth of income from bancassurance of banks to slow down compared to the 2019-21 period. VNA/VNS Photo |

HÀ NỘI — A new regulation on banning commercial banks from selling insurance together with banking services will negatively affect banks’ bancassurance revenue in the future, some analysts have claimed.

The regulation under the amended Law on Credit Institutions was recently passed by the National Assembly and will take effect from July this year.

According to analysts from the MB Securities Company, with the passing of the law, bancassurance activities will be more strictly managed, which will cause the growth rate of income from bancassurance of banks to decline compared to the 2019-21 period.

Sharing the same view, Yuanta Vietnam Securities Company’s analysts also believe the new regulation will greatly affect banks whose fee income mainly comes from bancassurance.

In fact, revenue from selling insurance through banks (bancassurance) decreased sharply in the first nine months of 2023.

According to banks’ Q3 2023 financial reports, there were eight banks giving detailed information about income from insurance activities, of which all except PG Bank, recorded a decrease in insurance revenue. In the first nine months of 2023, the total insurance revenue of the eight banks reached more than VNĐ9.4 trillion, down 26.1 per cent over the same period last year.

MB saw revenue from insurance sales decrease by 16.9 per cent to nearly VNĐ5.99 trillion in the first nine months of 2023. The decrease in revenue caused the bank’s net profit from insurance activities to drop by 28.21 per cent to more than VNĐ2.1 trillion. In the same period of 2022, insurance brought MB more than VNĐ7.2 trillion in revenue and more than VNĐ2.9 trillion in net profit.

VPBank's revenue from insurance activities also decreased from VNĐ2.44 trillion in the first nine months of 2022 to VNĐ1.86 trillion in the first nine months of 2023, a decrease of 23.6 per cent.

Techcombank, VIB and TPBank also saw revenue from insurance activities to decrease from more than VNĐ1.06 trillion, VNĐ936 billion and VNĐ661 billion to VNĐ458 billion, VNĐ689 billion and VNĐ291 billion, respectively.

According to Vietcombank Securities Company (VCBS), income from bancassurance in the banking industry last year was affected after some banks were found to have fraud and coercion bancassurance to banks’ customers in July last year.

At the same time, bancassurance business last year was also less positive as people's income decreased due to economic difficulties. VCBS estimated profits from insurance premiums in 2023 to decrease by some 10-15 per cent compared to the previous year. — VNS