Economy

Economy

|

| A logo of VIB. — Photo courtesy of the bank |

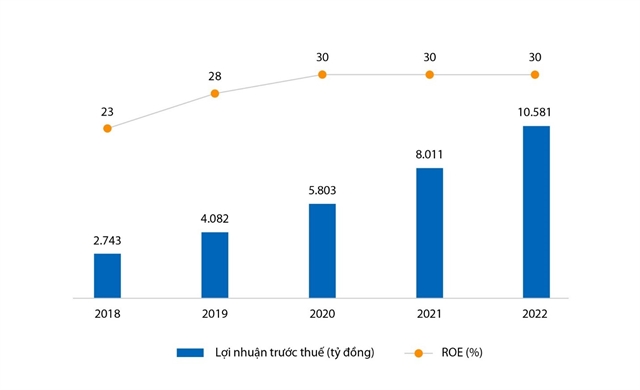

HÀ NỘI — Vietnam International Bank (VIB) has announced its pre-tax profit at over VNĐ10.58 trillion in 2022, up 32 per cent year-on-year or exceeding the plan set earlier by the bank's shareholders.

The bank's return on equity ratio (ROE) stood at 30 per cent, confirming its presence in the banking industry’s leading group, according to its unaudited business results in 2022 .

Outstanding business results, leading the industry in safety and efficiency

VIB said impressive profit growth results in 2022 came from core businesses, especially retail banking. Specifically, the bank's total revenue grew by 21 per cent year-on-year, higher than the growth rate of operating expenses at 17 per cent. That contributed to reducing its cost-to-income ratio (CIR) to 34 per cent, bringing VIB to the group of retail banks which had the best cost-effective management.

In 2022, VIB's total revenue reached over VNĐ18 trillion, up 23 per cent year-on-year. Its net profit also increased by 27 per cent year-on-year. Meanwhile, fee income saw a yearly rise of 16 per cent to nearly VNĐ3.2 trillion, contributing 18 per cent to last year's total revenue, largely thanks to the strong growth of the card business which experienced a growth of 53 per cent compared to 2021 and profits from bancassurance.

According to VIB, the efficient investment in technology and the effective operating model have contributed to ensuring the bank's stable operating costs. Accordingly, the cost-to-income (CIR) ratio in 2022 continued to improve compared to the previous year, standing at 34 per cent. This has shown the bank's effectiveness of the cost management strategy to maintain revenue growth higher than cost growth.

As of December 31, VIB's total assets hit VNĐ343 trillion, an increase of 11 per cent compared to the beginning of the year. Its outstanding credit balance topped VNĐ233.92 trillion, up 14.5 per cent year-on-year.

At the same time, the net profit margin was also maintained at a good level of 4.5 per cent by the bank thanks to its success in mobilising low-cost medium and long-term capital and in maintaining stable liquidity and interest rates amid the volatile market.

As per the report, VIB's return on equity (ROE) has been maintained at an average of 30 per cent for three consecutive years. The capital adequacy ratio (CAR) under Basel II reached a high level of over 12.7 per cent, compared with the SBV's regulations of 8 per cent. With a strong risk management foundation, VIB controlled bad debt at a low level of 1.79 per cent.

|

| A chart shows pre-tax profit and return on equity of VIB in the 2008-22 period. — Photo courtesy of the bank |

VIB is one of the first banks to host the Annual General Meeting of Shareholders in 2023, slated to be held in March. Thanks to positive business performance in 2022, VIB will propose to pay dividends up to 35 per cent. Currently, the bank's shareholders have approved the plan to pay a cash dividend in 2022 for its existing shareholders at 10 per cent of the charter capital. The dividend payment plan is waiting for approval from the competent authorities.

Leader in innovative trends of products and services

In 2022, VIB continued to implement the customer-centric strategy with the launch of products and services that have met the taste of customers and improved their experience.

VIB is the first bank in Việt Nam to provide Augmented Reality technology on the mobile banking application MyVIB 2.0. MyVIB 2.0 is also the first Cloud Native Mobile Banking application in Việt Nam. These are two of many positive signs that have confirmed VIB's position as one of the banks leading the digital transformation trend in the country.

As a financial instrument designed on the mobile phone platform that many Vietnamese users have favoured, MyVIB 2.0 application converges the latest technologies, enabling it to meet the needs of millions of customers.

|

| As of December 31, the number of VIB's newly-opened cards reached nearly 300,000, a year-on-year increase of 42 per cent. Photo courtesy of the bank |

Thanks to the strategy of leading the card trend and personalised cards with high technology content which has helped meet the diverse spending needs of each customer group, VIB has been positioned at the top of the cashless payment field in the market. As of December 31, the number of VIB's newly-opened cards reached over 2.4 million, including over 600,000 credit cards. VIB also accounted for more than 35 per cent of Mastercard's total spending in Việt Nam.

According to VIB, the encouraging result was thanks to outstanding incentive programmes for card holders, thereby driving total card spending by more than $3.1 billion for the whole of 2022.

VIB has launched account packages exclusively for individual and corporate customers such as the Sapphire account package for individual customers who have regular transaction and payment needs, the Diamond account package for customer groups wishing to enjoy priority privileges, and the Reserved account plan offering free all transaction fees for customers who are small-sized businesses.

Better meeting the needs of customers has brought VIB more than one million new customers in 2022, a hike of 200 per cent over the previous year and completing its target of having four million customers in 2022.

In addition in 2022, VIB spent US$150 million disbursed from IFC to further grant loans for individual customers who desire to buy, build, and repair their houses. It also co-operated with the Asian Development Bank to support female leaders in small and medium-sized companies to develop their management skills.

Creativity in approaching and meeting customer needs

Last year saw a significant change in the global economy during the post-COVID-19 period, leading to a remarkable shift in the daily financial transaction needs and habits of most individual customers. With its strength in applying advanced technologies such as artificial intelligence, big data and machine learning, VIB has surpassed others in the market in understanding customers' needs, thereby offering products and services which have been tailored to each user segment. In addition, the multi-cloud platform has helped the bank continuously update features to keep abreast of even the smallest changes in demand of more than four million customers.

As a result, by the end of 2022, VIB recorded the number of new customers registered via digital channels reaching 40 per cent of the total, representing a growth of 65 per cent compared to that of 2021. The number and value of transactions across VIB's different digital channels have nearly doubled over the years.

The 3-first model comprising mobile-first, cloud-first and AI-first has been effectively applied by VIB when the bank successfully built a digital interactive experience space that helped VIB become one of the top banks in terms of online transactions, with over 93 per cent of the total number of transactions.

Last year, VIB's customer network increased by 30 per cent over the previous year with young customers accounting for nearly 30 per cent. This was actively contributed by the modern and different approach to customers that VIB has been implementing over the past years.

Appearing with a youthful and dynamic image at the music reality TV show The Masked Singer, VIB made an impression with creative marketing and communication activities on many platforms. That demonstrated its success in reaching the right customers as well as expanding the user base year by year.

Continuing customer-centric strategy in 2023

Amid a challenging market, VIB considers sustainable development with core values as a positive growth driver for VIB in 2023.

VIB has said it will optimise its strengths in management and technology into business and operations, continuously focusing on customer development. The bank will expand its customer portfolio through strong investment in customer interaction platforms, upgrade products and services while digitising the user experience journey. This will be the direction to help the bank reach its goal of 10 million users by 2026, becoming a leading retail bank in terms of scale and quality.

In 2022, VIB also made its mark with creative marketing and communication activities on many platforms. Appearing at the music show - The Masked Singer Vietnam helped VIB continuously lead the banking industry in the ranking of outstanding brands on social networks.— VNS