Economy

Economy

|

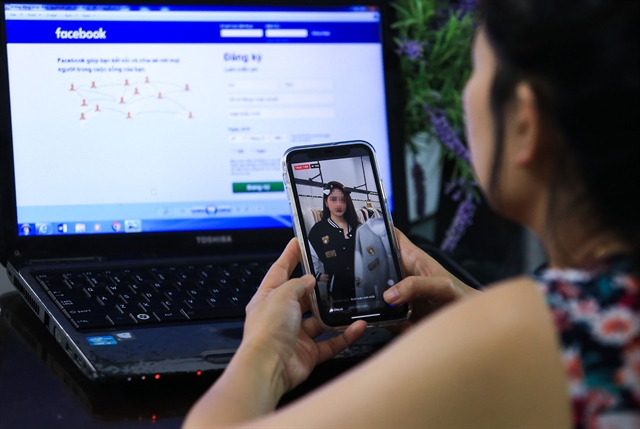

| Meta (Facebook) contributed 34.5 million EUR. — Photo thanhnien.vn |

HÀ NỘI — Foreign suppliers have paid taxes worth VNĐ1.8 trillion (US$76.7 million) via the official portal serving their operations in Việt Nam.

Of the sum, Meta (Facebook) contributed 34.5 million EUR, Google $28.8 million, and Apple VNĐ174 billion.

The General Department of Taxation’s portal https://etaxvn.gdt.gov.vn/nccnn/Reques was exclusively developed for foreign suppliers and put in place on March 21 last year.

So far, it has seen 45 suppliers registering and paying taxes.

The General Department of Taxation said that this was a very good signal in the co-ordination of tax declaration and collection between Vietnamese tax authorities and foreign suppliers right from the beginning of the new year.

This shows the trust, prestige and serious observance of tax laws by foreign suppliers for e-commerce and digital-based business activities in the territory of Việt Nam.

The total tax collected through the electronic portal for foreign suppliers is VNĐ3.4 trillion as of the end of last year.

Notably, six suppliers including Google, Facebook, Microsoft, TikTok, Netflix, and Apple - the units that hold the majority of market share in e-commerce service revenue doing business on cross-border digital platforms in Việt Nam – have registered, declared and paid tax in Việt Nam.

However, besides the above figures, tax administration for e-commerce activities and business on digital platforms still faces many challenges for the tax industry. — VNS