Economy

Economy

Some 20 years after the Asian financial crisis brought many Southeast Asian nations to their knees, business sentiment is buoyant in a region that now functions as one of the primary engines of global growth, according to the results of our inaugural Business Barometer: OBG in ASEAN CEO Survey.

|

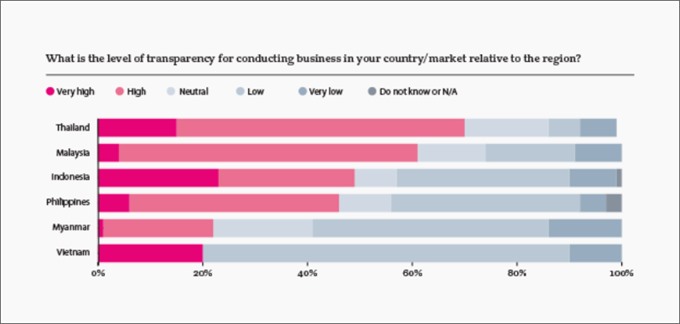

| Level of transparency for conducting business in six ASEAN countries relative to the region. — Photo Oxford Business Group |

HÀ NỘI — Some 20 years after the Asian financial crisis brought many Southeast Asian nations to their knees, business sentiment is buoyant in a region that now functions as one of the primary engines of global growth, according to the results of our inaugural Business Barometer: OBG in ASEAN CEO Survey.

Around 84 per cent of executives surveyed across six ASEAN states – Indonesia, Malaysia, Myanmar, the Philippines, Thailand and Việt Nam – had positive or very positive expectations for local business conditions in the coming 12 months, while 72 per cent were likely or very likely to make a significant capital investment.

The upbeat results reflect Asia’s emergence as the main driver of global economic expansion. The IMF forecasts the GDP of the “ASEAN-5” – defined by the fund as Indonesia, Malaysia, the Philippines, Thailand and Việt Nam – to grow by 5.4 per cent and 5.3 per cent in 2018 and 2019, respectively, and projects emerging and developing Asia will expand by 6.5 per cent annually over the same period, making it the fastest-growing continent by some distance.

This is the first time we have collated our proprietary data from individual ASEAN markets covered by OBG into a collective sample, allowing us to provide commentary on regional investor sentiment, as well as observe differing national perceptions within the bloc. Unsurprisingly, given its 250 million-strong population, the largest national sample came from Indonesia, followed by the Philippines, Myanmar and Thailand, while the smallest samples came from Việt Nam and Malaysia.

As ASEAN’s main trade partner and an increasingly important source of foreign direct investment and inbound tourists, China’s growing influence is reflected by the fact that 33 per cent of CEOs surveyed across the six countries cited a slowdown in Chinese demand as the top external factor that could impact their national economies in the short to medium term.

China’s trade with ASEAN grew 13.8 per cent to hit a record high of US$514.8 billion in 2017, according to official Chinese figures. While its share of global trade in the mid-1970s was just 0.5 per cent, it is now the world’s largest exporter and the top trading partner for all six countries covered in our survey. Its unprecedented growth and strategic ambitions are reshaping the geopolitical and economic dynamics of the region, with China now the hub of a flourishing transcontinental trade network that largely bypasses the US.

As President Xi Jinping presses forward with plans to pursue a so-called “high-quality”, sustainable-growth model, executives across ASEAN hope that any resulting moderation in China’s GDP expansion does not translate into significant falls in trade volumes and investment flows.

It is interesting to note the two countries in our survey with the greatest concern about a potential slowdown in Chinese demand – Thailand and Indonesia – have been cited in various studies as among the ASEAN members most vulnerable to China’s economic rebalancing towards consumption as the main growth driver. Thailand’s vulnerability stems from its particularly close trade linkages and Indonesia’s from being a net commodities exporter.

While China’s influence is clear, it should be noted that the survey was carried out before talk of a global trade war gathered pace in the first quarter of 2018. Just 19 per cent of executives surveyed chose trade protectionism as the biggest external risk to their economies, but one might expect that proportion to increase among business leaders currently being asked the same question.

The US trade deficit with ASEAN stood at around $69 billion in 2015, with negative imbalances with Việt Nam, Malaysia, Thailand and Indonesia especially notable. If US President Donald Trump pursues his pledge to reduce bilateral trade deficits, businesses across the region could face new restrictions on access to the US market, or increased competition from US entrants at home.

With the exception of Singapore, no ASEAN country features in the top echelons of respected global indicators on national business environments or competitiveness. Therefore, it is little surprise that our questions focused specifically on these areas elicited a mixed response.

Overall, 47 per cent of respondents said transparency in their market was high or very high relative to the region, while 41 per cent said it was low or very low. Respondents from Việt Nam and Myanmar were most negative about business transparency, although results in the former may improve if a controversial, high-level crackdown on corruption leads to tangible changes in the way business is conducted. Myanmar, meanwhile, is still dealing with the legacy of six decades of international isolation and military rule. Efforts by lawmakers in the civilian-led government to enact pro-business legislation have often resulted in ambiguous regulations that investors have struggled to interpret.

This varied picture was replicated on the matter of tax competitiveness, with half of the respondents saying their country’s tax environment was either uncompetitive or very uncompetitive on a global scale, while 41 per cent said it was competitive or very competitive. CEOs from Malaysia, Việt Nam and Thailand were more positive about their respective tax environments, while executives from the Philippines and Myanmar were the most negative.

It will be interesting to see if business leaders in the Philippines have a more favourable view of their tax regime in our next national survey, due to be published in the coming months, now that the first package of the multi-phase Tax Reform for Acceleration and Inclusion has been passed, and the second package is in the latter stages of the legislative process.

Further disparities can be observed in regard to access to credit, with 55 per cent saying it is either easy or very easy, and 40 per cent saying it is difficult or very difficult. Breaking this down, the only really negative outlier was Myanmar, where prohibitive interest rates, onerous collateral requirements, a lack of credit history and restrictions on the operations of foreign banks combine to create a barren lending environment in the formal sector.

Perhaps what this mixed picture of the business environment demonstrates above all else is that despite ongoing efforts towards the harmonisation of certain laws, standards, regulations and practices across the bloc, significant development disparities and competing fiscal regimes remain obstacles to the smooth integration of the ASEAN Economic Community (AEC), which by 2025 aims to create a cohesive single market and production base that promotes “shared prosperity” among all members.

If the AEC is to succeed in its ambition of creating a people-centred, outward-looking bloc that is highly integrated in international value chains, it is vital that member states focus on education and skills development to ensure the region’s workforce is equipped with the expertise and mindset required to keep pace with emerging technologies.

In the face of China’s aggressive pursuit of global leadership in areas such as artificial intelligence and robotics, not to mention the elevated research and development expenditure of East Asian powerhouses Japan and South Korea, ASEAN member states risk being left behind in the global innovation race if they do not adapt quickly.

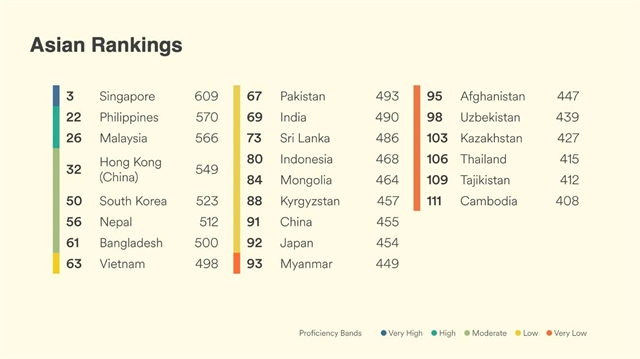

If we look at education systems in the region, ASEAN states have consistently ranked relatively low in international assessments over the years, with the exception of world-leading Singapore. Việt Nam was the only other member state to make the top 30 of the most recent OECD PISA rankings of 15-year-olds in science, maths and reading.

Recognising the need for improvements in human capital, 31 per cent of respondents across the six participating countries chose leadership as the skill in greatest need, while 28 per cent opted for engineering.

Interestingly, Thailand was the only country that didn’t have leadership as one of its top two choices, while Indonesia was the only other state that didn’t opt for leadership as its first choice. Respondents in both countries chose engineering as the most in-need skill in their respective labour markets – understandable when considering that Indonesia has an estimated transport project pipeline of $327 billion and Thailand is embarking on a major infrastructure drive as part of its transformative $45 billion Eastern Economic Corridor.

However, the perceived absence of leadership qualities represents a more fundamental challenge that will need to be addressed, as the region looks to cultivate a new generation of innovators that can translate ideas into sustainable wealth and job generation against a backdrop of intense global competition and rapid technological change, which will give birth to new industries while sounding the death knell for others. — Oxford Business Group