Economy

Economy

Banks have launched credit packages with preferential interest rates, aiming to assist capital sources for businesses and further boost domestic production.

|

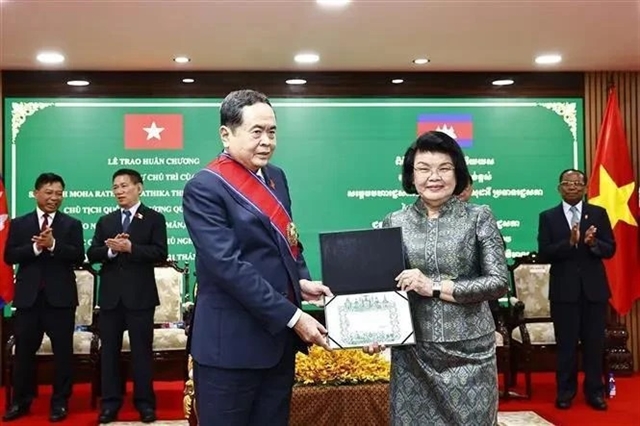

| BIDV successfully implemented two preferential packages worth VNĐ25 trillion to support manufacturing businesses. - Photo BIDV |

HÀ NỘI — Banks have launched credit packages with preferential interest rates, aiming to assist capital sources for businesses and further boost domestic production.

The Bank for Investment and Development of Việt Nam (BIDV) has introduced a new credit package worth VNĐ20 trillion (US$892.8 million), with a preferential interest rate from now until mid-2018.

Accordingly, borrowers can enjoy an annual interest rate of 6.5 per cent for short-term loans and from 7.2 per cent for long-term loans. Besides, customers who seek to do business would join many preferential programmes from other services, such as internet banking and insurance.

Since the beginning of this year, BIDV successfully implemented two preferential packages worth VNĐ25 trillion to support manufacturing businesses.

Meanwhile, Southeast Asia Joint Stock Commercial Bank (SeABank) has also launched a new programme, which provides preferential loans to corporate customers.

Borrowers could receive up to VNĐ1.5 trillion at an annual rate of 7.5 per cent for loans in Vietnamese đồng and 3 per cent for loans in US dollar. Based on financial needs, the bank will provide the best consultancy services to help enterprises improve the efficiency of capital.

In fact, many Vietnamese enterprises, especially small- and medium-sized enterprises (SMEs) are still facing long-standing difficulties in accessing loans.

According to banking and financial expert Cấn Văn Lực, most SMEs have a low management capacity and outdated technology, they lack transparency in information and feasible business plans, and do not have adequate assets for mortgages, making them ineligible for banking loans

Credit institutions are hesitant to lend SMEs money for the same reasons. Lực noted that these problems were compounded by complex banking procedures and a shortage of appropriate loan packages for SMEs.

Hoàng Thị Hồng, director of Small and Medium-sized Enterprises Development Fund under the Ministry of Planning and Investment, said it was necessary to develop a database about SMEs for credit institutions to use while evaluating.

In addition, capital-raising channels should be diversified, rather than largely dependent on banks, for instance, while raising capital from the securities market, Hồng said. — VNS