Economy

Economy

A year after it began to restructure under a Government-approved scheme, Sacombank appears to have turned the corner with decent results for 2017.

|

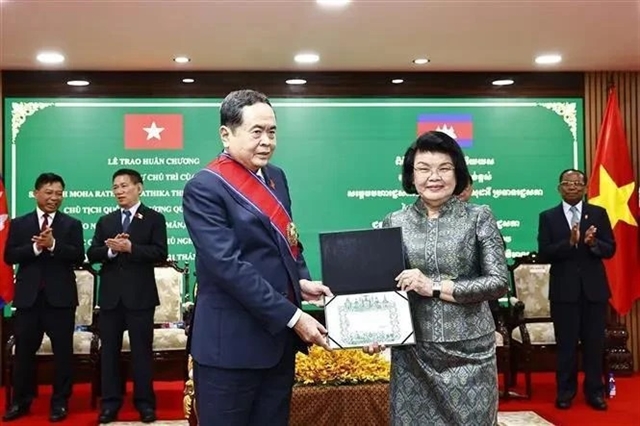

| Customers at a Sacombank transaction office. Sacombank had a good 2017 after a year of restructuring. — Photo courtesy of Sacombank |

HCM CITY — A year after it began to restructure under a Government-approved scheme, Sacombank appears to have turned the corner with decent results for 2017.

Its total assets increased as of December 31 by 10.7 per cent to VNĐ364 trillion. Deposits were up 11.4 per cent to VNĐ323 trillion (US$14.2 billion), and outstanding loans by 12.6 per cent to VNĐ219 trillion. Income surged 33 per cent to VNĐ8.2 trillion, strongly supporting bad debt resolution efforts.

Non-interest income was worth VNĐ2.4 trillion, with traditional fee income increasing 29.6 per cent.

The lender managed to recover more than VNĐ19 trillion ($837 million) worth of bad debts last year, reducing its non-performing loans (NPLs) ratio to 4.28 per cent compared to 6.68 per cent a year earlier.

Its chairman, Dương Công Minh, said the bank hopes to reduce the NPL rate further to below 3 per cent this year.

The bank is among the largest in terms of network with 566 transaction offices in 48 cities and provinces in Việt Nam, Laos and Cambodia.

Its two major goals in 2018-20 are to speed up the restructuring and settle bad debts, improving its asset quality, and become the top retail bank in the country and the neighbourhood.

The Government decided to restructure banks to improve the health of the financial sector.

Sacombank was among the lenders with a high NPL rate, and its restructure is expected to be completed in three to five years. — VNS