Society

Society

|

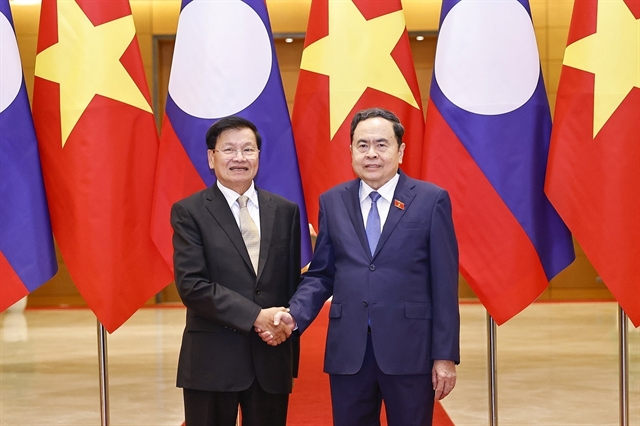

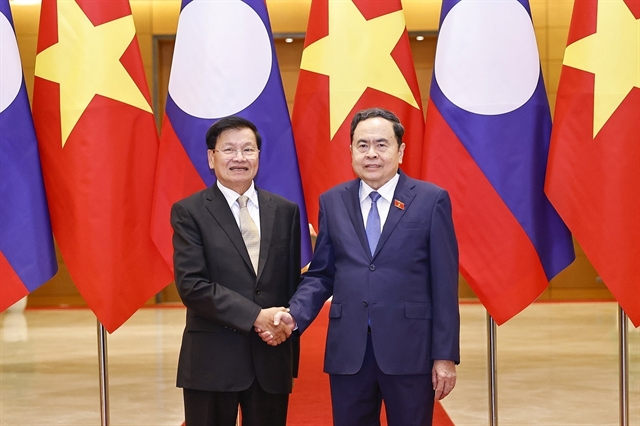

| Five suspects arrested in the high-tech loan shark ring. — Photo courtesy of HCM City Police |

HCM CITY — HCM City Police have broken up a payday loan ring headed by Chinese nationals, with some 60,000 debtors suffering cutthroat interest rates of 1,095 per cent per year.

The police on Monday said they had arrested five suspects, including Chinese nationals Tu Long, 28, and Yuan Deng Hui, 27, as well as Chề Ngọc Trinh, 25, from Đồng Nai Province, Lâm Cảm Quyền, 31, from HCM City’s District 5 and Lài Thế Hùng, 26, from HCM City’s Bình Tân District, to investigate the crime of "usury in civil transactions".

Earlier, the police detected that three companies named Vinfin, Beta and Đại Phát were owned by two Chinese people – 39-year-old Jiang Miao and Niu Li Li (unknown identity) – yet were registered to other people residing in HCM City.

These companies, headquartered in Bình Tân District, offer cash advances via smartphone apps called Vaytocdo, Moreloan and VD online, at absurdly high rates.

In late 2019, the police started inspecting the companies’ offices, working with 40 people, mostly Vietnamese, and found that these companies were divided into different units of management, interpretation, dossier reviewing and debt collection with various tactics to lend money at exorbitant rates.

Any first-time customer can take a loan of up to VNĐ1.7 million (US$72) via app “Vaytocdo” however, they actually receive only VNĐ1.4 million ($59), the rest is service fees. Within eight days, the customer will have to pay both principal and interest of more than VNĐ2 million ($85). In case of late payment, he will be fined VNĐ100,000 ($4.25) per day.

For two other apps – Moreloan and VD online – a first-time borrower can “theoretically” borrow VNĐ1.5 million ($64) yet receive only VNĐ900,000 ($38). Within a week, the debtor has to pay the principal of VNĐ1.5 million. Each day of late payment will be charged interest rates of 2 to 5 per cent. It means that debtors are forced to pay the interest rate of up to 3 per cent per day, equivalent to 21 per cent per week, 90 per cent per month and 1,095 per cent per year – five times higher than the regulated loan rate. Any borrower able to pay off by due dates is allowed to take bigger loans of up to VNĐ2.8 million ($119).

For those who are unable to clear their debts, their friends and relatives will be threatened by debt collectors using contacts hacked when they register for loans.

Many debtors could not bear the pressure and had to borrow further money to cover the debts.

According to the police, there are 60,000 people in all 63 localities caught in these traps with the total loan amount of VNĐ100 billion ($4.2 million).

The case is under further investigation. — VNS

Brandinfo

Brandinfo