Society

Society

|

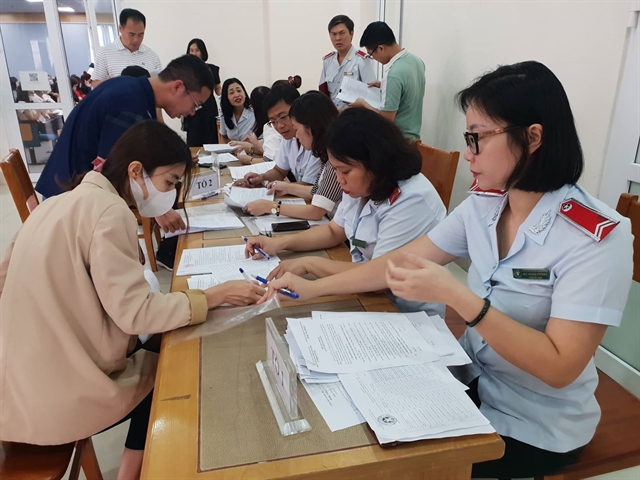

| Employers work with Hà Nội's inspectors on delayed social insurance payments for their employees. — VNA/VNS Photo |

HÀ NỘI — Experts have called for stricter penalties for employers delaying or evading social insurance payments.

Measures are needed to make them fulfil their duties to employees and a specific mechanism also necessary to support more than 200,000 affected workers, they said.

It is possible to consider the blocking of accounts of employers and even legal proceedings if they continue violations, they added.

Figures from the Vietnam General Confederation of Labour showed that social insurance debts owed by enterprises have reached roughly VNĐ22 trillion (US$933 million).

Of that, about VNĐ3.5 trillion ($148.4 million) is from more than 30,000 enterprises whose owners went bankrupt, the companies dissolved or fled, greatly affecting the legitimate rights of more than 200,000 employees.

Deputy Chairman of the confederation Ngọ Duy Hiểu told Dân trí online newspaper: “200,000 people are owed social insurance, which means more than 200,000 families are in financial difficulties. Employees with social insurance debts are not entitled to pensions, maternity benefits or compensation in case of illness or occupational accidents."

“This is a huge social security problem as hundreds of thousands of retirees don't know what they will live on,” he said.

Hiểu said the Vietnam General Confederation of Labour has proposed to the Prime Minister to assign the Ministry of Labour, Invalids and Social Affairs and Vietnam Social Insurance to coordinate with the confederation to review enterprises’ evasion of social, health and unemployment insurance payments.

The reports will be submitted to the National Assembly for solutions.

Hiểu said if the delay and evasion of social insurance payment can be limited, employees will have more confidence in the social insurance system and reduce the one-time withdrawal of social insurance.

"Enterprises’ prolonged delays or evasion of social insurance payments will definitely affect the interests of employees. Employees cannot get the benefits they deserve due to debts on their social insurance, even when they switch to another job,” he said.

Deputy head of the confederation’s Policy and Law Department Lê Đình Quảng said there are solutions for such enterprises.

Instead of forcing them to refund the entire amount, the law should allow such enterprises to pay smaller amounts.

For example, he said, an enterprise that owes social insurance of VNĐ500 million to 100 employees should be allowed to pay part of it for employees who want to close their social insurance books instead of paying the whole amount as currently.

However, he admitted that it was difficult to apply this method for enterprises that declared bankruptcy or their owners fled because when liquidating assets under the Bankruptcy Law, social insurance contributions are not a priority.

Quảng said the confederation has proposed a specific policy for more than 200,000 employees who are owed social insurance payments.

He also said that when amending the Law on Social Insurance, it is necessary to make appropriate adjustments to solve the problem and at the same time attract employees to join social insurance.

The revised Law on Social Insurance must ensure transparency, in which employees know exactly how much insurance premiums are paid by employees and by businesses. In addition, it is necessary to strengthen the responsibility of authorities on this issue.

“It is possible to study the penalty of blocking accounts of violating employers and publicise the list of violators on mass media, or even block them from participating in bidding,” he said.

In the long term, he said, authorities should strengthen inspections and strictly handle violators. Those who are found to relapse six months after their previous violations should face legal proceedings under article 216 of the Penal Code. VNS