Economy

Economy

The central bank’s reduction in refinancing and rediscount rates is expected to help improve the efficiency of the banks’ bad debt settlement.

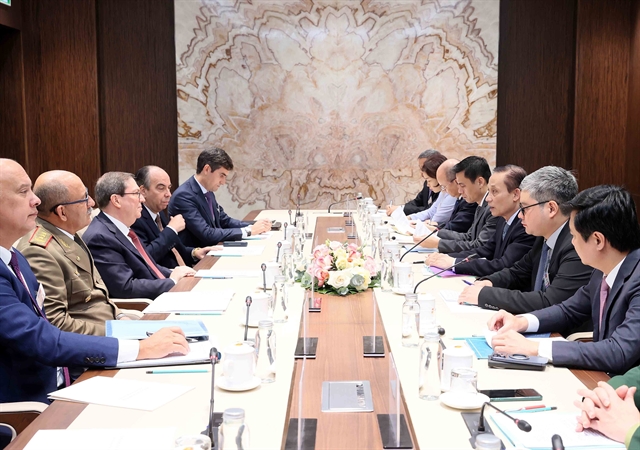

|

| Recently, the State Bank of Việt Nam decided to slash the benchmark interest rates by 0.25 percentage points and the interest rate cap for loans given to the five priority sectors by 0.5 points. — Photo zing.vn |

Is Việt Nam loosening monetary policy? The answer of many experts is no, it isn’t.

Recently, the State Bank of Việt Nam decided to slash the benchmark interest rates by 0.25 percentage points and the interest rate cap for loans given to the five priority sectors by 0.5 points.

These moves are considered by some analysts as the first step in loosening the monetary policy to stimulate growth.

But many economists disagreed with this, saying the rate cut decision only shows its positive view on inflation and foreign exchange.

They pointed to the fact that the rate cuts have not had a big effect on the monetary market.

Their explanation is that the 0.25-point reduction in refinancing, rediscount and overnight electronic inter-bank rates is merely an effort by the central bank to speed up bad debt settlement.

They said the National Assembly’s new resolution on bad debt settlement would soon be enforced.

With the resolution, credit institutions and the Việt Nam Asset Management Company (VAMC) can trade bad debts in an open, transparent manner at market prices in accordance with the law.

At that time banks will receive more bonds from the VAMC, and their refinancing and rediscount activities will increase.

The central bank’s reduction in refinancing and rediscount rates is expected to help improve the efficiency of the banks’ bad debt settlement.

The BIDV Securities Joint Stock Company however said banks were not too interested in refinancing or rediscounting with the central bank because deposit interest rates are lower.

The interest rates on non or short-term deposits now stand at 0.8-1 per cent, and on deposits of one to six months at 4.5-5.4 per cent.

The overnight rate between banks is around 2 per cent, and the new refinancing, rediscount and overnight electronic inter-bank rates are at rather high levels of 6.25 per cent, 4.25 per cent and 7.25 per cent.

The result is that though funding from the central bank is now cheaper than before it is still not attractive to the banks. This also means the liquidity in the banking sector will not increase much.

Enterprises in the five priority sectors (agriculture and rural development, production of export goods, small- and medium-sized enterprises, supporting industries, and high-tech enterprises) will immediately benefit from the 0.5 per cent reduction in the lending interest rate cap.

In HCM City, the loans in the five priority sectors now account for around 40 per cent of the total outstanding loans.

Experts however said banks would likely limit loans to those sectors since the low interest rates would affect their margins, pointing out this is the reason for the central bank being unable to effect deep cuts to these interest rates.

The central bank has announced that the yearly credit growth target of 18 per cent will remain unchanged meaning money supply will not really be loosened.

A spokesman for the central bank said monetary policies take into account all banking and economic factors.

The World Bank has warned that if Việt Nam maintains its high credit growth its economy would be too dependent on the banking system -- which is not in the best health -- further increasing the risks related to asset quality especially in the context that bad debts continue to be a problem.

Việt Nam imports from South Korea rise steadily

According to the General Statistics Office (GSO), Việt Nam’s exports to South Korea in the first half of 2017 soared 52 per cent year-on-year to $22.5 billion.

Earlier, in the first four months, Vietnam’s trade deficit with that country was $9.3 billion.

There has been a growing tendency to buy from South Korea in recent years instead of China, leading to a drastic increase in imports from the former.

The trade deficit is expected to continue.

Experts from the Việt Nam Institute for Economics and Policy Research attribute this to several reasons.

Vietnamese businesses do not want low-quality machinery from China any more, they say.

Many Korean companies wish to enter the Vietnamese market, while many already here want to expand their business.

Many of them tend to bring Korean machinery and equipment to their factories in Việt Nam.

South Korea is the biggest foreign investor in Việt Nam. The Korea Trade Investment Promotion Agency said in early June that since 1988 Korean businesses had invested $50.5 billion, or 30.8 percent of total foreign direct investment in Việt Nam. At least 71 per cent of that had been invested in manufacturing.

Most of the imports from South Korea were of spare parts, equipment and materials.

But imports of consumer goods had also been rising in recent years.

A spokesperson for Lotte Mart Việt Nam said imports of South Korean goods had increased from 3 per cent of the company’s turnover two years ago to 5 per cent now.

Some experts feel there is no reason to be alarmed by this trade deficit with South Korea.

They however said the entry of more products from South Korea and other countries would force Vietnamese businesses to adopt strategies to cope with the competition, including ways to export, they said.

Many new mutual funds make their debut

The State Securities Committee (SSC) recently allowed the Manulife Investment Balanced Fund and the Vietcombank Securities Investment Fund to issue mutual funds.

Those funds, both open-ended, hope to raise at least VNĐ50 billion(US$2.2 million) each.

Earlier the PVI Fund Management Joint Stock Company had instituted the PVI Infrastructure Fund worth VNĐ520 billion.

The SSI Asset Management Company has issued the SSI Bond Fund worth VNĐ50 billion (US$2.2 million).

The Thiên Việt Asset Management Company plans to issue a new closed-end fund by the end of this year and list on the HCM City stock market.

A closed-end fund raises a prescribed amount of capital once through an IPO by issuing a fixed number of shares, which are bought by investors.

Analysts said the establishment of many mutual funds is a positive sign for the market.

Many investors want to earn more than what bank deposits offer but also hedge their risk by investing in mutual funds, but have had few options.

The entry of funds also adds depth and liquidity to what is a small market.

The State Securities Committee and the Ministry of Finance should think about preferential policies related to taxation and fees to encourage the sector to develop, experts said.

Việt Nam now has 30 funds, including two exchange-traded funds and one Real Estate Investment Trust.

As of last May the combined value of their assets was over VNĐ5 trillion ($220.27 million).VNS