_med.jpg) Economy

Economy

The General Department of Taxation recently sent a document requesting the HCM City Department of Taxation to collect data to inspect tax payment of Uber B.V Netherlands Co., Ltd and GrabTaxi Co., Ltd.

|

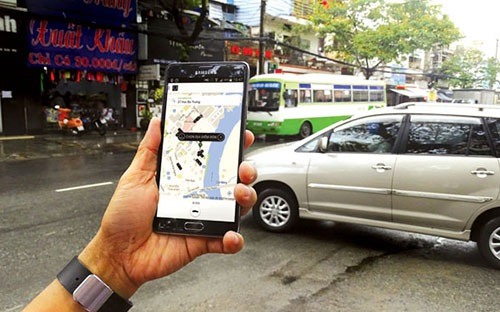

| The General Department of Taxation recently sent a document requesting the HCM City Department of Taxation to collect data to inspect tax payment of Uber and Grab. — Photo vneconomy.vn |

HÀ NỘI — The General Department of Taxation recently sent a document requesting the HCM City Department of Taxation to inspect the tax payments of Uber B.V Netherlands Co Ltd and GrabTaxi Co Ltd.

Traditional taxi firms claim that they have been subject to a variety of taxes and charges while Uber and Grab were only subject to a tax of 4 to 5 per cent of revenue.

With about 30,000 taxis in Hà Nội and HCM City, traditional taxi firms must pay an average tax of VNĐ2 trillion (US$91.7 million) annually, while the tax agencies have collected only VNĐ20 billion per year from 31,000 contracted cars using Uber and Grab applications, online newspaper VnExpress reports.

Nguyễn Thị Hạnh, director of department of personal income tax management, said that it is necessary to introduce a suitable tax policy for foreign enterprises doing business in Việt Nam without legal entity and accounting books to fulfill tax obligations.

However, representatives of the taxi apps have claimed that they did not evade taxes.

The online newspaper quoted Jerry Jim, director of Grab Việt Nam, as saying that Grab is a technology company and does not own any means of transport. Instead, they co-operate with transportation service providers to exploit their registered idle cars.

Jim also emphasised that the company understands the concerns of Vietnamese Government over traffic jam reduction, and they are working actively with the authorities to complete compliance with Vietnamese law.

The Ministry of Transport will provide information to the tax agencies to clarify Uber and Grab taxes soon.

Nguyễn Hồng Trường, deputy minister of transport, said the ministry will work with the Ministry of Finance, especially the General Department of Taxation, to share documents and calculate tax management options more tightly to avoid inequality in tax collection.

According to the General Department of Taxation, not only Uber and Grab, but also more than half of traditional taxi businesses reported losses in the past and did not pay corporate income tax. Other traditional taxi businesses payed taxes, but the paid amount was very low. — VNS

_med.jpg)