Economy

Economy

|

| Traders work at an office of VPS. — Photo courtesy of VPS |

HÀ NỘI — After a year of fierce competition among securities companies to attract and retain customers, there is significant disruption in the brokerage market share "pie".

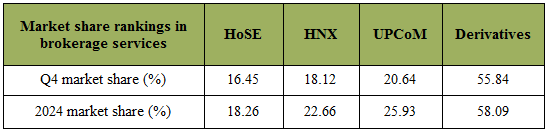

VPS Securities JSC continued to uphold its leading position in the brokerage market share for the fourth quarter (Q4) and the full year of 2024 across all four trading platforms: the Hồ Chí Minh Stock Exchange (HoSE), the Hà Nội Stock Exchange (HNX), UPCoM and derivatives.

According to data from HoSE and HNX, VPS's brokerage market share for Q4 and the full year of 2024 on the exchanges is as follows:

|

| Source: HoSE, HNX. |

In Q4, VPS Securities' brokerage market share on the HoSE was 16.45 per cent, down from the 17.63 per cent in Q3. This also marks the third consecutive quarter of decline for this securities firm.

Compared to Q3/2024, the top five rankings have remained unchanged.

SSI Securities Corporation continues to hold the second position with a market share of 9.29 per cent, up from the 8.84 per cent in Q3/2024.

Following VPS and SSI, the market shares of the next three companies have all seen growth from the previous quarter.

TCB Securities (TCBS) has achieved 7.7 per cent, Vietcap Securities stands at 7.03 per cent, and Hồ Chí Minh City Securities (HSC) is at 6.75 per cent. TCBS has demonstrated the most significant increase in market share among the top 10, with a notable growth of 0.61 per cent.

The market shares of VNDirect Securities and FPT Securities (FPTS) have declined compared to the previous quarter, reaching 5.08 per cent and 2.84 per cent, respectively. These two securities firms currently hold the seventh and tenth positions on the ranking board.

Conversely, MBS Securities has experienced a significant increase in market share, ranking second in growth after TCBS, reaching 5.16 per cent (an increase of 0.47 per cent). This growth has propelled MBS to surpass VNDirect and secure the sixth position within the top ten. — VNS