Economy

Economy

|

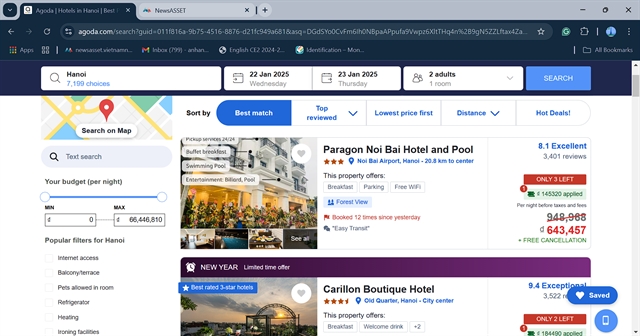

| Authorities have requested that Agoda, Airbnb, Booking, and PayPal comply with Vietnamese law and register for taxes after years of operating in the country. — VNA/VNS Photo |

HÀ NỘI — The General Department of Taxation under the Ministry of Finance has requested 100 banks and payment intermediaries to declare, withhold and remit taxes on behalf of transactions conducted with Agoda, Airbnb, Booking, and PayPal.

According to the general department, these four digital e-commerce platforms have operated in Việt Nam for years but have failed to register for tax purposes via the tax authority's electronic portal.

Agoda, Airbnb, Booking and PayPal do not have permanent bases in Việt Nam but have been generating income from providing services to

Vietnamese consumers. Consequently, these providers are classified as foreign contractors and are subject to value-added tax (VAT) and corporate income tax, calculated as a percentage of their revenue.

According to the Large Corporate Tax Department of the general department, these providers have been operating in Việt Nam for several years. Agoda and Booking are online travel agencies offering services such as hotel bookings, flights, tours and related products. PayPal provides online payment services and facilitates e-commerce transactions, while Airbnb connects renters with property owners.

The General Department of Taxation reported that, as of 2024, 123 foreign providers have registered, declared, and paid taxes, with a total of VNĐ8.687 trillion or US$377.7 million in taxes declared and paid through the foreign supplier electronic portal, representing a 26 per cent increase compared to 2023 and exceeding the forecast by 74 per cent. Since March 2022, when the electronic portal for foreign providers was launched, foreign enterprises have paid VNĐ20.261 trillion in taxes. Of this, companies such as Meta, Google, Microsoft, TikTok, Netflix, and Apple account for approximately 90 per cent of cross-border e-commerce service revenue in Việt Nam.

Deputy Director General of the General Department of Taxation Mai Sơn said that one of the main objectives for 2025 is to accelerate digital transformation, apply information technology, and enhance the efficiency and effectiveness of tax management, particularly in e-commerce and foreign provider activities. Foreign providers generating revenue in Việt Nam but failing to register for taxes or underreport revenue will be subject to review and appropriate measures by the tax authority.

Shared efforts

In practice, tax regulation efforts are not overseen by just the Ministry of Finance. Other ministries are also working to regulate cross-border platforms operating in Việt Nam.

For instance, the Ministry of Industry and Trade (MoIT) has taken steps such as halting operations of the cross-border platform Temu until the necessary licensing documentation is completed. It has also reviewed the legal procedures for other cross-border e-commerce platforms.

Lê Hoàng Oanh, director general of the Department of E-commerce and Digital Economy under the MoIT, said that for unlicensed cross-border e-commerce platforms, the department had issued directives to relevant units within the ministry to enhance regulatory measures. These included collaboration with the General Department of Market Surveillance and the General Department of Customs to monitor, identify, and address warehouses or collection points (if any) linked to unregistered platforms.

Challenges, however, remain, according to the official. While Government Decree No. 85/2021/NĐ-CP outlines conditions for cross-border e-commerce service providers entering the Vietnamese market, the regulations have not yet been fully implemented.

As a result, many platforms have entered the market without completing the required legal procedures. In 2025, the MoIT plans to propose the development of an E-commerce Law to institutionalise Party directives, align State policies, and create a coherent legal framework for e-commerce in relation to other laws, ensuring consistency within the legal system.

Similarly, the Ministry of Information and Communications (MIC) continues its efforts to require cross-border platforms to remove content that violates Vietnamese law. As a result, Facebook has blocked or removed 8,981 illegal pieces of content, achieving 94 per cent compliance, Google 6,043 or 91 per cent, and TikTok 971 or 93 per cent.

In 2025, the MIC will continue to work with cross-border platforms like Google, Facebook, and TikTok, as well as advertising networks, to ensure compliance with laws governing content provision, advertising services, and taxation. Minister of Information and Communications Nguyễn Mạnh Hùng earlier said global digital platforms must comply with Vietnamese law and that failure to comply could invite stronger measures by the government. — VNS